The ESG sukuk market, which includes green and sustainability sukuk, marked a significant milestone by surpassing $50 billion in outstanding value by the end of 2024.

Malaysia, Indonesia, and Saudi Arabia were the largest three markets, making up 67% of global market value.

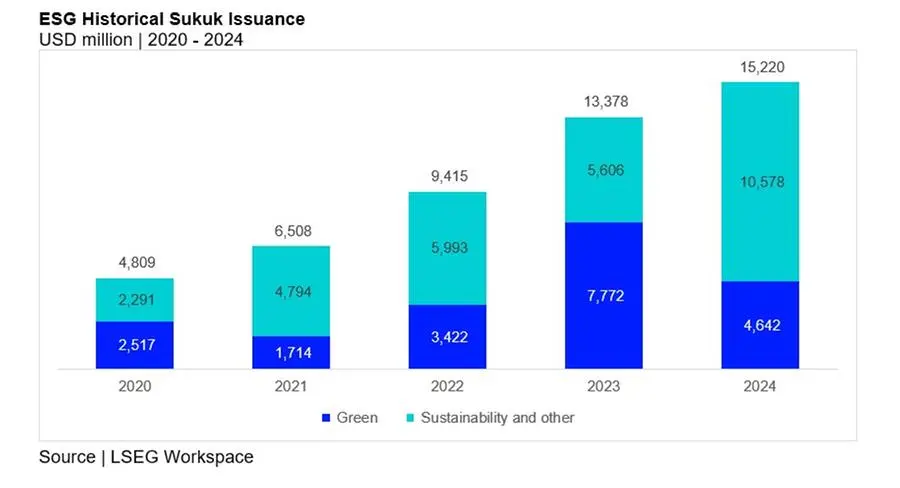

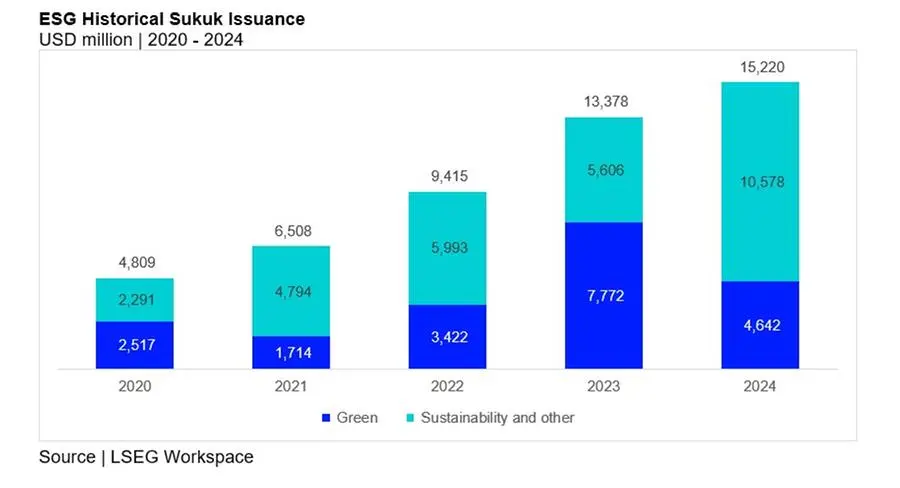

Issuances of ESG sukuk totalled $15.2 billion in 2024, reflecting moderated annual growth of 14.5%, according to data from the London Stock Exchange Group (LSEG). This marked the eighth consecutive year of record issuance since the inception of the ESG sukuk market in 2017.

ESG sukuk accounted for 1.8% of total ESG bond issuance and 6.2% of total sukuk issuance.

Sustainability sukuk, which also include sustainability-linked and social sukuk, nearly doubled in 2024, driven by a notable rise in issuances from financial institutions. These sukuk comprised 69% of total ESG sukuk issued, compared to 42% in 2023.

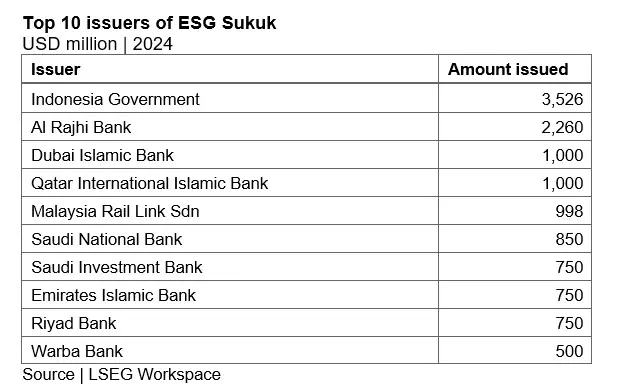

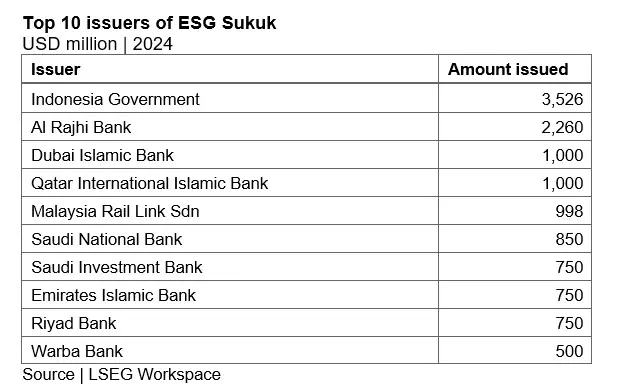

Financial institutions contributed the largest share of ESG sukuk issued in 2024, at 55% of the total value. Around 93% of this came from GCC-based banks, which issued most of the largest sukuk during this period.

GCC issuance driving momentum, boosted by expansion into new markets

ESG sukuk issuance from GCC-based issuers has been the main driver of market growth in recent years, accounting for 58% of the global total in 2024.

This growth was bolstered as ESG sukuk expanded into new markets, including Qatar and Kuwait, as more GCC corporates entered the market following COP28. This trend is expected to continue as the region remains committed to sustainability and investor demand for ESG-compliant financial instruments grows.

“We expect to see an acceleration of issuance if and when there is an acceleration in the climate transition of GCC issuers and renewable energy targets, as well as regulators offering incentives to take the sustainable issuance route,” said S&P Global Ratings Islamic Finance Head Mohamed Damak.

Several GCC governments have been laying the groundwork for issuing ESG debt. Oman, Qatar, and Saudi Arabia each released sovereign sustainability or green financing frameworks in 2024.

These frameworks establish guidelines and criteria for eligible projects, ensuring investors that the funds will be used for genuine environmental and social benefits, which is essential for issuing ESG debt instruments.

(Reporting by Jinan Al Taitoon, CESGA, editing by Seban Scaria)