There are several risk factors that, in theory, could weigh on bond market sentiment. Tariffs, gradually rising , elevated policy uncertainty in Washington, a government shutdown, and a deteriorating trend for federal finances, to name a few. But the US bond market is looking through these headwinds and instead focusing on one scenario: expectations for a slowing economy.

Anticipating softer growth is arguably is the main driver that’s lifting bond prices these days, which in turn is weighing on bond yields (prices and yields move inversely). The Federal Reserve is expected to play along and on Wednesday (Oct. 29), according to Fed funds futures.

Reflecting the tailwind for bonds, are trading near their lows for the year. The benchmark 10-year rate, for instance, ended last week at 4.02%, close to the year’s intraday low of 3.86% and well below the year’s 4.79% peak set in January.

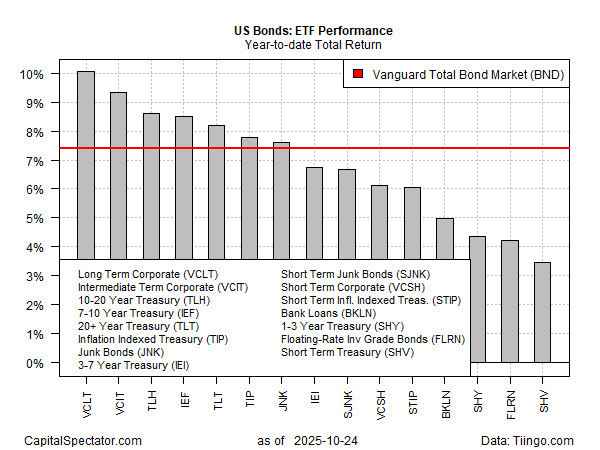

US bonds generally are posting across-the-board gains year to date, based on a set of ETFs through Friday’s close. The top performer: , which is up more than 10% in 2025. The benchmark for has rallied 7.4%.

The combination of Fed rate cuts and a growing sense in markets that US economic growth is downshifting is keeping demand humming for bonds.

Investors will be watching this week’s Fed meeting for clues on whether the party will continue through the end of the year. But the signals could be turn muddy as the government shutdown continues to postpone key economic reports.

“With a dearth of data and a still-divided FOMC, our US economists think Chair [Jerome] Powell is unlikely to provide clear signals on the policy path ahead, focusing more on topics including balance sheet policy and financial stability,” Deutsche Bank analysts wrote in a note.

To the extent that the bond market holds on to its gains, and perhaps rallies further, softer economic conditions will likely be a key factor.

“The economy is weaker than the market thinks, inflation is going to come off and, therefore, the Fed will be cutting rates,” predicts Steven Blitz, managing director and chief US economist at GlobalData TS Lombard. “Will it be four or five times? Probably not.”

By the end of the year, the Fed funds futures market is confident that the central bank’s target rate will slide to a 3.50%-to-3.75% range, or 50 basis points below the current range. That implies two more ¼-point rate cuts between now and New Year’s celebrations. On that basis, the bond market’s upside momentum still has room to run.