Weather: Brazil is turning wetter with heavy falls expected, while Argentina faces more rain that threatens wheat quality and slows soybean planting. The U.S. Southern Plains outlook remains favourable for winter wheat, and Europe shows no major new weather disruptions.

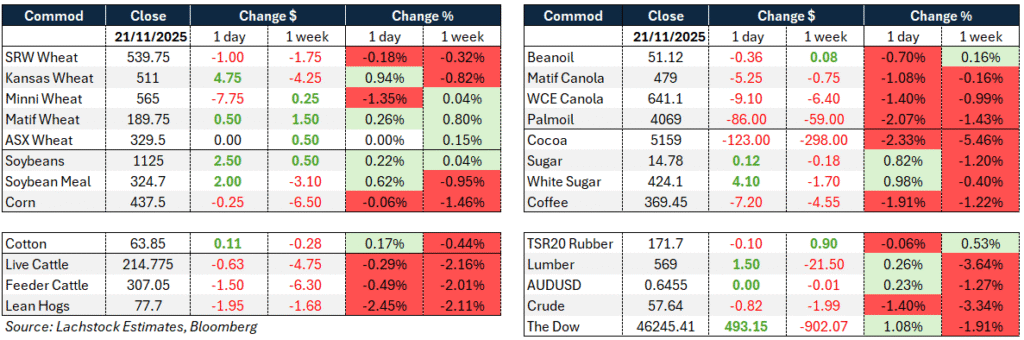

Markets: Wheat mixed on heavier global supply signals, corn stayed soft in a narrow range, and soybeans steadied after early selling but lacked fresh Chinese demand. Macro tone improved late on dovish Fed comments, while energy and broader commodities stayed under pressure.

Markets: Wheat mixed on heavier global supply signals, corn stayed soft in a narrow range, and soybeans steadied after early selling but lacked fresh Chinese demand. Macro tone improved late on dovish Fed comments, while energy and broader commodities stayed under pressure.

Australian Day Ahead: Offshore weakness points to canola opening softer. Heat in SA and Vic should speed up harvest and lift grain flow, potentially easing nearby demand. Cereals likely track steady to slightly lower in line with offshore.

Offshore

Offshore

Wheat

Global wheat sentiment remains heavy as higher world stocks dominate the narrative, with IGC lifting global 2025/26 wheat output to 830 million tonnes (Mt) on upgrades in Kazakhstan and Argentina, reinforcing burdensome balance-sheet themes.

Russia continues to weigh on markets after Sovecon raised its 2025 crop to 88.6Mt and projected an 83.8–87.9Mt range for 2026 depending on conditions, while GIWA upgraded WA wheat to 13.1Mt, adding to the global supply build.

Short-covering in KC helped support KC/CHI spreads as 122 certs were cancelled and no VSR storage contraction occurred, but flat price still made fresh monthly lows as December contracts move toward delivery.

Kansas firmness pressured Minny/KC with Minny calendars sold off, while SRW discussions are shifting toward potentially 5–20 percent lower planted area but remain speculative at this stage.

Demand signals remain mixed: Saudi tender sits on the radar and China chatter persists, with 132k SWW confirmed, though SRW interest remains unverified and traders want more weekly sales data.

Fundamentally the market is constrained by “too much wheat in the world,” with funds likely covering some shorts into resistance but lacking follow-through buying given elevated global carryout estimates.

Other grains and oilseeds

Soybeans saw choppy trade: early selling on talk of China cancelling Argentine cargos reversed into modest gains as the market bet that any lost Argie shipments may flow back to the U.S. instead.

Chinese soybean commitments remain well below expectations — only 1.8Mt confirmed (~2–3Mt estimated including unknowns), far short of the touted 12Mt framework and nowhere near past buying pace.

Technicals remain key: January soybeans must hold ~$11.10 to avoid a deeper slide; above that, a bounce toward $11.35–11.40 is possible, but a close below $11.10 opens the door to $11.00 and lower.

Corn remains pressured by USDA’s 186 bu/acre yield and large open interest ahead of FND, with interior cash and CIF softening; despite solid demand, the record U.S. crop keeps rallies capped.

Palm oil stabilised near MYR 4,150 with lower-output months approaching, but weaker exports (–14pc to –20pc) and a stronger ringgit capped strength; medium-term support comes from India’s expected 20pc import rebound and Indonesia’s B50 rollout tightening 2026 supplies.

Ukraine plans to further cut soybean plantings in 2026 due to poor profitability, while Argentina soybean planting reached 24.6pc of area despite flooding — signalling mixed supply risks across origins.

Macro

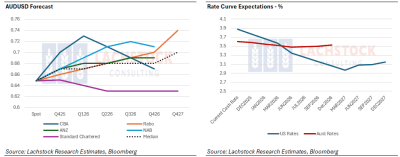

Fed’s Williams leaned dovish, noting easing inflation risks and rising employment risks, with market pricing for a December 25bp rate cut firming; U.S. yields fell with the 10-yr near 4.06pc.

U. Michigan sentiment ticked up to 51.0 with inflation expectations easing, reinforcing the view that the inflation backdrop continues to improve despite recent data volatility tied to the government shutdown.

EU composite PMIs signalled loss of momentum with weakness in German services/manufacturing and softer new orders, underscoring fragile demand and declining output-price inflation.

Energy markets softened as prospects for a Russia-Ukraine peace proposal raised fears that sanctioned Russian oil could return to the market, while European gas futures fell to 18-month lows amid high inventories.

Commodity sentiment was broadly risk-off: agricultural index +0.7pc bucked the trend, but base metals fell as doubts over Fed cuts resurfaced, partly offset late-week by China signalling potential property-sector support.

Equities firmed into the U.S. close on dovish Fedspeak, the USD held recent gains, and commodities stayed sensitive to shifting rate-cut expectations and geopolitical risk repricing.

Australia

In cricket, just something of interest, I saw over the weekend after the first test.

In cricket, just something of interest, I saw over the weekend after the first test.

In markets, WA canola finished last week steady around A$835, wheat $342, and barley $308 FIS Albany.

Through the east, canola held around $805, wheat $338, and barley $306 track Geelong.

SA and Vic set for proper heat today, which should help bring crops on and give exporters a better run at filling prompt demand.

SFWR delivered Western Districts remains bid around $330 for Jan+ delivery.

Faba beans continue to improve with currency support, now $455 Geelong/Melb for Jan+ delivery.