Stanley Druckenmiller and David Tepper are arguably two of the best investors of all time. Yet, the two have different viewpoints when it comes to China.

There may not be two investors with more successful careers than billionaires Stanley Druckenmiller and David Tepper.

Druckenmiller, through his fund, Duquesne Capital, generated average annual returns of 30%. Tepper and his fund, Appaloosa Management, generated a compound annual growth rate of 25%. It’s hard to believe that two investors as successful as Druckenmiller and Tepper could have such different views of the market, but that’s why we have a market.

Several weeks ago, right after China’s central bank announced the country’s initial stimulus measures, Tepper went on CNBC and told investors to buy “everything” in China. His largest position is the Chinese e-commerce giant Alibaba. However, Druckenmiller at a recent conference reportedly said he’s staying away from China and investing in a different foreign market instead. Does Druckenmiller know something Tepper doesn’t?

Trying to understand the Chinese government

Chinese stocks are so volatile because the government plays a big role in how they perform, and it’s not always easy to predict the government’s next move.

In 2021, regulators fined Alibaba a record $2.8 billion for violating antitrust regulations. They also pushed management to get a tighter grip on some of the company’s businesses, which analysts believe hurt Alibaba’s valuation. Regulators also shut down a planned $37 billion initial public offering by Ant Group. China is not the first country to push antitrust violations and try to rein in large companies. However, those moves discouraged foreign investors who had previously been considering getting more involved in Chinese markets.

Still, Tepper viewed recent stimulus in September, and a surprise Politburo meeting right after, as a green light that the government would do what’s necessary to help China’s ailing economy rebound. Heading into the stimulus announcement, Tepper predicated part of his thesis on the idea that large Chinese companies were generating double-digit growth and trading at single-digit price-to-earnings ratios. He equated the new stimulus to when the Federal Reserve began quantitative easing after the Great Recession. China’s CSI 300 Index, which tracks the performance of the top 300 stocks on the Shanghai Stock Exchange and the Shenzhen Stock Exchange, is up 18.5% over the past month.

But Druckenmiller said he’s not interested in buying the China rally as long as President Xi Jinping leads the country. Druckenmiller has his eyes set on other parts of the world.

Japan and Argentina

Druckenmiller said he “loves” Japan and views Argentina as a “great investment opportunity” with a “brilliant leader.” Japan has garnered plenty of interest in recent years. Berkshire Hathaway in 2020 took a significant stake in each of the country’s five largest trading houses.

Argentina is in a recession and is dealing with very high inflation, which is not abnormal for the country. Many investors view South America as a big opportunity. The libertarian Javier Gerardo Milei became president of Argentina in December 2023 with plans to radically cut spending and bring down inflation. It’s unclear how successful Milei will be, but with Druckenmiller concerned about irresponsible government spending in the U.S., he likely is drawn to a leader focused on austerity.

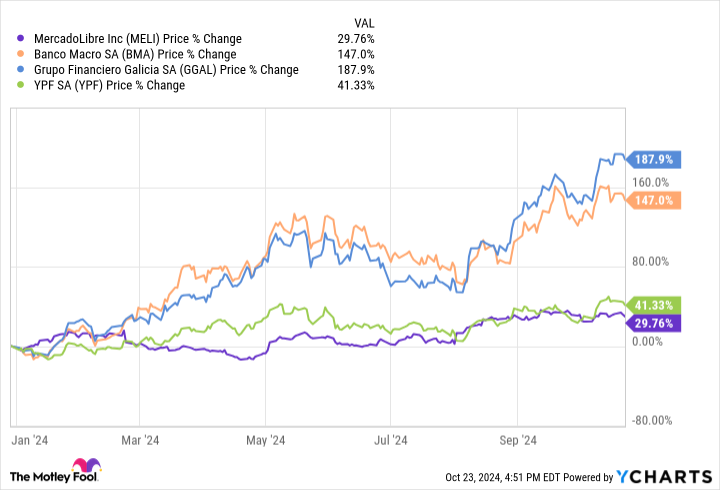

In Duquesne’s latest 13F filing, I didn’t see any Japanese holdings. However, Druckenmiller owns four stocks that are based in or do a lot of business in Argentina: the e-commerce online platform MercadoLibre; Argentina’s second-largest bank, Banco Macro; the country’s fifth-largest bank, Grupo Financiero Galicia; and the energy company YPF. Druckenmiller has hit big on these investments this year.

Does Druckenmiller know something Tepper doesn’t?

Both Tepper and Druckenmiller are incredibly smart, but take different approaches. Regardless of which country you invest in, understand that government and policy in foreign markets can be much more impactful to stocks than in the U.S. So that needs to be a big focus of your research if you invest in individual names in foreign markets.

Still, investing in companies in countries like China or Argentina presents massive growth potential at more affordable valuations because these markets are less developed than the U.S., and there is more uncertainty around regulation and government intervention.

Investing in foreign stocks requires a long runway and tolerance for volatility. An easier approach would be to buy an exchange-traded fund that holds a basket of Argentinian or Chinese stocks.

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and MercadoLibre. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.