It’s that time again… The year 2025 has come to a close, 2026 has begun, and we’re all eager to consider what may lie ahead for stocks in this new year. After a third straight double-digit annual gain, will the S&P 500 continue to roar higher? Which stocks will lead the way? No one can answer those questions with 100% certainty, but we might consider the general environment and, based on our observations, make a few predictions.

For 2025, I predicted that artificial intelligence (AI) stocks would continue to drive gains, and that did indeed happen, with names like Nvidia (NVDA +1.14%) and Palantir Technologies advancing about 40% and 140%, respectively, and CoreWeave jumping more than 300% from its March initial public offering through June — though it’s dipped since then, it still delivered a significant annual gain.

This time around, I’m making another prediction concerning AI stocks and a few others regarding the overall market. Here are my top five stock market predictions for 2026.

Image source: Getty Images.

1. AI winners and losers will emerge

In recent years, a broad range of AI stocks have soared — from those developing AI to those using the technology. In some cases, even companies very far from profitability have seen their stock prices take off thanks to their presence in the AI space.

In this new year, some not-yet-profitable AI companies may continue to climb, but in general, I predict investors will look more closely for results from AI players: They will want to see a clear path to profitability and solid long-term prospects, for example.

This year, we’ll start to see the emergence of AI winners and losers. And investors will turn to companies that are leaders in their specialty area, generate strong growth, and have what it takes to benefit from the technology in the years to come. Well-established companies like Nvidia and Amazon come to mind, but smaller and younger players also may fit the bill.

So, when buying AI stocks in 2026, pay close attention to the company’s recent track record, the competition it faces, and how it fits into the picture as the AI boom reaches its next stages.

Today’s Change

(1.14%) $2.13

Current Price

$188.63

Key Data Points

Market Cap

$4.6T

Day’s Range

$188.27 – $192.90

52wk Range

$86.62 – $212.19

Volume

6.1M

Avg Vol

185M

Gross Margin

70.05%

Dividend Yield

0.02%

2. The stock market won’t be driven by AI only

Though many AI stocks may continue to score a win, the S&P 500, which I believe will climb, won’t be driven uniquely by AI in 2026. Other industries, from pharmaceuticals to consumer-related names, may deliver greater gains and push the famous benchmark higher.

Why do I predict such a movement? AI stocks have been advancing for the past few years, and though their potential remains solid, early investors in this area may look to lock in some gains and rotate into other promising areas. This means that if you’ve invested heavily in AI, you might aim to broaden your reach across industries in 2026 — whether my prediction is right or wrong, this diversification will serve you well in any market environment and over the long term.

3. Investors will flock to dividend stocks

Investors haven’t paid a huge amount of attention to dividend stocks amid the excitement about AI. Some long-established tech stocks pay dividends, but you’re most likely to find these payouts from companies in other industries like healthcare, consumer goods, or industrials.

As investors seek diversification in 2026, they may choose dividend stocks that offer them passive income regardless of the market or economic environment. If you want to get in on this movement, check out the list of Dividend Kings. They’ve increased their dividend payments for at least 50 straight years — this suggests that rewarding shareholders is important to them and that they may continue along this path.

4. Valuations will come down

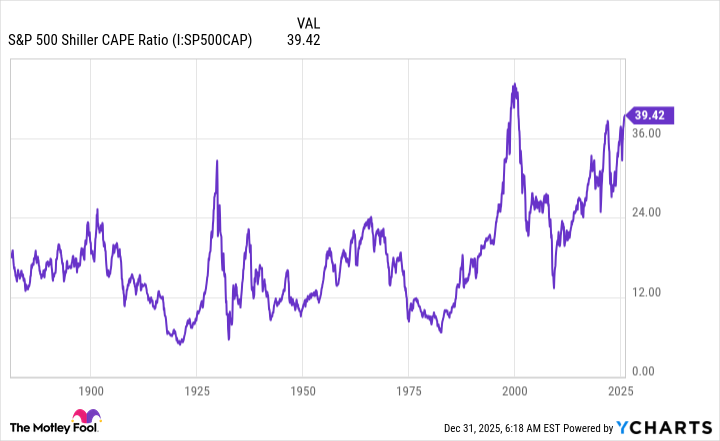

As of Dec. 31, 2025, the S&P 500 Shiller CAPE ratio stood at 39, a level it’s only reached once before throughout the S&P 500’s history.

S&P 500 Shiller CAPE Ratio data by YCharts

The Shiller CAPE ratio is a measure of stock price in relation to earnings per share over a 10-year period, offering a clear picture of valuation. Today, the metric’s level shows that, overall, stocks are expensive. I predict that these levels will come down in 2026 as investors, many of whom already have expressed concern about high valuations, opt for reasonably priced stocks.

If this happens, it’s great news for investors because it will offer us a whole new wave of buying opportunities.

5. Quantum computing stocks may offer bursts of growth

Quantum computing stocks have climbed in recent years amid excitement about the potential of this technology. It relies on quantum mechanics and offers the possibility of solving problems that are out of reach for even the most powerful supercomputer. Both pure play quantum companies, such as IonQ, and tech giants like Alphabet have made progress in the space — but it’s a complex technology, meaning it could take years to deliver a generally useful quantum computer.

Progress along the way, however, could drive shares of these companies higher at any moment. So growth investors may want to select a few solid players in the space, get in on them early to benefit from these bursts of growth, and importantly, hold on for the long term.