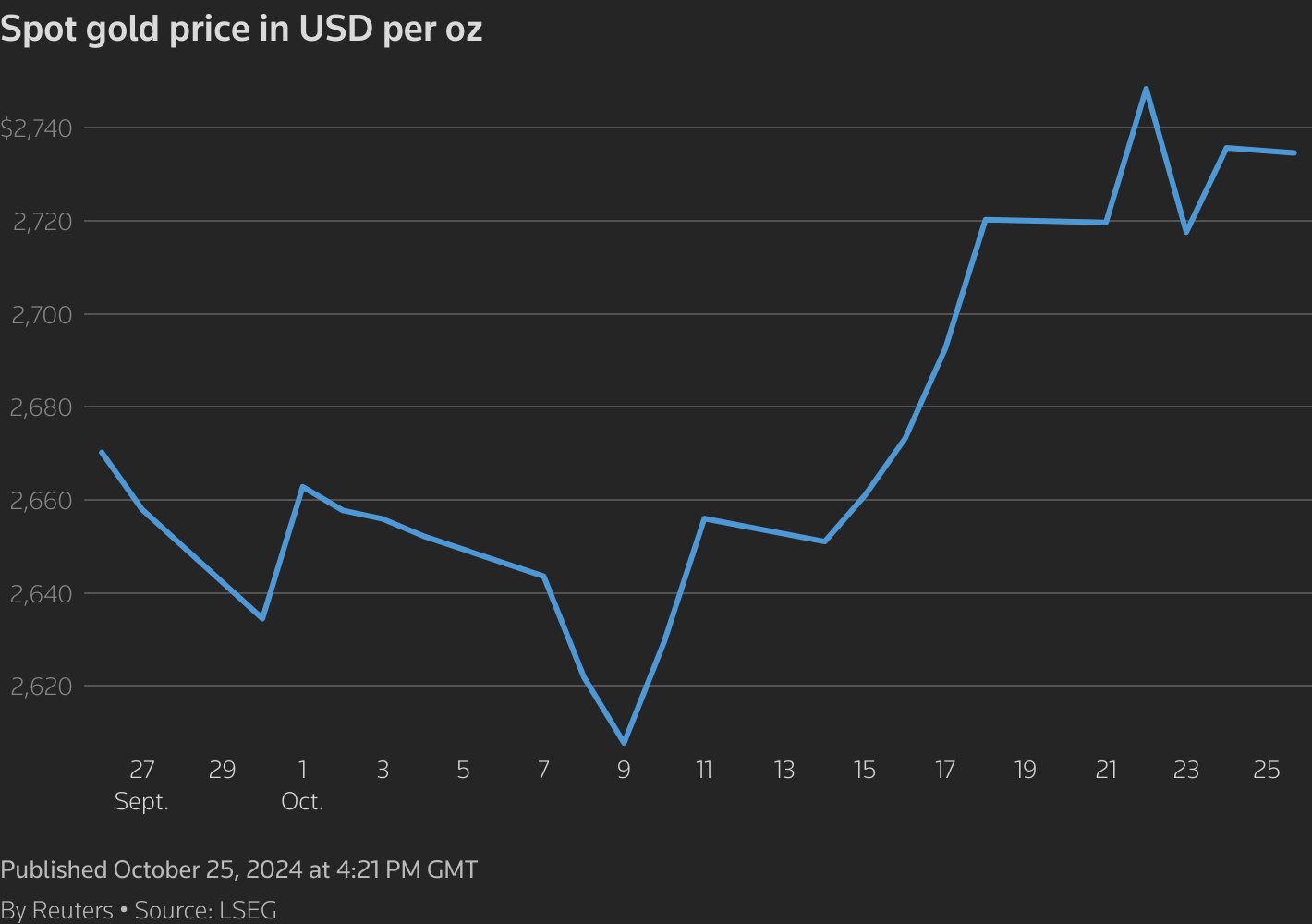

Oct 25 (Reuters) – Gold prices edged up on Friday after recovering from a profit-taking bout as Middle East tensions and U.S. election jitters supported prices, while palladium prices extended gains to 10-month highs.

U.S. gold futures settled 0.2% higher at $2,754.60.

The fact that maybe something is going to happen this weekend between Israel and Iran could have triggered some safe-haven buying going into the weekend, said Bob Haberkorn, senior market strategist at RJO Futures.

At least nine Palestinians were killed and several wounded in an Israeli air strike on Al-Shati, medics told Reuters.

Gold prices have slipped back into anti-traditional-driver mode in recent weeks, seemingly caught up in a wider “Trump trade,” Capital Economics said in a note.

“One can make logical cases for gold prices to rise further from here. But we would stress that gold is not a one-way bet,” Capital Economics said as they see a good chance of a sizeable price correction.

Spot palladium hit a ten-month high for the second consecutive day, amid concerns about exports from Russia. It was last up 3.2% at $1,194.36 per ounce.

Palladium rose 9% on Thursday following news that the U.S. asked Group of Seven allies to consider additional ways to restrict Russian revenues for the metal sector by exploring restriction on palladium and titanium.

Spot silver fell 0.3% to $33.61 per ounce after hitting a 12-year high of $34.87 earlier this week. Platinum lost 0.2% to $1,024.20.

Sign up here.

Reporting by Anjana Anil in Bengaluru, additional reporting by Swati Verma; Editing by Shreya Biswas, Alan Barona and Mohammed Safi Shamsi

Our Standards: The Thomson Reuters Trust Principles.