The semiconductor stock looks far less expensive when factoring in its long-term prospects.

The hype and excitement around artificial intelligence (AI) has led to many stocks soaring in recent years, with one of the best examples being Nvidia, a key rival of Advanced Micro Devices (AMD +0.68%). Between the start of 2023 and the end of 2024, shares of Nvidia skyrocketed more than 800%, while AMD’s stock rose at a much more modest 86%.

This year, it’s been a different story, with AMD outperforming its rival, with returns of 115% versus 42%. And despite that impressive surge this year, here’s why it still may not be too late to invest in the tech company.

The company’s chip business is still in its early innings

A big reason AMD wasn’t generating huge returns like Nvidia prior to this year was that it hadn’t been taken seriously as a major competitor. It also offers AI chips, but it has been lagging behind Nvidia in chip development. And as Nvidia has achieved significant revenue growth and captivated growth investors, AMD’s financials have looked far less impressive by comparison. Until recently.

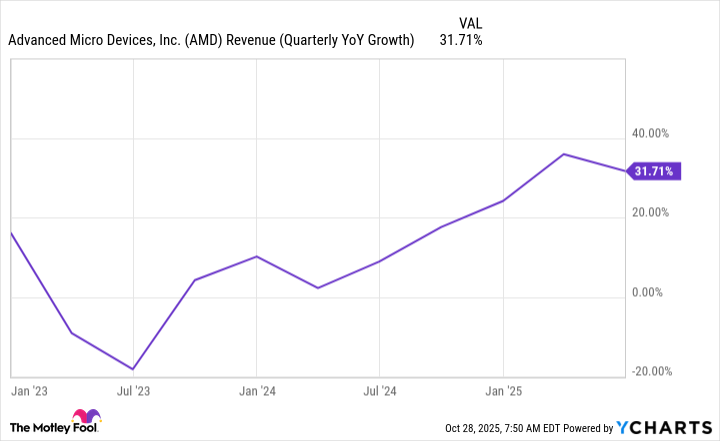

The business is no longer struggling to generate any kind of growth whatsoever. Instead, its growth rate has comfortably been in double digits in recent quarters, which is a promising sign that its AI chip business is finally taking off.

AMD has been establishing itself as a much more formidable rival to Nvidia lately, with ChatGPT maker OpenAI planning to be a big customer and potentially even an investor in the company. The two recently announced a deal where OpenAI could end up taking a 10% stake in AMD.

IBM also says that AMD’s chips can be used to help in the development of quantum computers, which can be yet another promising growth catalyst.

Its valuation looks high right now, but it may still be cheap in the long run

At first glance, AMD’s stock may seem expensive at a price-to-earnings (P/E) multiple of around 160. It looks wildly overpriced. But that’s just its trailing P/E. Growth investors can start to see the value in the stock when looking at its more modest forward P/E, which takes into account how strong its earnings will be in the year ahead, based on analyst estimates. At less than 29, its forward P/E is much more attractive.

Today’s Change

(0.68%) $1.74

Current Price

$256.58

Key Data Points

Market Cap

$416B

Day’s Range

$253.43 – $262.10

52wk Range

$76.48 – $267.08

Volume

1.2M

Avg Vol

61M

Gross Margin

43.20%

Dividend Yield

N/A

Over an even longer time frame, the stock turns into a potential bargain. Its price-to-earnings-growth ratio, or PEG, is around just 0.5. The cutoff for a good growth stock is 1.0; anything less than that suggests it could be a bargain. The PEG factors in five years of expected future growth.

And it’s hard not to be bullish on the company’s future earnings when CEO Lisa Su estimates that it could generate tens of billions of dollars from its AI business in the years ahead. With so much growth on the horizon, AMD’s stock starts to look much cheaper.

AMD is a strong buy-and-hold stock

At a market cap of $420 billion, AMD has grown significantly, and with more AI-powered growth in its future, it may not be all that unreasonable to expect for it to one day hit a $1 trillion valuation. As businesses look for alternatives to Nvidia’s high-priced chips and AMD demonstrates its cutting-edge technology, that can lead to more growth and optimism around its business in the months and years ahead.

It may take some time, but if you’re willing to hang on for multiple years, you could still be in an excellent position to generate great returns even if you buy the AI stock today.