An upcoming event may not result in gains for Nvidia.

Nvidia (NVDA +0.03%) has become the stock market’s biggest star, delivering a 1,200% gain over the past three years, but the company’s fame isn’t due to this performance alone. It’s also linked to this player’s key position in one of today’s biggest growth markets — the artificial intelligence (AI) market — and the promise of what Nvidia may achieve as this AI boom roars on.

But this doesn’t mean Nvidia stock will offer investors a smooth and steady ride into the stratosphere. This stock, which continues its ascent, rising 45% so far this year, at certain points may lose momentum. This already happened earlier in the year amid concerns about AI spending and the impact of President Donald Trump’s tariffs on semiconductor imports.

Those worries have since disappeared, but in the coming weeks, Nvidia may be heading for another rough patch. In fact, my prediction is Nvidia stock is going to stall out on Nov. 20, following a key moment for the company. Let’s take a closer look.

Image source: Getty Images.

Nvidia’s big bet

Before jumping in, we’ll start by considering the Nvidia story so far. The company is a designer of graphics processing units (GPUs), chips that power the most essential of AI tasks like the training and inferencing of models. Nvidia went all in on AI before the real boom even began, tailoring its GPUs for this purpose. It was a major bet, and it turned out to be the perfect one. Thanks to this move, Nvidia established its leadership early, and thanks to its ongoing innovation, it’s maintaining this position.

All of this has resulted in massive revenue growth for the company — for example, in the latest fiscal year, Nvidia’s revenue soared in the triple-digits to a record of more than $130 billion. Nvidia also has wowed investors with its profitability on sales, as seen through gross margins of more than 70%.

Today’s Change

(0.03%) $0.05

Current Price

$188.13

Key Data Points

Market Cap

$4572B

Day’s Range

$178.91 – $188.15

52wk Range

$86.62 – $212.19

Volume

9M

Avg Vol

181M

Gross Margin

69.85%

Dividend Yield

0.00%

Now, let’s consider the event that’s coming up after the closing bell on Nov. 19, and this is Nvidia’s fiscal 2026 third-quarter earnings report. I’m optimistic that this will be another great moment for Nvidia — after all, chief Jensen Huang recently said total cumulative shipments of its current Blackwell and the upcoming Rubin platform as well as networking products so far total half a trillion dollars over 2025 and 2026. And the manufacturer of Nvidia chips — Taiwan Semiconductor Manufacturing — as well as Nvidia customers such as Oracle recently have spoken of strong AI demand.

Why Nvidia stock may fall

So, clues suggest Nvidia, too, will speak of a successful third quarter. Considering all of this, why do I expect Nvidia stock to stall out following the news? In recent days, some investors and analysts have expressed concern about a potential bubble in the AI market — even if a bubble isn’t forming, the presence of these worries has been weighing on technology stocks, and this may continue. For example, Palantir Technologies hit it out of the park, announcing explosive quarterly earnings growth, and the stock fell in the trading session following the report.

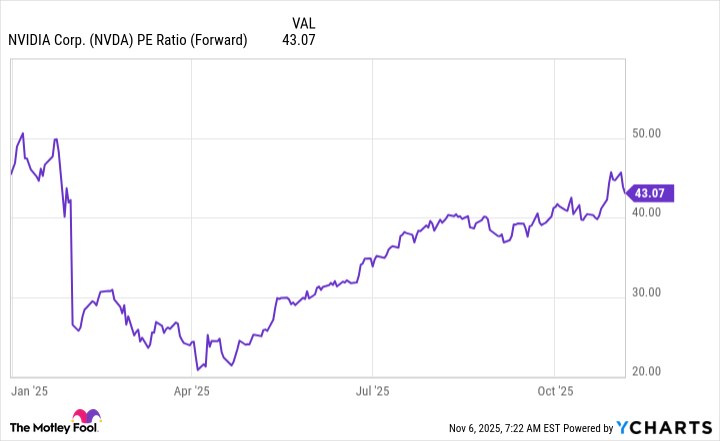

It’s also true that valuations have climbed, and though Nvidia remains reasonably priced considering its long-term potential, at 43x forward earnings estimates the stock still is much pricier than it was earlier this year.

NVDA PE Ratio (Forward) data by YCharts

Finally, after Nvidia’s most recent report — which was extremely positive — the stock slipped about 4% in the days that followed. So, a solid earnings report from Nvidia doesn’t always result in fantastic stock performance.

All of this prompts me to predict that Nvidia stock will stall out following its Nov. 19 earnings report. But this doesn’t mean I’m bearish on the stock, as I think any loss of momentum would be short term. In fact, I would use a dip in the shares to add to positions as I’m optimistic about Nvidia over the long haul. So, if I’m right and Nvidia stock loses momentum following its earnings report, growth investors seeking an AI winner may see this as a valuable buying opportunity.