One of the reasons China grovelers are so prevalent in Australia is the argument that China is one of the few substantial countries with which we have a trade surplus.

This is true. But for how long?

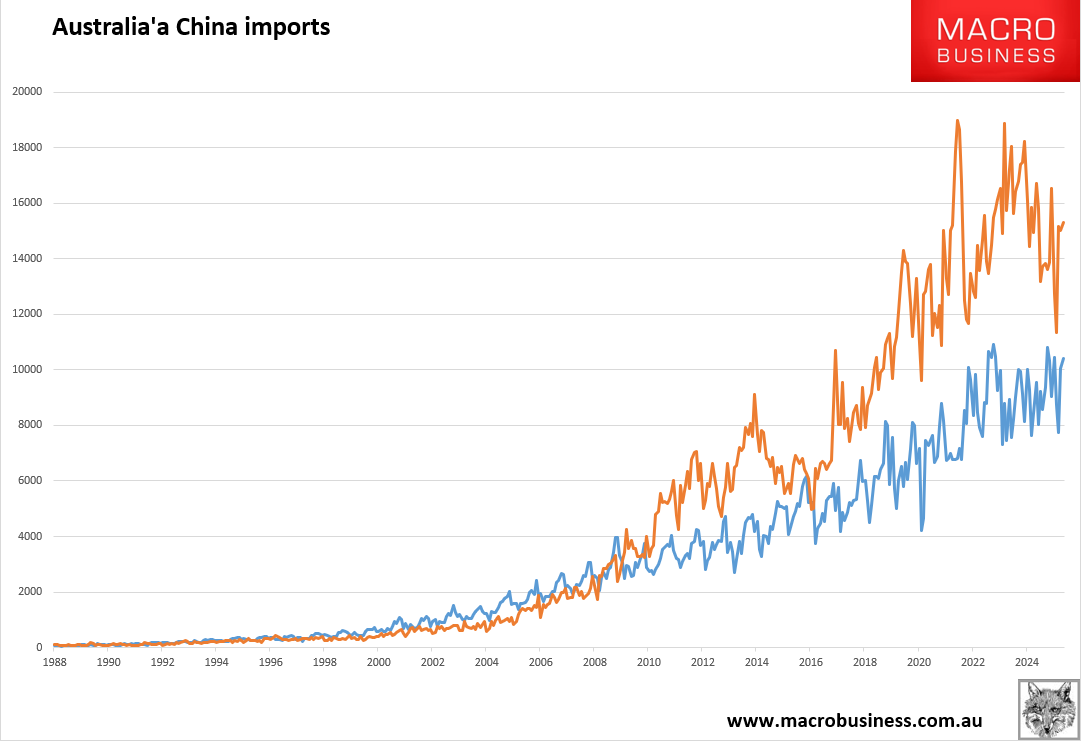

Albo’s three year Great Grovel of China has been so successful that Aussie exports are imploding while imports ratchet towards new records.

It is entirely likely that Australia will have a trade deficit with China in 2026/27, just as we did briefly in 2015 and before 2008 for many years.

Advertisement

The argument is twofold.

On the merchandise exports side, bulk commodities have another third to fall in their post-Ukraine and post-China property boom funk.

That gets export revenues close to today’s imports already.

Now add the imports side, which will keep climbing as the economy pivots from high terms of trade fueling excessive public spending, to smashed terms of trade and budget cuts, triggering crashed interest rates and house price rises, plus consumption from crazy, rich old people. Endless hordes of mass immigration will ensure the transition.

This will transpire amid global market share battles as trade wars continue, hollowing out whatever is left of Australian industry.

Advertisement

There’s your Chinese trade deficit, right there, as exports collapse and imports climb. Worse, given that Chinese property is cooked forever, it may well become permanent.

To describe this as stupid, following the 14 conditions to end democracy, COVID, and the emergence of Chinese gunboat diplomacy Down Under, doesn’t quite say it.

These are all clarion warnings of what is to come. The hegemonic struggle over Taiwan that the Great Grovel of China has now guaranteed we will be utterly unprepared economically.

Advertisement

But hey, Trump, eeeeiiiuuuu. Better to give up your freedom.