Greggs’ (LON:) H125 results reflect disruption to revenue growth from unusual weather as well as the phasing of cost pressures. The presentation focused on why weak trading is not specific to Greggs. Directionally, revenue growth is consistent with market trends (ie improving momentum) through May 2025 until the June heatwave reversed the trend.

There was no specific negative effect on volumes following the most recent price increase, and management quantified cannibalisation of existing stores within a catchment area from the addition of new stores is minimal. As a result, it believes the relatively weak trading reflects the wider weak consumer confidence as well as pressures on disposable income for some consumers, beyond the one-off weather effects.

The announcements of numerous new initiatives, including trials of smaller ‘bitesize Greggs’ stores in appropriate locations, extending the frozen ‘Bake at Home’ range into Tesco (LON:) and trialling of kiosks in stores, show management continues to seek new growth initiatives and efficiencies.

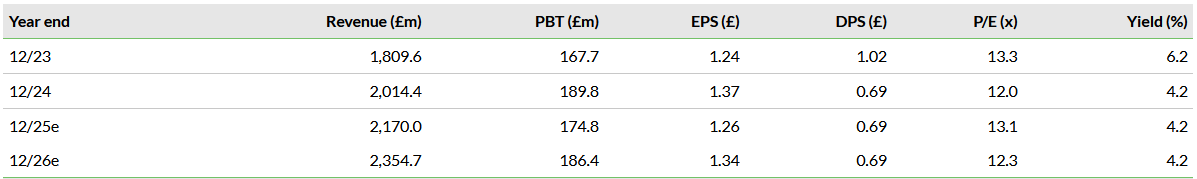

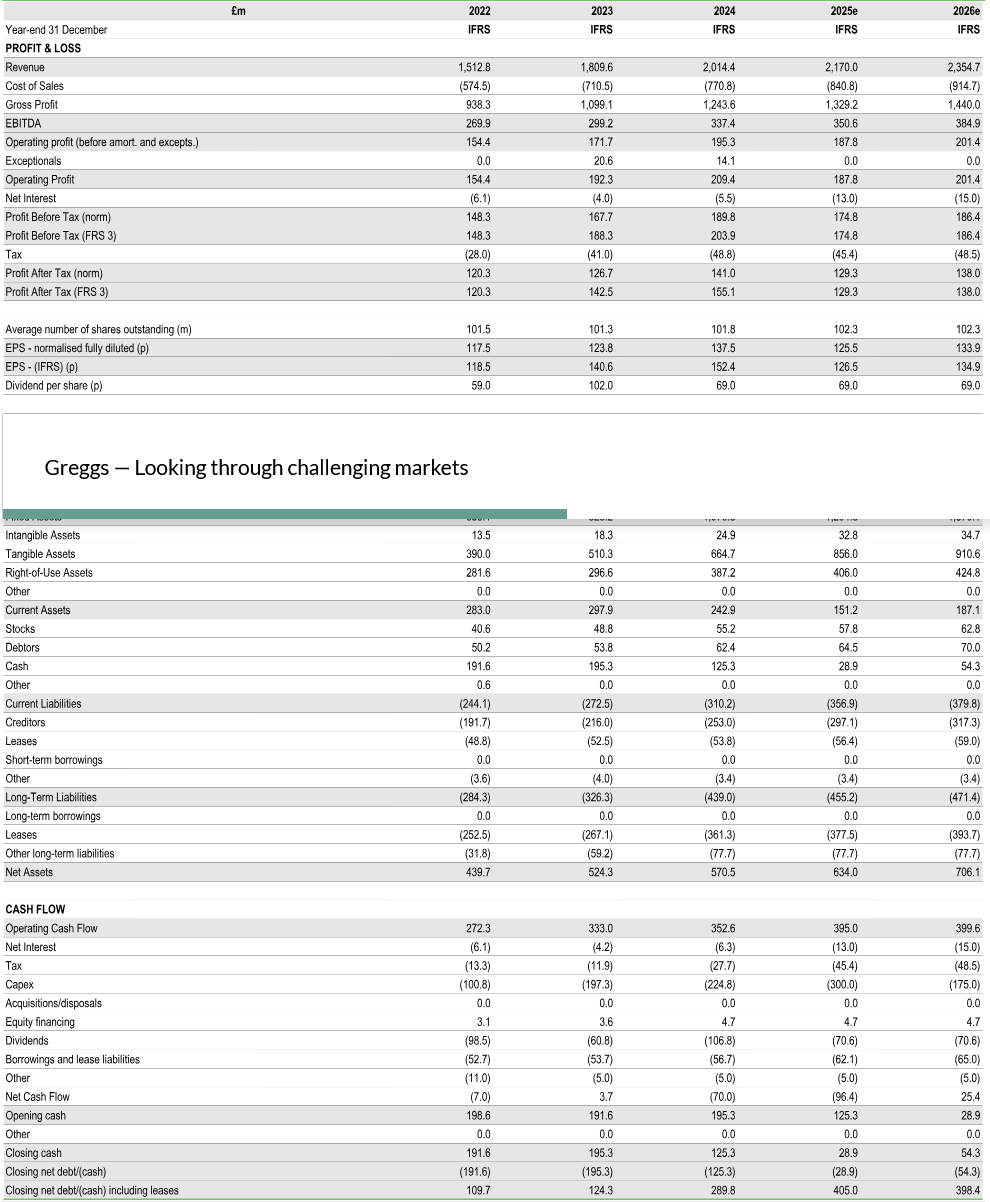

PBT and EPS are normalised, excluding amortisation of acquired intangibles and exceptional items

H125 – Profit Decline

Despite year-on-year revenue growth of 7% to c £1,028m, Greggs’ operating profit declined by c 7% to £70.4m (a margin of 6.9% versus H124’s £75.8m and margin of 7.9%) and PBT declined by c 14% to £63.5m. The lower profits primarily reflect under-recovery of the cost inflation due to the weaker-than-expected volume performance in H1, as well as some other one-off costs and annualisation of prior year costs that will not recur in H225.

Management quantified the lost profit contribution from the weak volume performance at £5m in June, similar to the absolute year-on-year reduction in operating profit.

No Change To Estimates

There is no change to management’s already-reduced expectations for FY25. It expects relatively subdued trading to continue through the summer months before more positive growth in Q425 against easier comparatives from Q424. The H125 interim dividend of 19p was flat versus H124, and the progressive dividend policy will ensure a flat dividend versus FY24 until dividend cover builds back towards the desired 2x.

As a result, we have increased our dividend estimates for FY25 (cover 1.8x) and FY26 (cover 1.9x), having downgraded them with the July trading update as we applied the 2x cover to our reduced estimates.

Lower Profit in FY25 Weighing on Valuation

The share price has performed poorly as the weaker revenue growth and recent reduction in profit estimates have negatively affected sentiment. It goes without saying that more positive trading news would be more than helpful in lifting the FY25 P/E multiple from 13.1x.

Exhibit 1: Financial Summary

Greggs, Edison Investment Research