Join Our Telegram channel to stay up to date on breaking news coverage

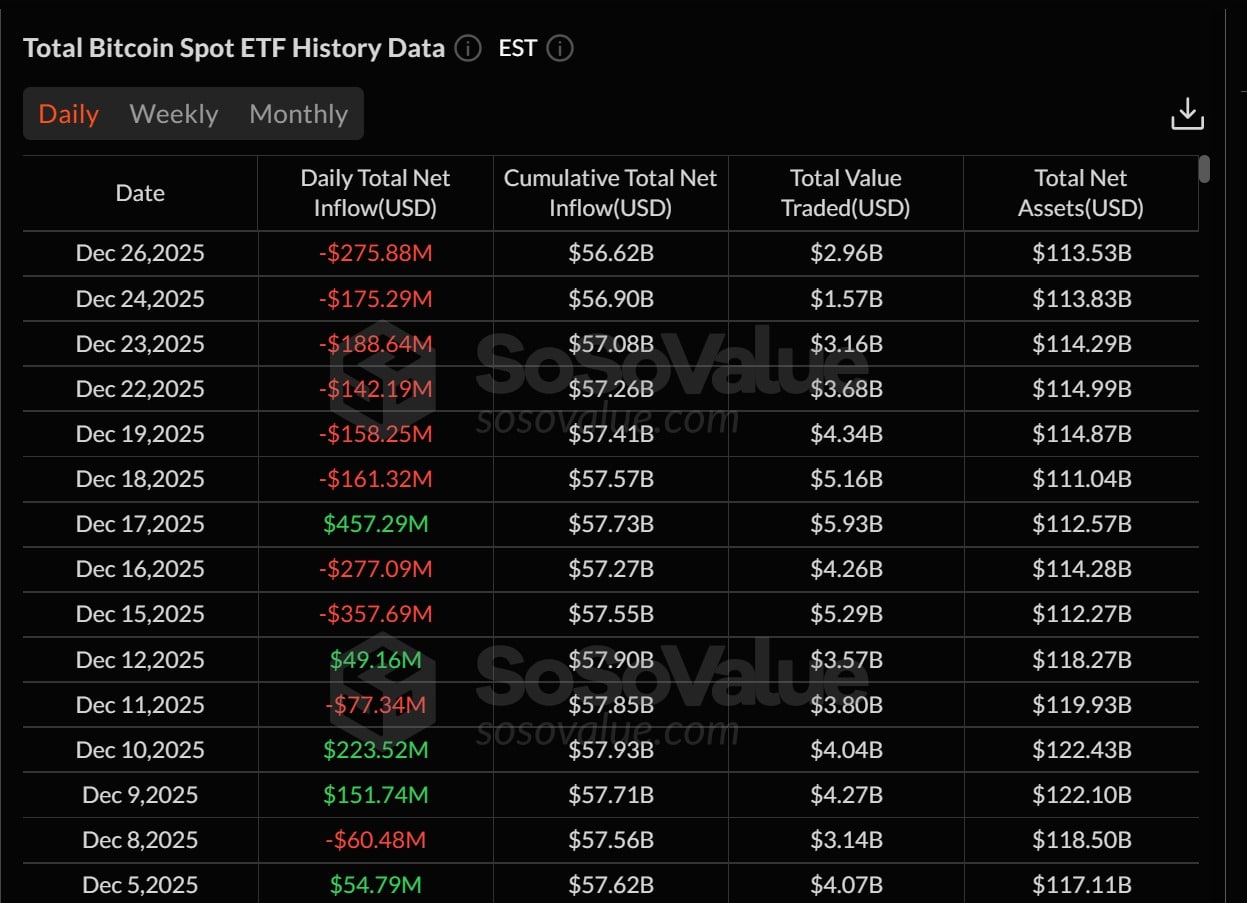

The Bitcoin price has surged 1% in the last 24 hours to trade at $87,994 as of 12 a.m. EST, even as US-listed spot Bitcoin ETFs experienced heavy outflows over the Christmas week.

Investors withdrew a total of $782 million from these funds, with the largest single-day exit of $276 million occurring on Friday. BlackRock’s IBIT led the losses with nearly $193 million leaving the fund, followed by Fidelity’s FBTC at $74 million, while Grayscale’s GBTC continued to see modest redemptions.

Because of these exits, total net assets in US spot Bitcoin ETFs fell to roughly $113.5 billion, down from peaks above $120 billion earlier in December. Friday also marked the sixth consecutive day of outflows, the longest streak since early autumn, with cumulative withdrawals exceeding $1.1 billion in over six days.

Analysts say these outflows are likely temporary. Vincent Liu, CIO at Kronos Research, noted that holiday trading and thin liquidity often drive ETF selling during Christmas. He expects flows to normalize in early January as institutions return.

