- This week, central banks, especially the Fed and BoE, dominate financial market attention.

- The Fed’s 25bp rate cut aligns with expectations, while BoE remains cautious on cuts.

- BoE’s decision affects GBP/USD volatility with eyes on key price levels.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

This week’s focus is squarely on central banks, with the Fed and the Bank of England setting the tone. The Fed yesterday, in line with expectations, and signaled room for further easing as the softens.

The Bank of England, by contrast, is expected to hold off on additional cuts as remains well above target. The divergence has already fueled volatility across US dollar pairs, including , where today’s is likely to set the near- to medium-term trend.

Policy Divergence Between FED and BoE

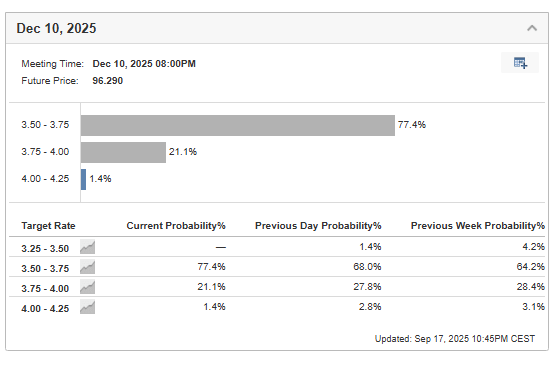

The Fed is expected to press ahead with more in the coming months as weakness in the US labor market takes priority. Markets are pricing in two additional 25bp reductions by year-end, even as remains above target. In contrast, the Bank of England is seen holding rates steady, with policymakers wary of easing while price pressures remain elevated.

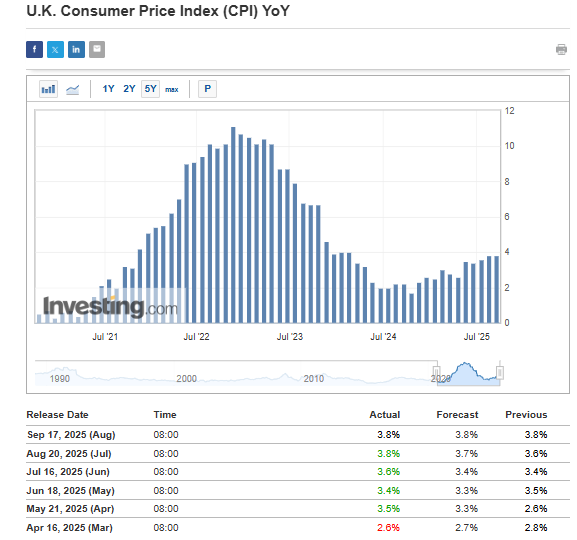

That puts upcoming payroll reports at the center of the Fed’s decision-making. Even if inflation stays above target, rising will carry more weight in shaping the path of rate cuts. In the UK, the latest inflation print at 3.8% year-on-year reinforced expectations that the Bank of England will hold rates steady. While the figure marks stabilization compared to prior months, it remains well above the bank’s target.

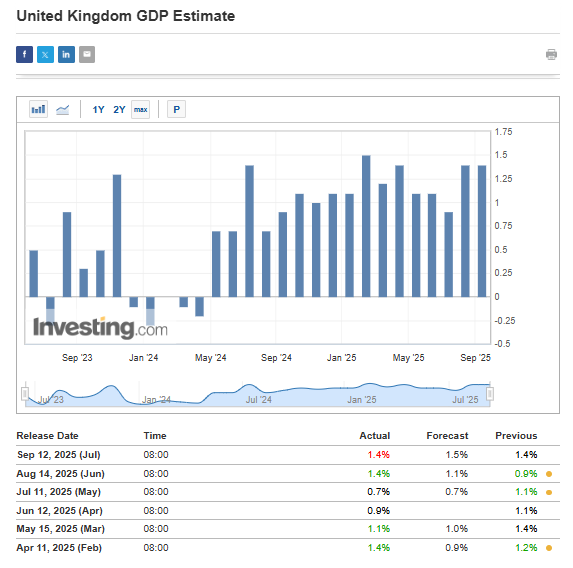

By year-end, forecasts suggest CPI could climb above 4%, making the Bank of England’s decision to delay rate cuts appear justified. The challenge for policymakers, however, is that sticky inflation is accompanied by weak growth, with the latest year-on-year reading at just 1.4% — below market expectations.

With inflation still elevated, the Bank of England is unlikely to cut rates unless the economy tips into a clear recession. As current data stop short of signaling such a severe downturn, policymakers may lean toward a more hawkish stance in the coming quarters.

GBP/USD Pair Awaits Clear Direction

After the Fed meeting yesterday, the main currency pair did not show a clear trend. This is shown by the high point in the price chart and the fact that prices did not keep falling. Now, everyone is waiting to see what BoE says and does next, as this will be very important.

If the BoE adopts a more cautious or gentle approach, the first focus will be on the point where the fast upward trend line meets the 1.36 support level. If this point is broken, it could lead to further drops in value. On the other hand, if there is demand and prices start to rise again, the next challenge will be breaking through the resistance level around the 1.38 price area, which has been high for a long time.

***

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

- AI-managed stock market strategies re-evaluated monthly.

- 10 years of historical financial data for thousands of global stocks.

- A database of investor, billionaire, and hedge fund positions.

- And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.