Shares of Strategy ($MSTR) plunged again today as Bitcoin’s sell‑off deepened, reinforcing the tight correlation between the world’s largest corporate Bitcoin holder and the digital asset’s price action.

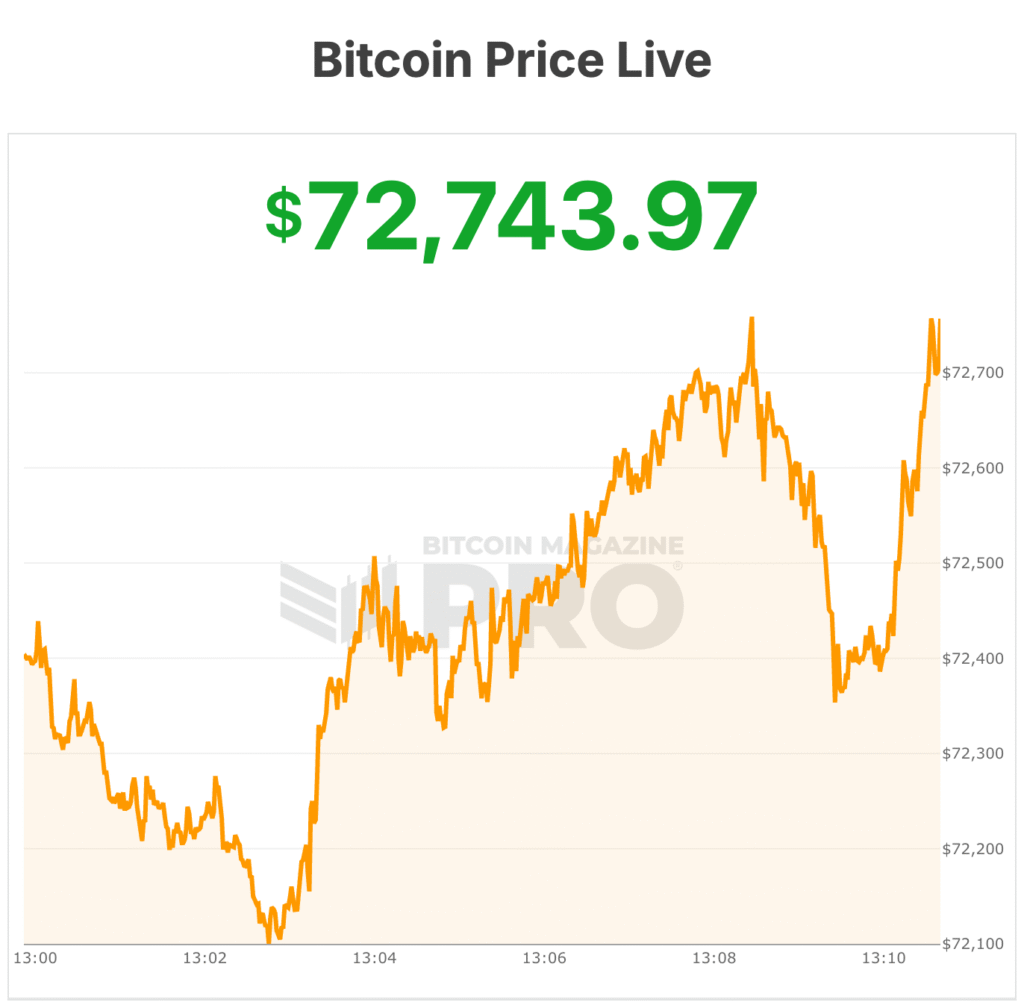

Bitcoin cratered toward $72,000, extending losses to levels not seen since late 2024, while MSTR shares tumbled roughly 9% on the session, dipping to intraday lows near $121.19.

At current levels the stock is down roughly 15% year‑to‑date and a staggering 72% from its November 2024 peak.

The drop in Bitcoin — now hovering near $72,000, far below the multi‑year highs seen in 2025 — has rippled across the broader crypto complex.

With sentiment souring and tactical traders eyeing technical support levels near the mid‑$60,000 range, risk assets have taken on a pronounced downbeat tone.

Commentary from market strategists has ranged from cautionary to outright bearish, with calls for deeper retracements if demand fails to stabilize.

Analyst slashes $MSTR price target by 60%

In a notable update this week, Canaccord Genuity analyst Joseph Vafi, long viewed as one of MSTR’s most vocal supporters, dramatically slashed his price target from $474 to $185 — a 61% reduction — while maintaining a Buy rating on the stock.

According to Vafi’s revised outlook, the new target still implies “significant upside” from current levels if volatility subsides and Bitcoin finds a tradable bottom.

Vafi’s retained bullish stance — despite the sharp target cut — highlights a nuanced view among some Wall Street strategists: even amid brutal downside, the stock’s deep discount to theoretical Bitcoin net‑asset value could eventually reprice upward.

Strategy continues bitcoin purchasing

Earlier this week, Strategy said it purchased 855 bitcoin for about $75.3 million, paying an average price of $87,974 per BTC, according to a Monday filing.

The acquisition came just days before bitcoin fell below $75,000 over the weekend on some rapid selling, briefly pushing Strategy’s treasury close to $1 billion in unrealized losses. Now, the price of bitcoin is below those levels at $72,000.

The company now holds 713,502 BTC, acquired for roughly $54.26 billion at an average cost of $76,052 per coin.

Last week’s purchase was fully funded through the sale of common stock, following Strategy’s ongoing capital-raising approach to finance bitcoin buys. The purchase of 855 bitcoin was significantly smaller compared to prior company purchases.

All eyes remain on MSTR’s upcoming fourth‑quarter 2025 earnings release, scheduled for later this week, a report that could provide more color on its capital‑raising cadence, BTC purchase strategy, and the evolving balance between leverage and asset coverage.

At the time of writing, bitcoin’s price dropped to lows near $72,000 today, its lowest level in over a year. The bitcoin price has now retraced more than 40% from its all‑time highs reached in late 2025.