Since the issues facing China’s property sector exploded into mainstream view in 2021, it has been a rollercoaster ride of different perspectives and scenarios on how it will all play out.

While the issues faced the Chinese economy have now faded from the headlines, the reality is the risks within the Chinese economy remain significant, and the woes of the property sector are far from over.

So far the Chinese government has been able to mitigate the impact of declining levels of activity in the property sector through increased levels of infrastructure construction and investment in manufacturing capacity.

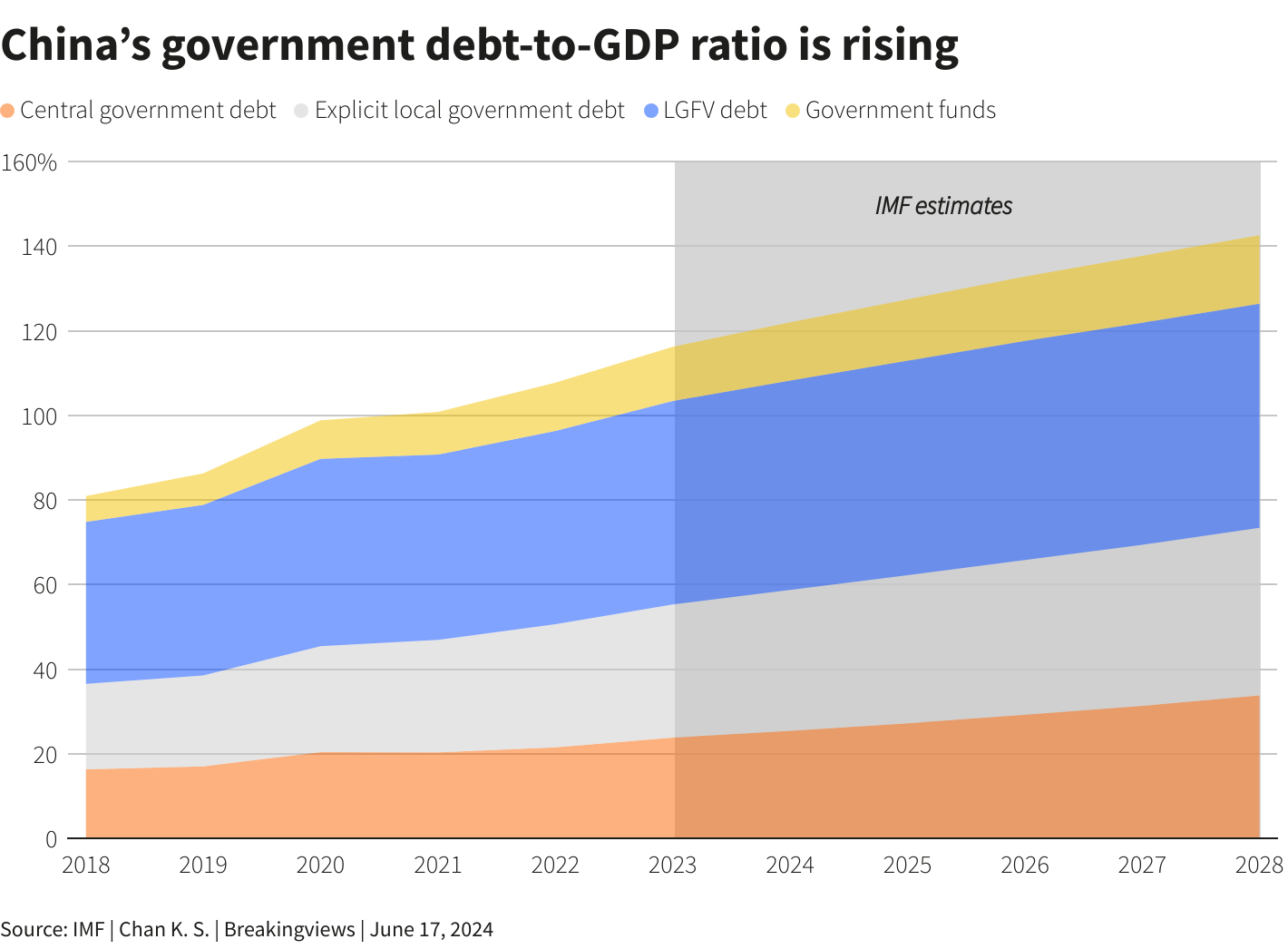

But these strategies have significant costs, with many projects unlikely to ever have a net benefit from a fiscal perspective, doing more to add to China’s debt pile than to it’s economy in the long term.

Advertisement

Now as the scope to continue to support the Chinese economy through these means is thrown into longer term doubt due to the impact increasing manufacturing overcapacity and local governments facing debt sustainability issues in aggregate, the ongoing decline of the Chinese property sector is back in the spotlight.

