Five years in the making, the City of London is set to find out if its equity market reforms can deliver results.

An outperformance of UK stocks, new listing rules taking effect and green shoots in its initial public offering pipeline are making prominent figures hopeful for a long-awaited market revival, but the sentiment shift still needs to be matched by results.

Success will depend on whether the UK capital can turn its pipeline of IPO candidates into traded companies, stem the steady leak of cash in its equity funds, and if its benchmark indexes can keep up with international peers.

A multiyear set of reforms by the UK government, its market regulator and the stock exchange have sought to make London’s equity market more attractive, partly triggered by frequent delistings and a scarcity of IPOs.

“London is definitively open for new companies to list and I think that theme will gather pace during this year,” said Charles Hall, head of research at Peel Hunt Ltd. “It’s not going to go from famine to feast, but I think there is definitively a mood shift.”

As of this week, London-listed companies won’t be required to issue a lengthy prospectus for most capital increases. The latest changes followed the announcement of a three-year stamp duty holiday for newly-listed firms in Chancellor of the Exchequer Rachel Reeves’ November budget.

Index provider FTSE Russell is also said to be weighing changes to its rules that would make it easier for foreign companies — such as Norwegian tech firm Visma AS — to join its UK stock indexes, including reducing free float requirements for foreign incorporated companies from 25% to 10%.

Visma is top of the list of companies considering a London listing this year. The Norwegian firm has provisionally selected London as a venue for its IPO — potentially one of Europe’s largest this decade.

Other major offerings could come from Uzbek gold miner Navoi Mining & Metallurgical Co. and Uzbekistan’s national investment fund, UzNIF. Online travel agent Loveholidays and insurer Markerstudy are also said to be considering listing in London as soon as this year.

“Muted IPO activity in the UK was a function of limited supply of sizable quality companies, and we’ve seen that improve quite a lot,” said Ashish Jhajharia, head of ECM for Europe, the Middle East and Africa at JPMorgan Chase & Co. “There’s been an improvement in sentiment towards the UK.”

The Financial Conduct Authority is about halfway through a program of “really ambitious” reforms to UK capital markets, executive director of markets Simon Walls told Bloomberg Radio on Monday. On the agenda is a plan to cut IPO timelines by a week, in a bid to make London listings more agile.

To be sure, a capital markets revival in London will also depend on global events. The chaos unleashed by US President Donald Trump’s tariffs last year shut the market for weeks, prompting some European issuers to delay IPO plans. Trump’s latest threats over Greenland have spurred a new bout of volatility, shattering a calm start to the year for markets.

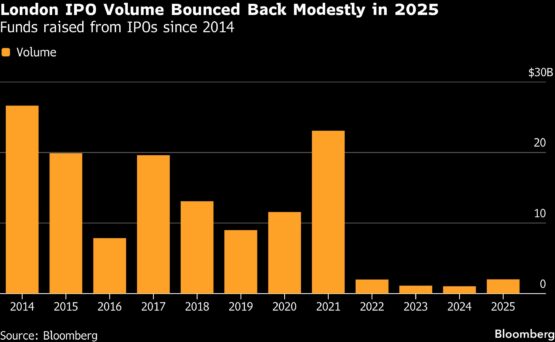

The push comes after London’s capital markets suffered years of decline. Persistent outflows from local funds and competition from other markets have weighed on the UK, while delistings for mergers and acquisitions, combined with a thin crop of IPOs, have shrunk the market. The UK has also lost several big companies to New York in recent years.

Things started to look up toward the end of last year, when a burst of IPOs helped to boost the total raised by companies in London to $2 billion — double the amount raised in 2024. Despite the uptick, volumes were still far below historical levels, according to data compiled by Bloomberg.

Last year’s new London listings have had a mixed performance, with specialist lender Shawbrook Group Plc up about 18% since listing while shares in canned tuna maker Princes Group Plc have slipped about 4%.

A potential London listing of Visma would dwarf last year’s offerings. The company, which is backed by UK-based Hg Capital, was last valued at €19 billion ($22 billion) in 2023.

Among others looking at London are CK Hutchison Holdings Ltd., which is working on a dual listing of its health and beauty business in Hong Kong and London. Also on the radar is Barnes & Noble and Waterstones, with the Financial Times reporting that Elliott Management is preparing for a IPO for the combined business of the booksellers.

“We’re having a lot of discussions with companies and shareholders,” said Mark Austin, a partner at Latham & Watkins who is also a part of the UK Capital Markets Industry Taskforce. “London is now demonstrably the least frictional IPO venue in Europe when you work through the respective listing rules, governance codes, remuneration approaches or ease of indexation.”

The government, the FCA and the London Stock Exchange are trying to attract greater capital inflows by enticing retail investors, culminating in a cross-industry campaign in April.

“We need to keep this challenger mindset” to compete with established and upcoming markets, the FCA’s Walls said. “The energy in the City is good.”

© 2026 Bloomberg