Analytics platform firm Santiment says that Bitcoin (BTC) is primed to break out based on historic correlations with two other asset classes.

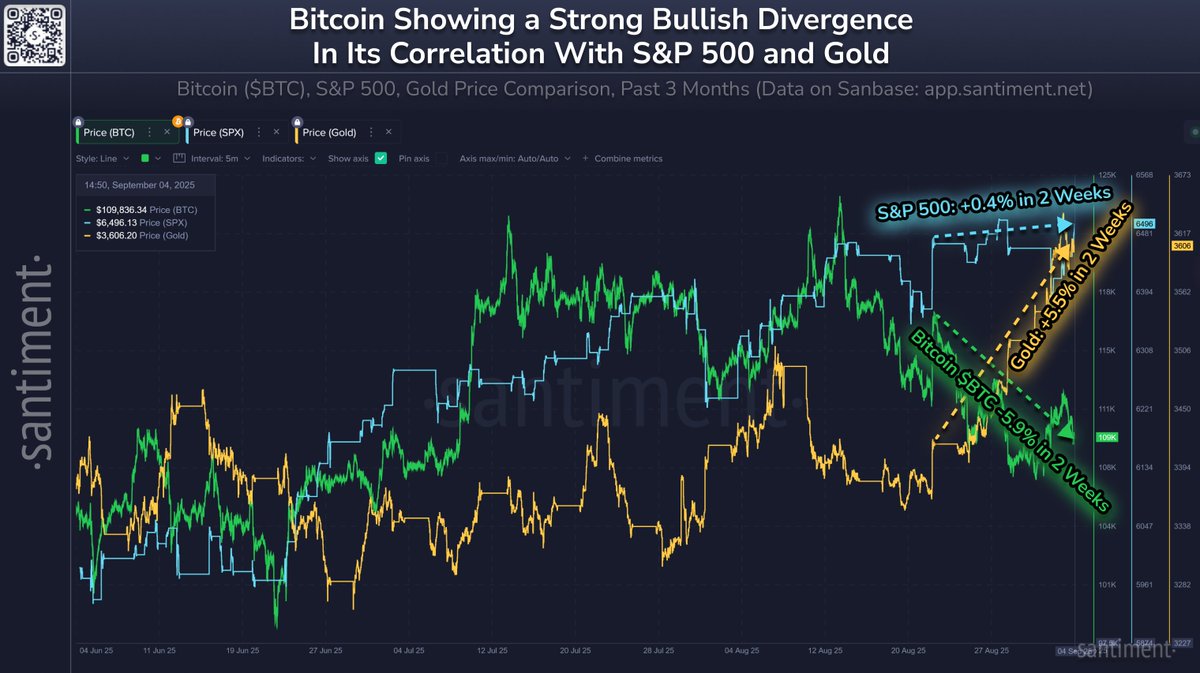

Santiment says that Bitcoin is forming a bullish divergence against the S&P 500 and gold, signaling the flagship crypto asset may be on the verge of an explosive move to the upside.

A bullish divergence occurs when the price of an asset is forming lower lows while an oscillator is forming higher highs.

“There is a major bullish divergence that has been forming over the past two weeks:

- Bitcoin’s market value has dropped -5.9% since August 22nd.

- S&P 500 has risen +0.4% since August 22nd.

- Gold has risen +5.5% since August 22nd.

Since early 2022, cryptocurrencies have been especially correlated with equities, as institutionals have increasingly added exposure to them alongside their stock holdings. In cases like this divergence over the past two weeks, Bitcoin (and altcoins) have a high probability of playing ‘catch up’ when they trail world economy price trends for a sustained period of time. The larger the gap between equities and BTC gets, the stronger the argument there is for an upcoming crypto bounce.”

Bitcoin is trading for $110,839 at time of writing, up marginally on the day.

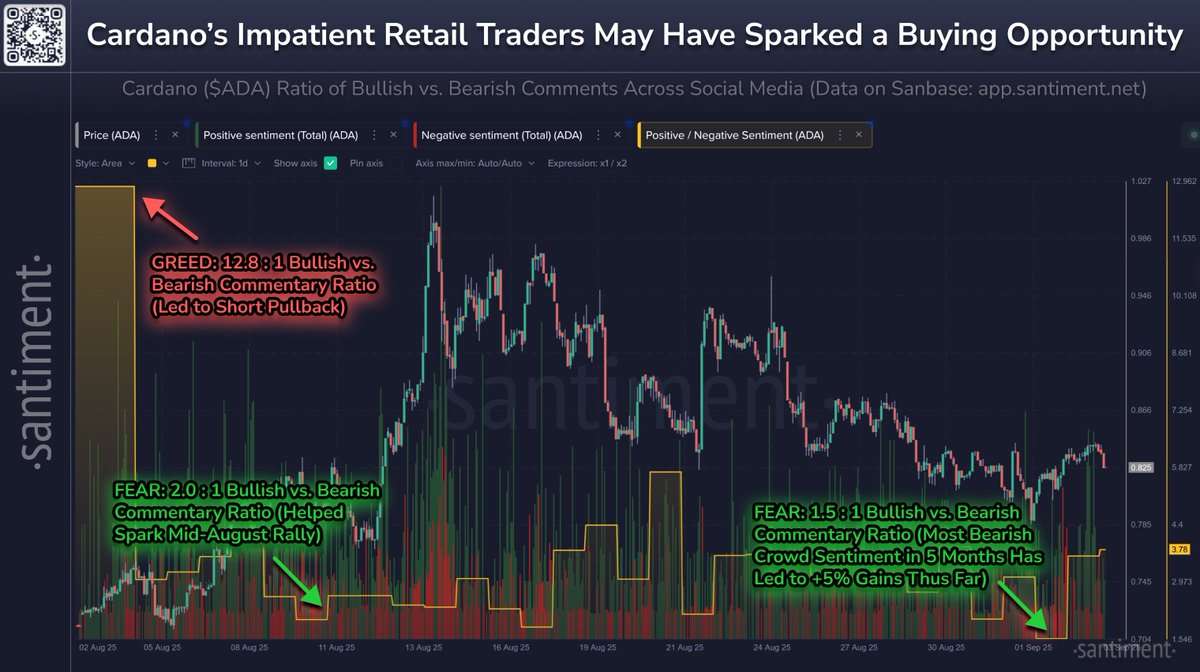

Next up, Santiment says that the increasing negative sentiment on social media for smart contract platform Cardano is a bullish signal for ADA.

“Cardano has quietly seen its normally optimistic crowd start to turn bearish. After the lowest sentiment recorded in five months, ADA’s price is +5%. Patient holders and dip buyers during this three-week downswing should root for this trend of bearish retailers to continue. Prices typically move in the opposite direction of the crowd’s expectations. When small traders sell off their bags out of impatience and frustration, it is generally the key stakeholders who accumulate and drive up prices again.”

ADA is trading for $0.825 at time of writing, up 2.1% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Giovanni Cancemi/Andy Chipus