Source: Reuters

Advertisement

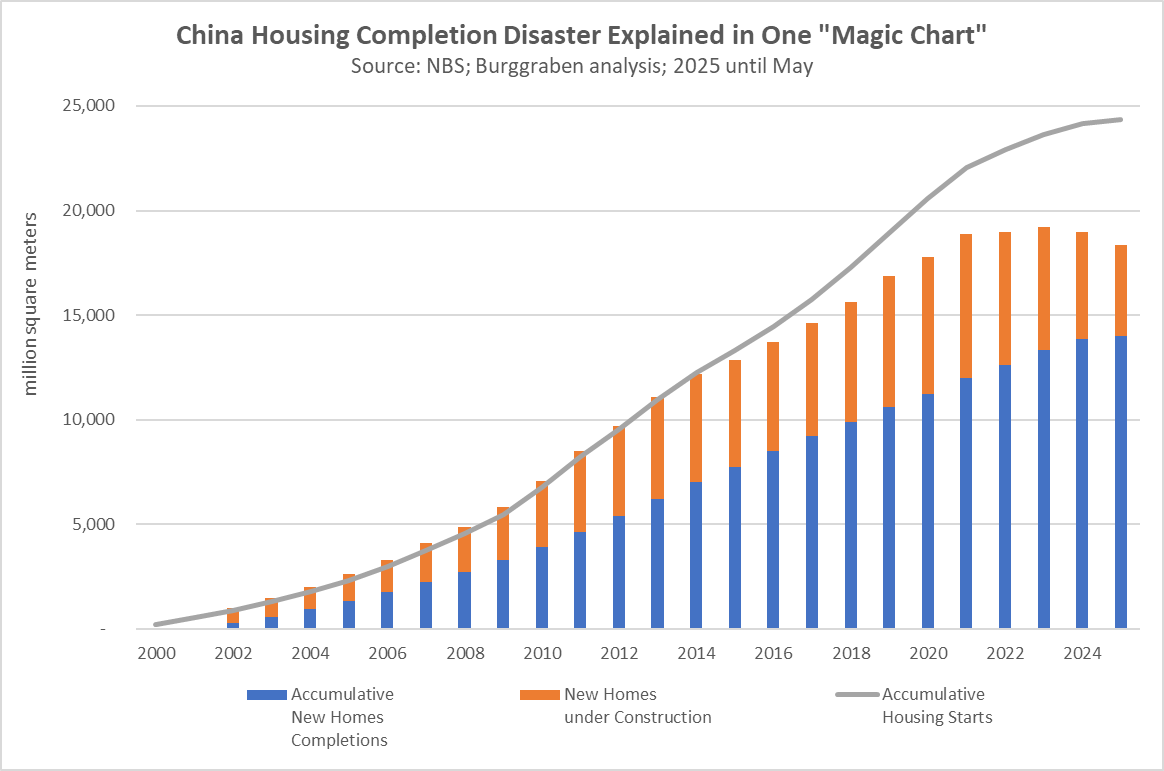

One of the best recent short-form analysis on the Chinese property sector comes from Alexander Stahel of the Commodity Compass.

“Another way to grasp the scale of this unprecedented crisis is through the “Magic Chart” below. It compares cumulative housing starts with cumulative completions in China since 2000. Beginning in 2015, a widening gap emerges—now totaling 10,345 million square meters of started but uncompleted housing as of May 2025. At an avg apartment size of 81.5 sqm, that translates to 126 million unfinished units—roughly equivalent to the entire housing stock of the United States.”

If completed, these units will add to the already sizable oversupply of housing in China. Estimates at the conservative end of the spectrum put the oversupply at around 80 million homes already.

He Keng, the former deputy head of China’s statistics bureau, believes it’s significantly greater.

Advertisement

“How many vacant homes are there now? Each expert gives a very different number, with the most extreme believing the current number of vacant homes are enough for 3 billion people,”

“That estimate might be a bit much, but 1.4 billion people probably can’t fill them,” Keng said at a 2023 conference in Dongguan.

Advertisement

It is perhaps notable that Keng’s view was not only allowed to be said in a publicly accessible conference, but that a video of him sharing his opinion was released by official Chinese state media.

