Walmart Inc (NYSE:) will report its results tomorrow, and they matter more than usual because of the fast-changing US tariff policy and its effect on the economy. Investors are closely watching , which in the last two reports have held steady. That sets a positive tone for Walmart’s numbers. If the company avoids a negative surprise, the stock could keep rising and possibly hit new highs.

Meanwhile, these market moves are happening while peace talks continue in the background. So far, the talks have brought no concrete progress, but the next step may be a direct and unprecedented meeting between Ukrainian President Zelenskyy and his Russian counterpart Putin.

Weighing Economic Trends Ahead of Walmart Earnings

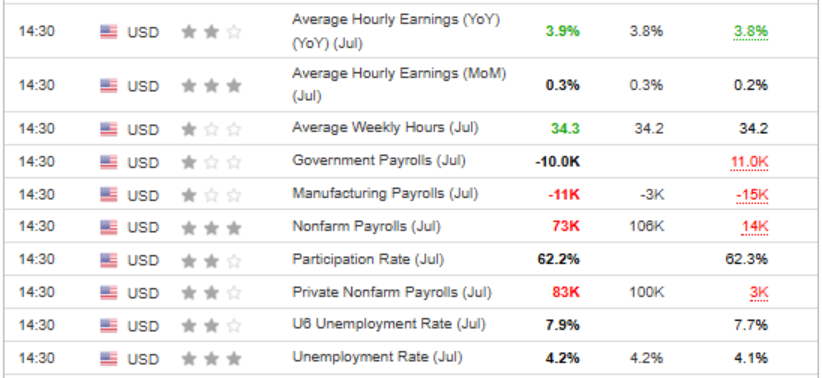

Even though the latest numbers do not show a high risk of the US economy suddenly collapsing, they still raise some concern. The focus is mainly on , which the Federal Reserve watches closely. The market reacted negatively because job growth came in below forecasts, and earlier months were revised down by a large margin.

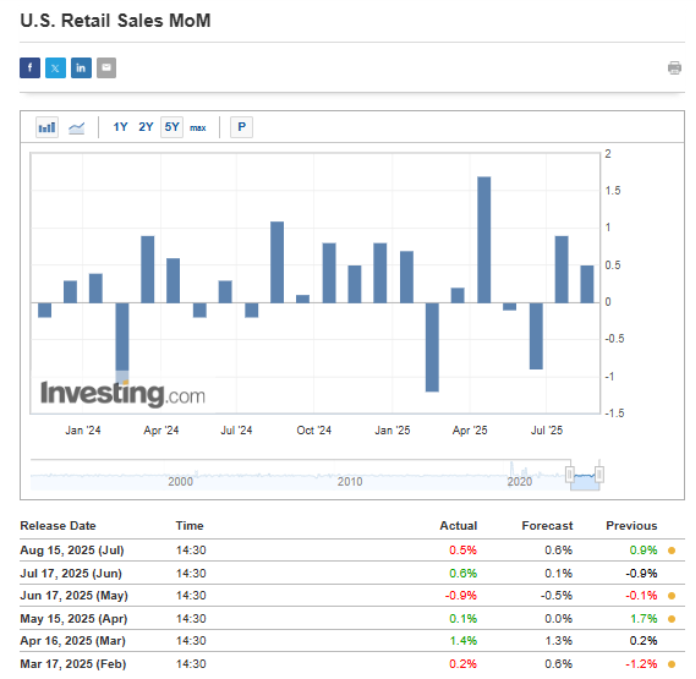

This is a warning sign, but so far it has not affected retail sales, which have shown positive results in the past two months.

One factor behind the recent results was auto sales, which rose 1.6%, likely because tax credits will expire at the end of September. The coming months will be important, as we will see more clearly how tariff policy affects prices and retailers’ profit margins.

Investors are expected to focus on margins outside of core items, which have already dropped by 34 basis points and 86 basis points year-on-year in the last two quarters. Analysts will also pay close attention to Walmart Connect, the company’s advertising platform that links manufacturers with customers. This segment is growing quickly, with 24% year-on-year growth in the last report.

When looking at outside factors affecting Walmart, it is important to remember that about one-third of its products come from countries caught in the growing tariff dispute, especially China.

With recent revisions leaning toward the optimistic side, investors are not expecting a negative surprise this time. Still, the real test will come with the data released over the next three months.

Walmart’s Technical Analysis

Since the sharp drop in early April, Walmart’s stock has been climbing steadily and is now close to its record high of around $105 per share.

The breakout attempt in March failed, leading to a pullback toward the $100 support level. For now, the main scenario is still a continued upward move. Whether the next push higher succeeds will depend on tomorrow’s quarterly results. If the numbers disappoint and the stock falls below $100, the next support level is around $94.

****

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

- AI-managed stock market strategies re-evaluated monthly

- 10 years of historical financial data for thousands of global stocks

- A database of investor, billionaire, and hedge fund positions

- And many other tools that help tens of thousands of investors outperform the market every day!

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.