CHRIS UHLMANN, PRESENTER: The bargain of a lifetime: American real estate at rock bottom prices, available now to cashed-up Australian investors. Sound too good to be true? That’s because, unless you’re very lucky, it is. Thousands of Australians have been enticed to snap up residential properties in the stagnant US market to capitalise on the heartbreak of countless Americans who lost their homes during the global financial crisis. The spruikers promise returns far higher than those available in Australian property markets, but some investors wasted their life savings on roll gold duds. Greg Hoy reports.

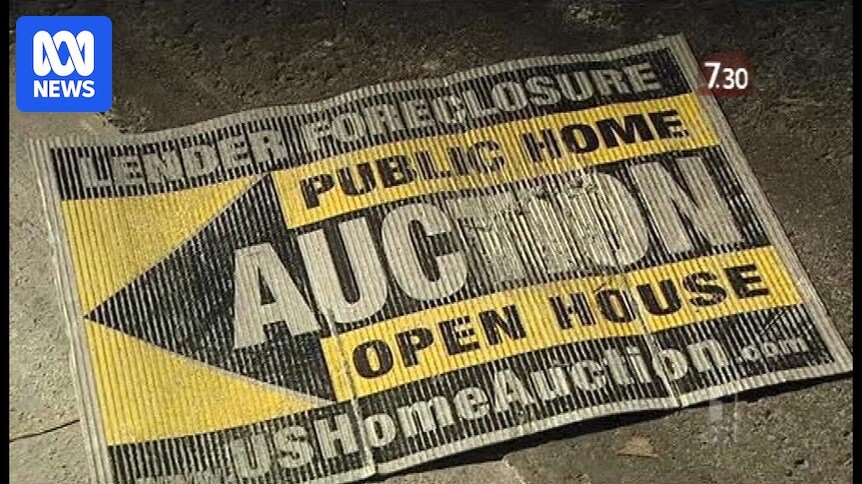

GREG HOY, REPORTER: Negative growth in Australian home values in recent years has seen hordes of Australians drawn to the American Dream – riding the strong Australian dollar into the US housing market, which in large areas has remained depressed since a huge housing bubble and glut of subprime properties helped trigger to global financial crisis.

JEREMY LAWS, INVESTOR: You can buy almost anything in a larger city, and you will not lose, and you will kill the returns you will get in Australia.

EMMA MCGRATH, INVESTOR: Now is obviously an incredible opportunity.

GREG HOY: Sydney investor and buyer agent Emma McGrath and Qantas pilot Jeremy Laws have made good money buying and selling dozens of US properties, but warn the Australian investment frenzy is attracting a great school of sharks.

EMMA MCGRATH: It is so tragic and it is so hard to hear these stories. People are losing their life savings and it is unbelievable.

MY USA PROPERTY AD: Hi, and welcome to My USA Property. Leaders in helping Australian investors buy USA investment property.

ANDREW ALLEN, CEO, MY USA PROPERTY: It’s still the home of Tom Cruise. It’s… you know, whether you like it or not there’s still a lot of wealth.

GREG HOY: Founder of My USA Property, Andrew Allen, is offering a smorgasborg of dirt cheap properties, all of which are subtly owned and/or sold into limited liability companies, or LLCs, which avoid consumer protection laws and regulations for nonresidents.

JEREMY LAWS: It’s a very easy way for the less scrupulous purchasers to circumvent the property regulations in Australia and in the States. It’s pure offshore wild west stuff.

GREG HOY: Bargains galore Americans just can’t afford – or so the spruikers say, promising to take care of everything: from property managers to renovators; mortgage brokers; stable tenants to pay back the debt; adding the lure of huge capital gains as the US dollar and economy recover. It sounds too good to be true – and very often it is.

MY USA PROPERTY AD: We don’t charge you a service fee, so you have nothing to lose.

EMMA MCGRATH: You have nothing to lose but your life savings.

GAVIN HICKS, INVESTOR: It is my life savings and he is responsible, even though he’s not taking responsibility for it.

GREG HOY: Melbourne school teacher Gavin Hicks believed Andrew Allen’s assurances. He was asked to pay a service fee of $13,000 to invest his $65,000 savings in small apartments in Ohio and a home in Detroit. But the only tenants he got were squatters. His investment, worth nowhere near what he paid, has now been boarded up. Andrew Allen has gone missing in America.

