The short answer is no. But it will generate growing dividend payouts that you could use for a host of purposes.

Realty Income (O 1.24%) is one of the largest net lease real estate investment trusts (REITs) you can buy. It is not an exciting stock, but it is a reliable one, with 30 years of annual dividend increases under its belt. It probably won’t make you a millionaire all on its own, even if you invest $100,000 into its shares. But don’t pass by this stock without considering what it can do for your portfolio.

Realty Income doesn’t swing for the fences

One of the biggest problems that investors face is dealing with their own emotions. As Warren Buffett has said, it only requires average intelligence to be a successful investor — but beyond that, in his view, what’s really important is emotional stability and the ability to think independently. But investment fads that eventually implode — like meme stocks, for example — show that these are not traits that everybody poses.

Image source: Getty Images.

Far too often, investors believe they should be on the hunt for that one single investment that can skyrocket dramatically and turn them into millionaires. For those few who manage to find such a needle-in-a-haystack stock, it is more likely a function of luck than skill. This is why building a diversified portfolio and taking a slow and steady approach is a better option. Working toward seven figures slowly isn’t exciting, but it is far more likely to end successfully than jumping on fads and hoping for the best.

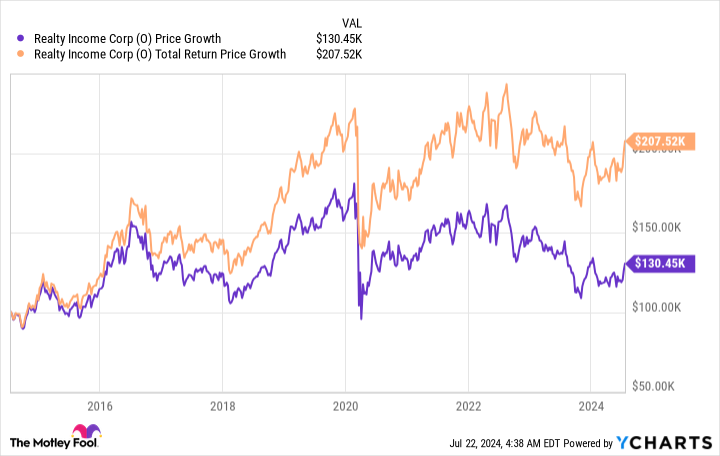

Realty Income is exactly the kind of get rich slow stock most investors could benefit from owing. A $100,000 investment in this REIT 10 years ago would only be worth around $130,000 today. But if you reinvested the dividends it has paid over that span, your position would be worth nearly $210,000.

Realty Income is a foundational investment

Realty Income owns a huge portfolio of retail and industrial properties spread across North America and Europe. Under the net leases it offers, tenants have to pay most of the property-level operating costs. It has an investment-grade-rated balance sheet, and with its massive $50 billion market cap, it has advantaged access to capital markets relative to smaller peers.

This is the foundation that underlays the REIT’s generous dividend, which yields about 5.5% at the current share price. A $100,000 investment in Realty Income would generate almost $5,500 in cash each year from dividends. That may not sound like a huge amount of money, but it can be reinvested (compounding your gains), used to pay for living expenses (so you don’t have to sell assets/touch your principal), or put to work in other investments. Whatever choice you make, you have a solid foundation in your portfolio that will allow you to layer on more aggressive, growth-oriented investments.

Those could come in the form of exchange-traded funds or individual stocks. But Realty Income gives you the ability to both sleep at night and take on higher-risk investments. To get back to the Buffett comment, a reliable high-yield investment like Realty Income gives you a cushion that will allow you to take on rational risks elsewhere in your portfolio. To put it another way, Realty Income isn’t very exciting, but that’s exactly why you might want to own it.

One stock isn’t a portfolio, it’s a bet

If you are trying to find that one magic stock that will turn you into a millionaire, you are, really, just making a bet. The more reliable approach to investing is to construct a diversified portfolio that can produce reasonable returns over time. A portfolio that will likely include both boring foundational investments such as Realty Income and somewhat more aggressive investments — for example, a growth-focused ETF such as the Vanguard Growth Index ETF or Invesco QQQ Trust. While Realty Income alone probably won’t make you a millionaire, it can be a foundational piece of a portfolio that can.

Reuben Gregg Brewer has positions in Realty Income. The Motley Fool has positions in and recommends Realty Income and Vanguard Index Funds-Vanguard Growth ETF. The Motley Fool has a disclosure policy.