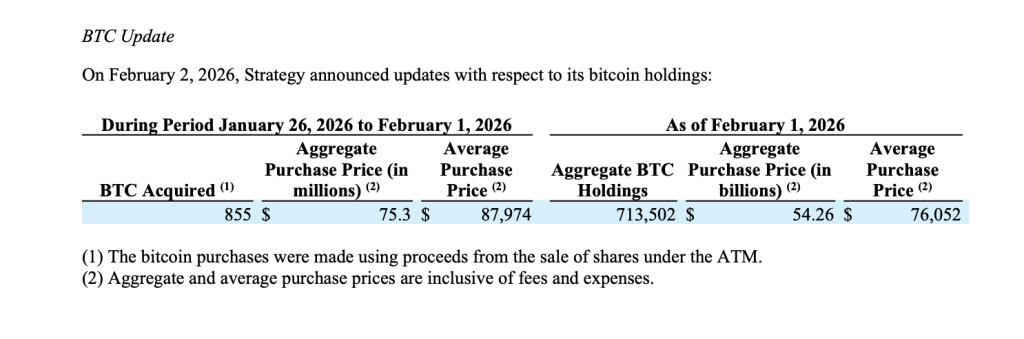

Michael Saylor’s Strategy has expanded its already massive Bitcoin treasury, acquiring an additional 855 BTC for approximately $75.3 million, at an average purchase price of roughly $87,974 per Bitcoin.

The purchase, disclosed in a company update dated February 2, 2026, shows Strategy’s continued commitment to Bitcoin accumulation even amid heightened volatility across crypto markets.

The latest acquisition brings Strategy’s total Bitcoin holdings to 713,502 BTC as of February 1, 2026, positioning the firm as the largest corporate holder of Bitcoin globally.

Total Bitcoin Holdings Now Exceed $54 Billion Cost Basis

According to the filing, Strategy has acquired its Bitcoin stack at an aggregate cost of approximately $54.26 billion, with an average purchase price of about $76,052 per Bitcoin, inclusive of fees and expenses.

With Bitcoin trading around the mid-$70,000 range in recent sessions, the disclosure shows how closely the company’s cost basis now aligns with current market levels, following the sharp selloff seen over the weekend.

Strategy’s aggressive treasury strategy has long been viewed as both a high-conviction bet on Bitcoin as a long-term store of value and a leveraged proxy for institutional Bitcoin exposure.

Funded Through At-the-Market Share Sales

The company noted that the Bitcoin purchases were funded through proceeds from the sale of shares under its at-the-market (ATM) offering program.

During the period from January 26, 2026, to February 1, 2026, Strategy sold 673,527 shares of its Class A common stock, generating net proceeds of approximately $106.1 million.

The ATM program remains a key mechanism through which Strategy continues to raise capital for additional Bitcoin accumulation, while maintaining flexibility in execution.

Institutional Sign Amid Market Capitulation

The acquisition comes at a time when crypto markets have faced broad capitulation driven by leverage washouts, with both Bitcoin and Ether experiencing steep weekly declines.

Despite the turbulence, Strategy has remained consistent in its approach: buying Bitcoin through both rallies and drawdowns, reinforcing its long-term thesis that Bitcoin will play an increasingly central role in global financial infrastructure.

As of early February 2026, Strategy’s Bitcoin position represents one of the largest institutional treasury allocations in the digital asset space, with holdings acquired at an average price well below the latest purchase level.

Epstein-Related DOJ Document Release Mentions Saylor Donation

A tranche of Epstein-related documents released by the U.S. Department of Justice on January 31 includes a 2010 email referencing Michael Saylor in connection with a high-profile charitable event and elite social invitations.

CryptoNews contacted Michael Saylor’s press team for comment on the email reference and any potential connection, but had not received a response at the time of publication