Liu added that expectations of Federal Reserve rate cuts in 2026, currently priced at 75–100 basis points, may support Bitcoin ETF demand. Growing bank-backed crypto infrastructure could also make it easier for large investors to re-enter the market.

However, data from Glassnode shows Bitcoin and Ether ETFs have been in a sustained outflow phase since early November, signaling a more cautious approach from institutional investors amid tighter market liquidity.

This indicates that while holiday outflows may be temporary, overall institutional demand has cooled after a year in which large allocators were a major driver of the crypto market.

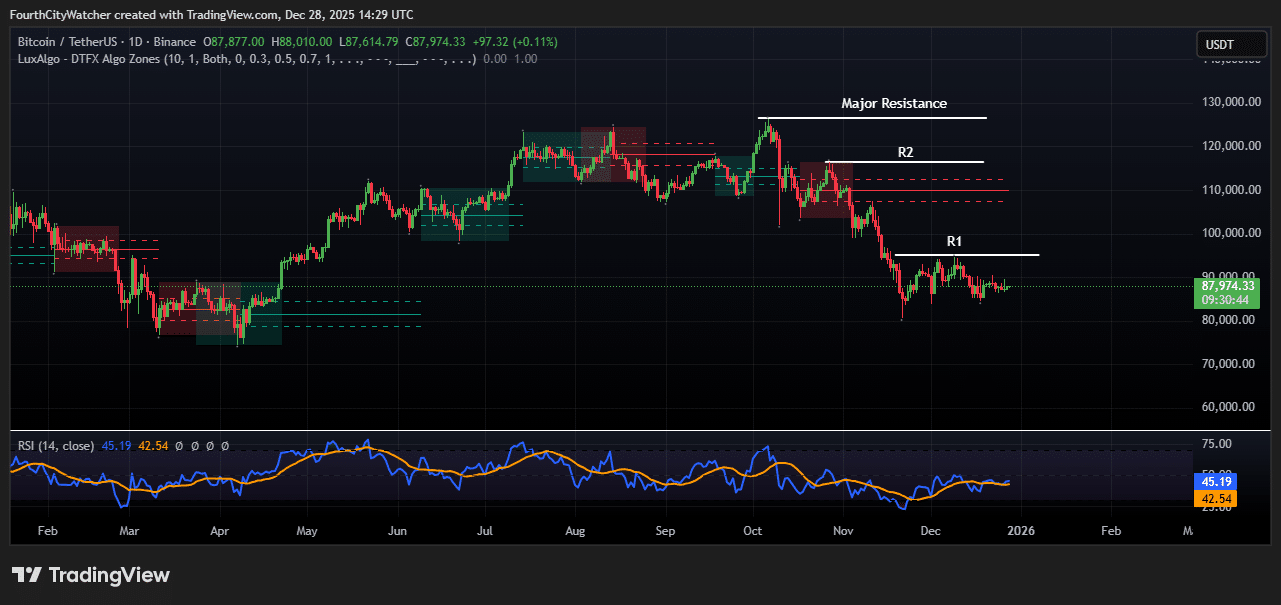

Bitcoin Struggles to Break Resistance as Bears Maintain Control

Bitcoin is currently trading at $87,976, reflecting a minor gain of 0.11% on the day. The price action shows that Bitcoin has been in a sustained downtrend since mid-October, after reaching a peak near $123,000. Since then, the market has formed a series of lower highs and lower lows, indicating persistent bearish pressure.

Immediate support is located around $87,600, which has held several recent daily closes. A stronger support zone exists between $82,000 and $84,000, marking the low seen in early December. On the upside, resistance is evident near $90,000, with a more significant barrier around $95,000 to $96,000, corresponding to previous consolidation periods in late November.

The shaded red and green zones on the chart highlight these key supply and demand areas, showing where selling and buying pressure have historically been strongest. Momentum indicators, particularly the 14-day Relative Strength Index (RSI), currently read 45.20, slightly below the neutral 50 level.

BTCUSDT Analysis Chart. Source: Tradingview

This indicates that Bitcoin is neither overbought nor oversold, though bearish momentum remains slightly dominant. The RSI has been trending sideways following a recovery from oversold levels in December, indicating that the market is consolidating rather than showing strong upward momentum.

The broader trend remains bearish, as confirmed by the pattern of declining peaks and valleys. While short-term bounces have occurred, Bitcoin has repeatedly failed to break above resistance levels, indicating that sellers continue to dominate at higher prices.

Holding support could lead to a potential recovery, while a breakdown below $87,600 may push the price toward the next significant support near $82,000, which could serve as a key accumulation area.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage