Foxtons Group’s (LON:) Q325 revenue growth was clearly affected by the loss of consumer confidence in the sales market. We, and the company, believe this will probably continue until the end of the year, given the unhelpful headlines relating to potential tax increases in the Autumn Budget and the slower-than-hoped-for decline in interest rates.

We have reduced our profit estimates and valuation as a result. However, we believe Foxtons’ strategic direction remains positive, and the internal initiatives previously outlined will bear fruit. Furthermore, the revised medium-term financial targets announced in June are ambitious but achievable, underpinned by structural growth, headquarter-related cost savings, Foxtons’ technology stack, and its proprietary data vault.

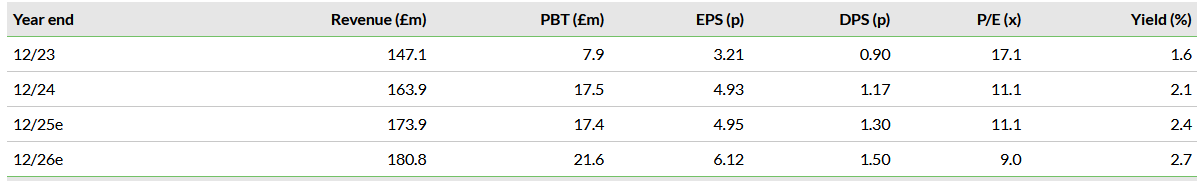

Note: PBT and EPS include amortisation of acquired intangibles and exceptional items (ie diluted company definition).

Q325 Revenue Growth Slowed to 3%

Foxtons’ group revenue amounted to £49.0m in Q3, implying growth of 3%. Lettings, the largest division, grew revenue by 5%, and Financial Services revenue rose 37%. However, Sales, previously the fastest-growth division, was affected by reduced consumer confidence ahead of the Autumn Budget, and its revenue reduced 7%. Furthermore, the change in stamp duty in Q1 pulled volumes forward to that period, affecting Q2 and Q3 volumes.

Positive Trends And Actions

There are a number of trends and initiatives that are expected to positively affect Foxtons’ markets and/or profits. These include the Renters’ Rights Bill, which is approaching its final stages in Parliament. This is likely to help drive private landlords towards professional property management services.

Foxtons has also launched a new people initiative called ‘Getting It Done. Together’ (GIDT), which aims to foster a more respectful, rewarding and inspiring culture within the group. Finally, the company announced another £3m share buyback in September and is well advanced with plans to relocate its head office, which will deliver meaningful cost savings from January 2026.

Valuation: Estimate Revisions and Adjustments

Given the clear market weakness in Sales in Q325 and the uncertainty that already-agreed sales will compete on the timescale expected in Q4, Foxtons has guided down market expectations of adjusted operating profit from a consensus of £23.7m, to £21.5–23.2m. We have reduced our FY25, FY26, and FY27 expectations accordingly and have adjusted our valuation from 134p per share to 126p per share.

Sales Volumes in Q425 Subject to Volatility

There is little doubt that the reorganisation and reinvigoration of Foxtons, as well as the revised strategic targets, are driving positive change. However, in Q3, the confidence that had been in the sales market has evaporated as the media has picked up on discussions surrounding the now-delayed Autumn Budget and the potential for further tax rises.

This suggests that Q4 is likely to be less promising than previously assumed. Therefore, we have reduced our FY25, FY26, and FY27 estimates as it is unclear what level of agreed sales will be completed by year-end, considering the market uncertainty. Despite this, Foxtons continues to drive the business and improve its internal functions even if the outside markets are less forgiving.

Year-to-date Revenue and Q3 Results Driven by Non-Cyclical Business

Foxtons’ Q325 results demonstrated overall revenue growth of 3% to £49.0m, but this hides the weaker market-led performance in Sales, where reduced consumer confidence led to lower levels of sales activity in the period. There was also evidence that the stamp duty change at the end of Q1 also contributed to the quarter’s weakness.

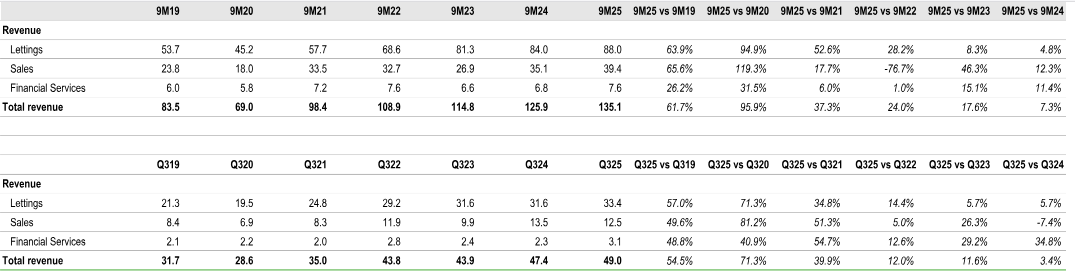

In the nine-month year-to-date period (9M25), overall revenue increased 7% to £135.1m, with that growth spread more equitably over the three divisions. Looking at the table below, 9M25 group revenue is up more than 60% on the 9M19 pre-COVID-19 comparative period.

Q3 Lettings revenue increased by 5% (or £1.8m) to £33.4m, driven by £0.6m of like-for-like growth (operational improvements, enhanced portfolio retention, new deals and rental price lifts) and £1.5m from acquisitions, offset by a £0.3m reduction in the interest earned on client money. 9M25 Lettings revenue, accounting for 65% of year-to-date revenue, increased 5% to £88.0m, which included £4.4m from incremental acquisitions, offset by a £0.8m reduction in interest on client money.

Exhibit 1: 9M25 and Q325 Revenue Growth Rates by Division and Group

Source: Foxtons Group, Edison Investment Research

In Sales, Q3 revenue declined 7.4% to £12.5m as exchange volumes decreased due to lower volumes of market transactions. Buyer activity was affected by deals pulled into Q125 due to the stamp duty deadline, more limited interest rate reductions than had been expected, and uncertainty surrounding the delayed Autumn Budget. Year-to-date revenue increased 12.3% to £39.4m, benefitting from the strong Q1 period, boosted by the stamp duty deadline.

The smallest division, Financial Services, saw Q3 revenue increase 37% to £3.1m, benefitting from the expected bounce in remortgage activity (relating to original deals taken out in the early period of COVID-19) and new purchase mortgage activity, which was stable, despite the weaker sales market, underscoring the resilience of the re-finance portfolio. Good operational progress relating to lead generation and adviser productivity growth strategies contributed to the strength. Year-to-date revenue was up 12% to £7.7m.

Continued Strategic Development

Exhibit 2 below highlights the divisional revenue trends. Clearly, Lettings has grown steadily in each of the last five years in contrast to Sales and Financial Services, as the underlying markets have been quite volatile, driven by outside influences. Revenue in both Sales and Financial Services has grown in 9M25, compared to 9M24 and, despite the evident volatility, the revenues of both divisions are comfortably higher than they were in 9M19. This, in our opinion, reflects the active investment in fee earners, staff training, data suites and the Foxtons brand, especially recently.