GAVIN HICKS: He’s making guarantees that they will be paying themselves off within a couple of years. Detroit, Michigan was a bad place to invest in. Even though the house looked fine the actual neighbourhood was obviously… it wasn’t a good idea. It was pretty silly. But I was going through… I was going through what Andrew was saying basically, and I had faith in what he was selling.

JEREMY LAWS: Andrew Allen is a fool to himself and a burden to others. What he is doing is unconscionable. If you buy a two bedroom apartment in Trump Tower on 5th Avenue in New York you will never have a tenant problem. If you go to an area in Detroit with a 20 per cent return, you will need a handgun to collect the rent.

GREG HOY: Indeed, the trial continues in Detroit for a man who allegedly shot Australian investor Greg McNicol, from Victoria, who was trying to collect a late rent payment from the accused’s daughter.

NEIL JENMAN, CONSUMER ADVOCATE: More people have guns in the United States than don’t have guns. We’ve already had one Australian investor killed over there, and others are being slaughtered financially.

GREG HOY: Many but not all. My USA Property does have some contented customers, like Brisbane surveyor Steve Cooper, who personally surveyed his properties before purchasing.

STEVE COOPER, INVESTOR: We researched a lot. There is a lot of people out there doing it and selling it – they don’t know what they’re doing… they are full of lies.

JEREMY LAWS: They prey on fear and once they’ve conquered the fear thing with you, you feel safe with them then they will sell you an overpriced property.

GREG HOY: My USA Property’s Andrew Allen did not respond to 7.30’s repeated request for an interview, and he’s not alone. There is, it seems, a certain type of salesman flourishing as Australians flock into the US housing market to try their luck – and where better to try your luck than in the world’s capital gambling capital Las Vegas?

VOX POP: What bothers me about these promoters of these properties is that they are shonky people.

ALAN WILKIE, INVESTOR: In hindsight it’s been the worst mistake of our life. I’d strongly recommend other people to get their facts in hand before they make any conscious decision to buy properties in the US.

GREG HOY: Queensland policeman Alan Wilkie pinned his and wife Jillian’s retirement hopes, and $300,000, on assurances given by Jason Paris of US Properties. The Wilkies bought an LLC title to a foreclosed house and townhouse in Las Vegas, which never delivered the rental returns assured by Jason Paris, and can’t be resold for anything near the price paid.

ALAN WILKIE: It looks like the retirement plans are shot to pieces. I will probably have to work until I’m 100.

GREG HOY: US Properties say they charge clients an $8,000 marketing fee. But only later did public records reveal the Wilkie’s properties had in fact cost $37,000 less than what Jason Paris had suggested. The promoters now say that that was for “improvements”, but the Wilkies say that sadly they had to make their own improvements, and now they’ve found that this is an all-too-familiar story.

NEIL JENMAN: I have sat in people’s loungerooms and seen elderly folk crying in front of me because of having dealt with Jason Paris.

GREG HOY: Neil Jenman has long campaigned for improved ethics in the real estate industry. He’s particularly critical of Andrew Allen’s cofounding director of My USA Property, and later US Property Sales Australia, Trent Richards.

NEIL JENMAN: Well, Trent Richards he’s… to me, he’s synonymous with the word “shonk”.

GREG HOY: These are Trent Richards’ own videos. He’s a high flyer with a penchant for helicopters and fast cars, but has a scandal-plagued history with the Insight Investment Corporation now in receivership.

NEIL JENMAN: Trent Richards has form in selling overpriced properties in Australia. Now he’s selling properties in the United States.

GREG HOY: Trent Richards did not respond to interview requests. US Property Sales, which he later founded, is still pitching for customers, as is My USA Property, and CEO Andrew Allen’s new venture, Prime USA Property – now targeting overseas investors.

PRIME USA PROPERTY AD: Welcome to Prime USA Property, leaderors in sourcing USA property to international investors.

GREG HOY: So they’re still out there, and while authorities like ASIC and the Office of Fair Trading suggest they have limited jurisdiction and so are powerless to stop them, the moral of this story becomes “buyers beware”.

GAVIN HICKS: Even if I don’t get my money back I want to see Andrew Allen held to account for what he’s done as well.

EMMA MCGRATH: The biggest thing you need to know is to do your own due diligence. Know what you’re buying, know who’s going to rent it, and deal with licenced professionals because if you get burnt, you might want to consider legal recourse, and you’d better make sure that you actually have it.