Advertisement

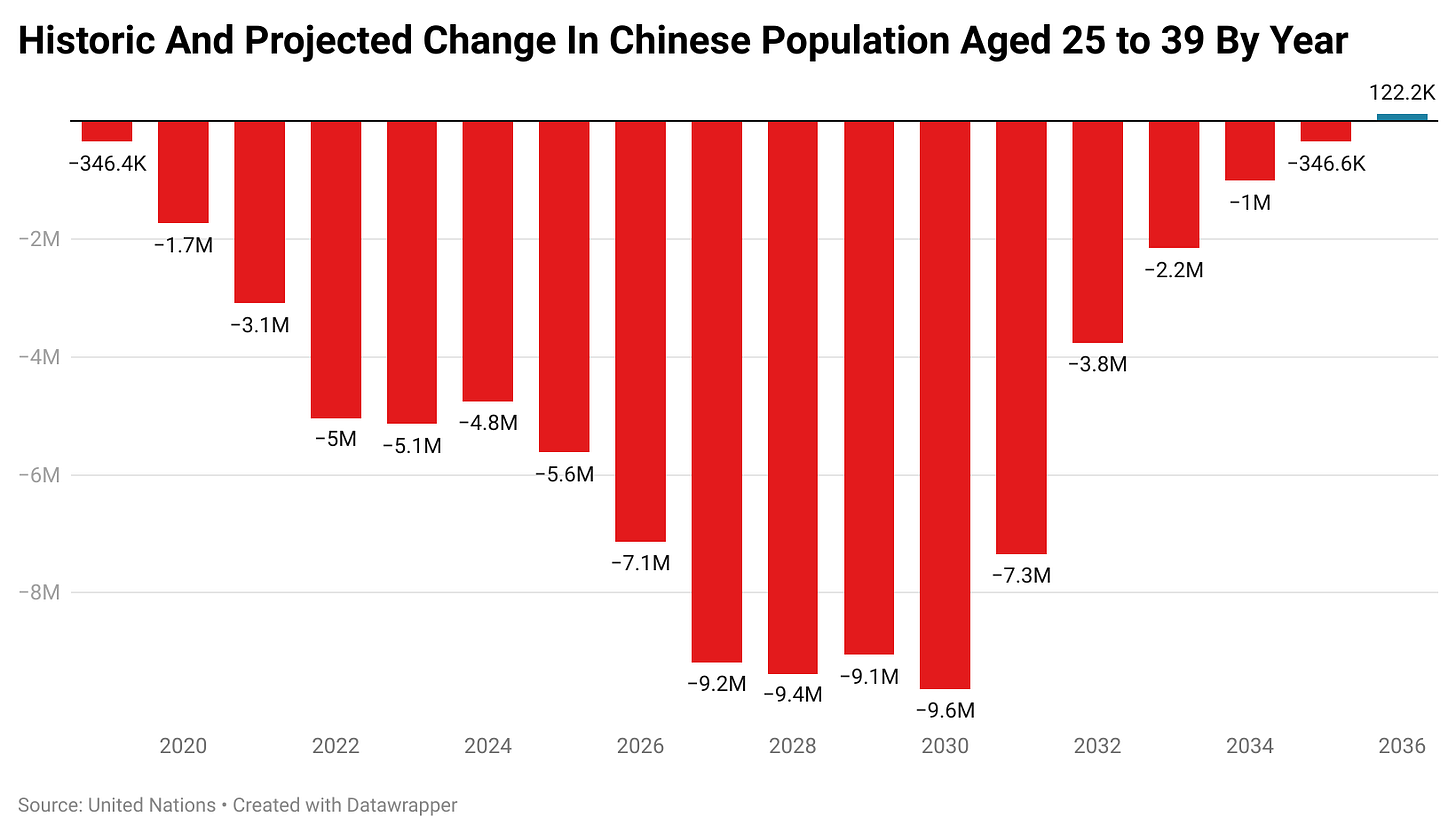

Meanwhile, if one looks at China’s demographic outlook, it illustrates that demand for property is unlikely to improve.

The population of the 25 to 39 demographic peaked in 2018, at a shade under 328 million people. By 2026, that number will drop by 32.8 million, and by 2030, it will have fallen by over 70 million.

Falls in the size of this demographic rapidly accelerated to over 5 million people annually in 2022. The falls will accelerate further to over 7.1 million in 2026 and then over 9 million per year until 2031.

Meanwhile, in the broader 25 to 54 age demographic, things have been deteriorating quite a bit faster. Since peaking in 2017, this age group has already shed 40.3 million members, with more than half of those exiting the demographic before demand for property peaked in 2021.

But it gets significantly worse starting now. In 2024, it is estimated that this demographic will lose 10 million people during this calendar year. By the end of 2027, this group will have shed the best part of 80 million people since peaking a decade earlier.

Despite the fact that it doesn’t make the headlines it used to, the Chinese property sector remains a ball and chain around the ankle of the broader economy.

Advertisement

If the Chinese government is serious about shifting its focus to the consumer economy, government resources once focused on the construction sector will need to be redirected toward this new endeavour.

In time, this will weigh on demand for steelmaking commodities, impacting Australia’s budget and economic outlook, particularly as the Simandou mega iron ore mine ramps up production in West Africa in 2026 and 2027.

Advertisement