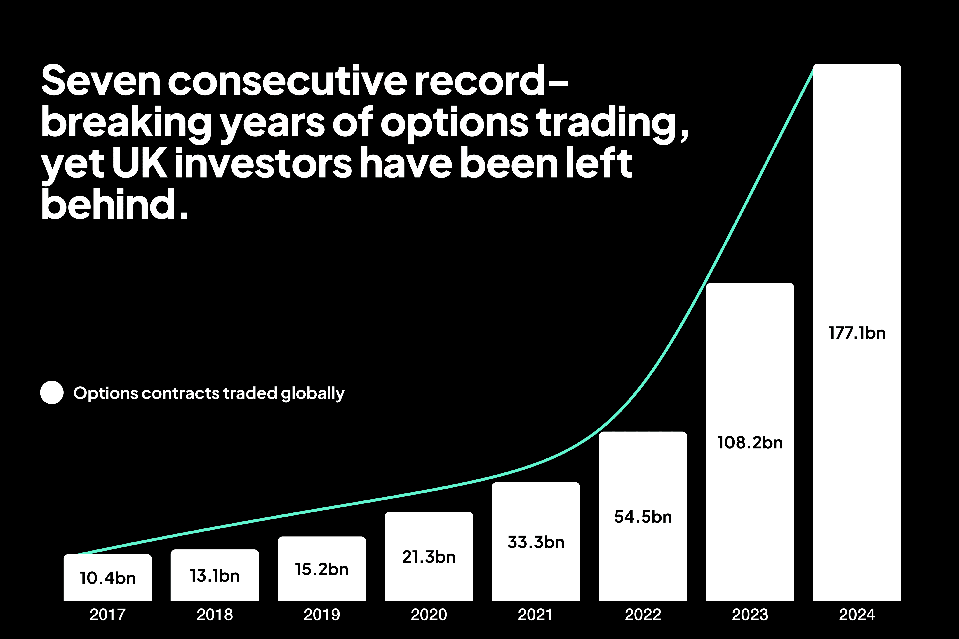

A chart from Investa’s investor pitch, showing that while options volume in the US is skyrocketing, options have not yet gained a foothold in the UK.

Investa

For years, UK retail investors have watched American traders share screenshots of extraordinary gains from options trades on social media. A call option turning £500 into £50,000 overnight. A put trade that perfectly timed a market crash. Meanwhile, British investors trying to replicate these strategies faced a maze of complex platforms, hefty fees, and interfaces designed for institutional traders rather than regular people.

That exclusion is ending. Two major developments in 2025 have cracked open a market that was technically available but practically inaccessible to most UK retail investors.

Robinhood Proves UK Appetite For Options Trading Exists

Retail options trading has become synonymous with Robinhood in the US. But while the GME saga unfolded, it was not yet available to UK investors. Until recently.

When Robinhood launched options trading for UK customers in February 2025, the response validated what many suspected: British investors had been desperate for accessible options trading all along. The platform that democratized options in America brought the same simplified approach to the UK market, offering zero contract fees through May and a streamlined mobile interface.

But Robinhood’s entry was just the beginning. Small local players also want a piece of the action.

How Investa Plans To Beat US Giants At Their Own Game

Investa’s early team, including former City equity derivatives trader Alec Beasley in the middle.

Investa

This week, UK fintech Investa opened its second crowdfunding round on Crowdcube, aiming to raise £1 million after its previous campaign was overfunded by 220% in 2024. The company’s success story reveals something important about UK market dynamics that Robinhood might have missed.

“The support we received from the Crowdcube community last year was phenomenal,” said Alec Beasley, co-founder and CEO of Investa. “It not only validated our mission to make options trading accessible to UK retail investors, but also highlighted that on-the-go traders want a level playing field.”

Investa’s approach differs from Robinhood in crucial ways. While both offer zero-commission trading, Investa has designed its platform specifically around options education that UK investors, less familiar with options trading than their American counterparts, are likely to need. One of the features the app aims to expand upon is what the company calls “Option Sidekick” – a feature that asks users simple questions about their market view and suggests appropriate options strategies, complete with scenario analysis showing potential outcomes.

More importantly, Investa has made a deliberate decision that sets it apart from US platforms: customers cannot sell “naked” options. This eliminates the unlimited loss potential that has led to horror stories of retail traders owing hundreds of thousands of dollars they do not have.

Why Options Trading Never Took Off In The UK Before

The technical infrastructure for options trading has existed in the UK for decades. The London Stock Exchange has offered options contracts, and several brokers provided access to both UK and international options markets. So why did options remain the preserve of professional traders and wealthy individuals?

The answer lies in accessibility barriers that went far beyond regulation. Traditional UK platforms treated options as an advanced feature bolted onto stock trading platforms. Users faced complex order screens with dozens of parameters, Greek letters (delta, gamma, theta) without explanation, and minimum account balances that excluded smaller investors.

Interactive Brokers, one of the most sophisticated platforms available to UK retail investors, exemplifies this problem. While offering extensive options access, its interface resembles Bloomberg terminals more than consumer apps. The learning curve is steep, the minimum deposits substantial, and the user experience assumes prior knowledge of derivatives trading.

These platforms were not designed for someone wanting to make their first options trade with £100. They were built for investors already comfortable with concepts like implied volatility and time decay.

The Mobile Revolution Making Complex Trading Simple

The new generation of UK options platforms takes a mobile-first approach that prioritizes simplicity over sophistication. Instead of overwhelming users with every possible options strategy, these apps focus on the most common use cases: hedging positions, generating income, and directional speculation.

Investa’s “options cards” strip away the jargon and complex chains that characterize traditional platforms. Users see simplified information about potential profits, losses, and breakeven points without needing to understand Black-Scholes pricing models.

This approach mirrors what happened in the US, where Robinhood’s simplified interface attracted millions of new options traders. The difference is that UK platforms are learning from American mistakes. Robinhood’s UK launch validates the market demand, but also reveals the challenges. Options trading requires more education and hand-holding than stock trading. Getting the balance right between accessibility and safety will determine which platform captures the UK market.

The Consumer Education Challenge

Behind the simplified interfaces lies a complex challenge: how do you make sophisticated financial instruments accessible without misleading users about the risks involved?

Both Robinhood and Investa are required put users through appropriateness tests before accessing options trading. But these regulatory checkboxes do little to prepare someone for the reality of watching an options position lose 50% of its value in a single day due to time decay.

Investa’s approach of showing scenario analysis for each potential trade represents one solution. Users see exactly how much money they could make or lose under different market conditions and timeframes. This educational component is built into the trading process rather than relegated to separate help sections.

The UK market also benefits from more conservative regulatory oversight compared to the US. While this might slow innovation, it provides guardrails that could prevent some of the spectacular losses that have plagued American retail options traders.

The revolution in UK options trading accessibility is not just about the democratisation of financial services. It represents the evolution of what some have called the “Degenerate Economy” where speculation is increasingly seen as entertainment. Instead of offering complex tools and expecting users to adapt, these platforms are adapting tools to match user capabilities.

Whether this democratization ultimately helps or merely entertains retail investors remains an open question. But for the first time, UK investors have real choices in how they access options markets. The exclusion is ending, and the real experiment is just beginning.