Investors should pay attention to the actions of the legendary investor.

Warren Buffett is telling investors something — not through what he has said, but through his actions with the balance sheet of his investment conglomerate Berkshire Hathaway (BRK.A -0.40%) (BRK.B 0.85%). These actions should be taken as a warning sign with the stock market reaching elevated valuation levels in recent months.

As the market and Berkshire Hathaway stock soar, Buffett is pulling back and building a huge cash position. Should you follow his lead? Here’s what Buffett’s moves could mean for the stock market as well as Berkshire Hathaway itself.

Huge cash pile and halted share buybacks

Two actions from Berkshire Hathaway indicate a level of caution for Buffett at the moment: a rising cash pile and the halting of share buybacks. Last quarter, Berkshire Hathaway’s level of cash and equivalents reached $344 billion, which is larger than the market capitalizations of all but 27 publicly traded companies in the world.

Buffett keeps selling stocks in his portfolio such as Apple, reducing his cumulative position to $267 billion as of the end of the second quarter. This means Berkshire Hathaway has more of its capital sitting on the sidelines than invested in the stock market.

In recent years, Buffett has used his excess cash to repurchase shares of Berkshire Hathaway stock. No longer. In the second quarter of 2025, Buffett completely halted share repurchases, which is a huge slowdown compared to a quarterly rate in the billions of dollars back in 2020 to 2022. Berkshire uses the cash to reduce its shares outstanding, but only when Buffett believes his own stock is trading at a discount.

In the second quarter, Berkshire Hathaway’s price-to-book value (P/B), a good metric for evaluating an insurance and investment company, grew to a 10-year high of close to 1.8. Slowing share buybacks with the P/B rising like this indicates that Buffett does not believe Berkshire Hathaway stock is a bargain for investors at the moment.

Image source: The Motley Fool.

Soaring valuations should make investors nervous

Even though Buffett has a record high cash pile and brought in $25 billion in operating earnings through the first six months of 2025, he has still sat on the sideline and declined to purchase more stocks — an indicator of what Buffett thinks of the stock market in general.

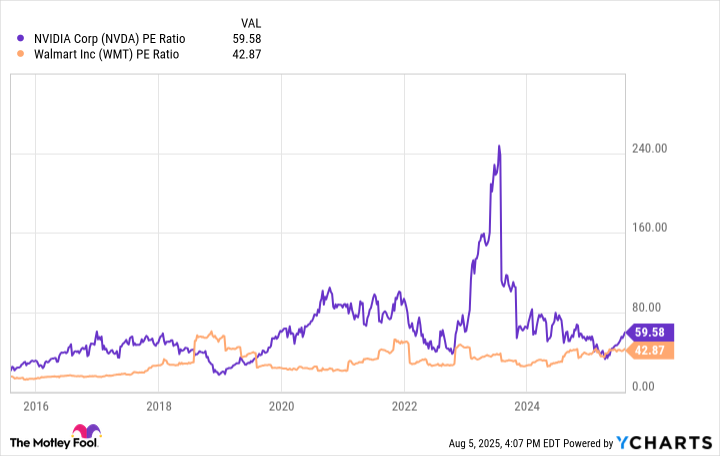

Historically, Buffett has increased his cash position and exited stocks when valuations got overheated, such as 1968 and 1999. In the near term this can look foolish, but over the long run buying stocks at an elevated price-to-earnings ratio (P/E) will lead to worse forward results, all else equal. Today, the S&P 500 index trades at a P/E ratio of 30, which is well above its long-term average. Fast-growing stock Nvidia trades at a P/E of 59, while even slower-growing Walmart trades at a P/E of 42.

Unsurprisingly, Buffett is finding it tough to identify bargain stocks to buy in this market environment. Instead, he would rather sit on a cash equivalent and earn guaranteed interest income, waiting for his opportunity to strike. This patience is why Buffett has crushed the market over the decades as one of the best investors of all time.

NVDA PE Ratio data by YCharts

What should you do?

Investors should heed Buffett’s actions. He is getting increasingly cautious with Berkshire Hathaway’s balance sheet as the market soars.

What you do about it entirely depends on your personal financial situation, however. If you are a younger person under the age of 40, you do not necessarily need to worry about high P/E ratios from stocks in your investing portfolio, as long as the money is being saved for retirement or many years into the future.

On the other hand, older investors should pay much closer attention to Buffett’s actions. You do not want your entire portfolio in stocks if you are drawing down money for retirement or plan to use it for any upcoming expenses with P/E ratios at such elevated levels. There is a major risk of a correction and regression to the long-term mean.

Instead, put money into cash equivalents like Treasury bonds, or cheaper dividend-paying stocks. Buffett’s example with Apple is a good lesson in this regard. He greatly trimmed his position with the low-growth technology giant’s P/E ratio between 30 and 40, which does not inspire confidence for strong forward returns.

Stay cautious, and do not get over your skis with the stock market chugging to all-time highs. Take Buffett’s historical lessons to heart and keep a balanced investment portfolio for your personal financial situation.

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Nvidia, and Walmart. The Motley Fool has a disclosure policy.