Property prices in the UK rose once more in September, following August’s slight fall – but new figures show flats remain out of favour with buyers.

Nationwide data shows prices are up 0.5 per cent month to month, keeping annual prices rising at 2.2 per cent.

But the statistics show there are major differences in price changes between the north and south of the UK, as well as in the property type.

Semi-detached properties rose 3.4 per cent over the last 12 months, while detached (2.5 per cent) and terraced (2.4 per cent) saw slightly slower price rises. The cost of flats continues to decline, seeing average prices fall by 0.3 per cent.

Figures further show the price of a typical flat increasing by around 20 per cent over the past 10 years – less than half of the price growth of terraced houses over the same period.

Despite the ongoing year-on-year price growth, the third quarter of 2025 – July to September – saw a slowdown in price increases, which experts believe is connected to Budget uncertainty as people remain cautious with their money and plans.

“Annual growth remained steady at 2.2 per cent – a slightly higher pace of growth compared to August, though the majority of regions saw a modest slowdown in annual house price growth in the three months to September,” explained Alice Haine, personal finance analyst at BestInvest.

“The swirl of speculation has prompted some buyers, particularly at the top end of the market, to put purchase plans on pause. This could dampen market activity over the next couple of months if buyers wait to see what they are contending with before they commit.

“Sellers are responding by pricing homes more competitively, recognising that buyers are not only facing higher purchase costs but also the uncertainty that comes with possible tax changes.”

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

While property type is a factor, so too is location.

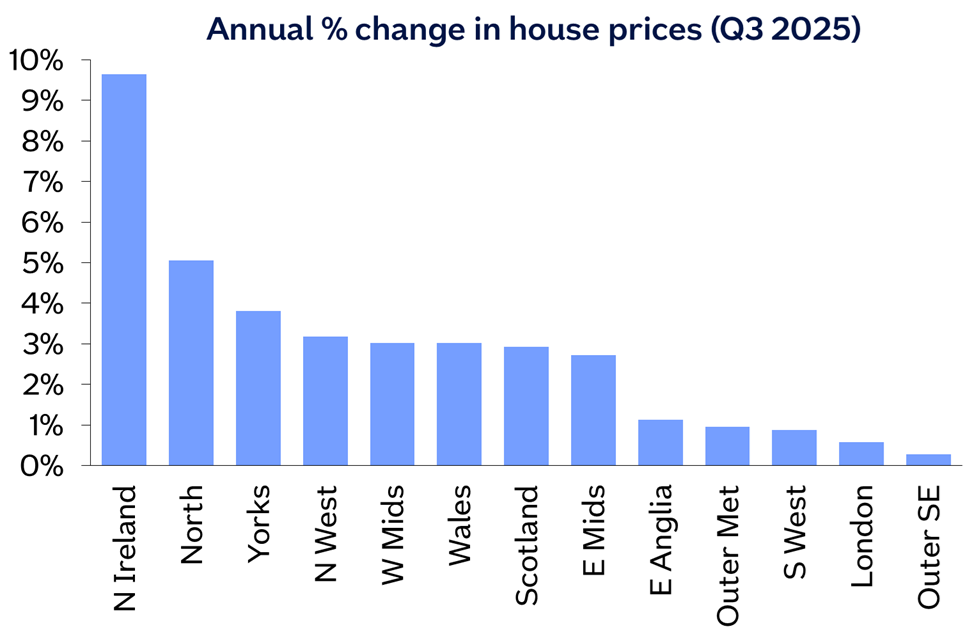

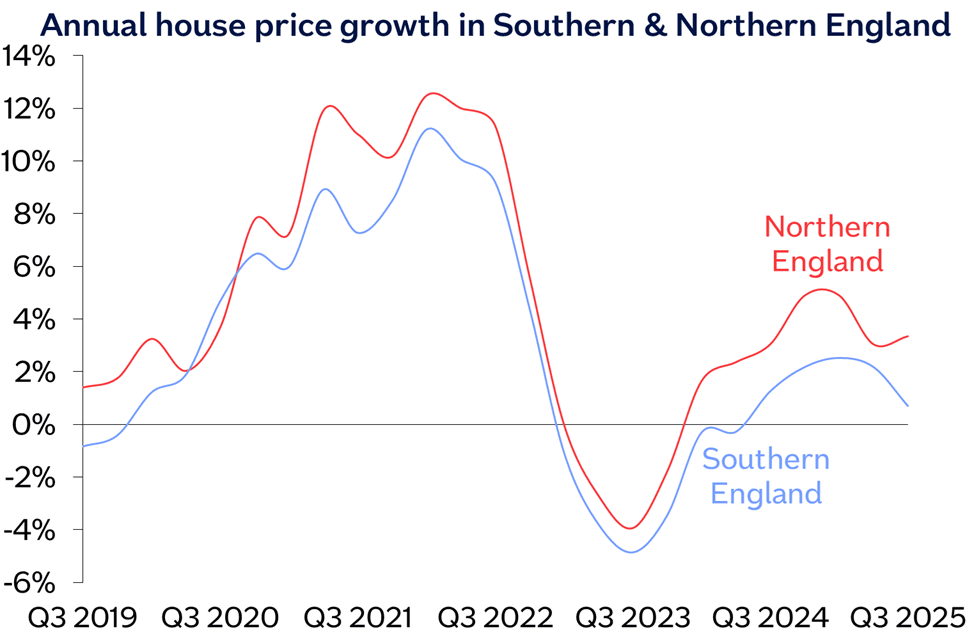

Homes in Northern Ireland and the north of England continue to see price growth far outstripping that in the south.

“The slowdown is sharpest in the commuter belt around London,” said Jonathan Hopper, CEO of Garrington Property Finders.

“The problem here is that the number of sellers far outstrips the number of serious buyers. Even in highly desirable areas, sellers are having to price their homes keenly just to grab buyers’ attention, and many are offering discounts or sweetening the price in other ways – perhaps by making a contribution to the buyer’s stamp duty costs – to get a deal done.

“This issue is being compounded by the uncertainty surrounding next month’s Budget. Rumours of a shake-up in property and wealth taxes have led many discretionary buyers to sit on their hands, and this has applied the brakes to prices in prime areas. Things are brisker at lower price points, especially among first-time buyers who are the most likely to benefit from August’s reduction in the Bank of England’s base rate.

“But while these factors matter, the market is ultimately driven by the forces of supply and demand – and this is where the gap between north and south is turning into a gulf.

“Average prices in northern England rose almost five times faster than they did in the south during the third quarter of the year, and Scotland and Wales both posted growth rates four times higher than that of southern England.”

Nationwide, detailed house prices in northern England regions are rising 5.1 per cent year on year, versus 0.7 per cent in southern England.

“The property industry also remains in the dark over potential changes in the tax regime in the Autumn Statement. While rumoured tax changes, such as a potential property tax on houses worth over £500,000, will significantly affect the market, the uncertainty over what’s to come may keep activity subdued until more clarity is provided in the Budget,” noted Tanya Elmaz, managing director at Together.

“Sellers looking to complete their sale before Christmas need to be entering the market now with the right agent and an added sense of urgency,” added Guy Gittins, CEO of Foxtons.