Few expect a this month, but the vote split and forward guidance will be closely scrutinised for any subtle endorsement (or not) of a November move. We narrowly favour one more cut later this year, though this is heavily contingent on the economic data

Our Bank of England View

After a pause in September, we still narrowly favour another rate cut in November. But it’s a close call and will heavily depend on the and jobs data before then. For now, we also expect two more cuts in 2026.

1. Vote Split

September’s meeting almost certainly won’t result in another rate cut, with policymakers instead poised to keep rates at 4% on 18 September. But the prospect of a November cut hangs in the balance, and this meeting will be heavily scrutinised for hints on whether officials are still considering further easing this year.

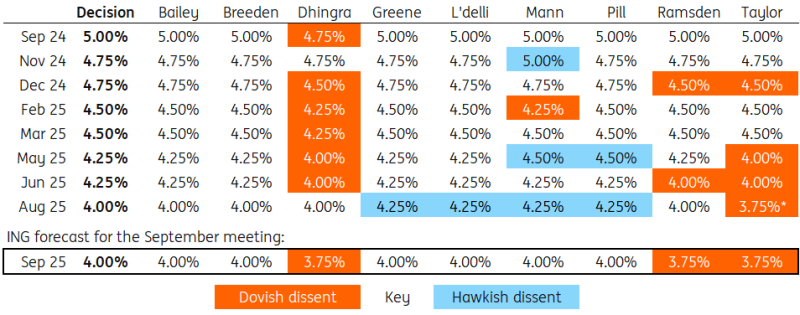

The first thing to watch is the vote split. Our best guess is that six officials will vote to keep rates on hold, with three voting for another 25bp cut. Those dissenters are likely to include Swati Dhingra and Alan Taylor, the latter of whom initially voted for a 50bp cut in August (before changing his vote to break an unprecedented deadlock). There is a question mark over Dave Ramsden, a deputy governor who has a recent history of siding with those pushing rate cuts.

Whatever happens, we’re always cautious about inferring too much from the vote split. History has shown us that its predictive power for future meetings isn’t as high as some investors might think.

How different committee members have voted over time

*Taylor initially voted for a 50bp cut in August, before switching his vote to 25bp to break a tied vote

Source: Bank of England, ING

2. Forward Guidance

The Bank’s communications have for some time merely stated that further easing is likely to be “gradual” and “cautious”. Yet one of the many eye-catching aspects of the hawkish August meeting was that the Bank said the “restrictiveness of monetary policy has fallen”. This is a statement of the obvious, though it was read by some as a hint that rate cuts were nearing their endgame.

We doubt any of this will change at September’s meeting, barring any massive surprises in the inflation or jobs data in the couple of days ahead of the decision. Fundamentally, the Bank remains sceptical about the trajectory of inflation beyond this year, given headline inflation is set to remain above 3.5% into year-end. For more on what needs to happen to unlock a November rate cut, read our separate report covering our expectations on the data between now and then.

3. Quantitative Tightening

Every September, the Bank votes on how far it wants to reduce its government bond holdings over the following 12 months. For the past few years, this has been consistently set at £100bn, done through a combination of active gilt sales and allowing bonds to mature without reinvestment. The ambition is to continue doing this until the level of bank reserves reaches its equilibrium level.

Nobody knows for sure what level that is, but BoE research puts it between roughly £380 and £550bn. Were the Bank to continue with £100bn QT for the next 12 months, adding in some repayment of loans introduced during Covid-19 (Term Funding Scheme), then reserves could be nudging the top of that range by this time next year.

The fact that usage of BoE repo facilities has increased considerably over recent months suggests we are getting closer to a more balanced demand and supply for bank reserves. And though the Bank itself judges that QT hasn’t had an outsized impact on markets, there is growing pressure on the long-end of the UK gilt market.

We therefore expect a slowdown in the pace of QT. A reduction in the annual gilt reduction target to £75bn would be consistent with a recent survey of market participants, and therefore is unlikely to rock the boat. We’ll also be looking for any hints that the Bank is prepared to shift active sales away from longer-dated maturities.

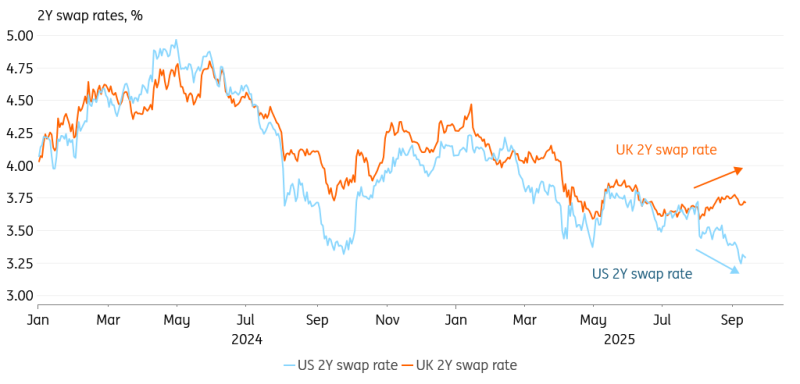

Rates: Multiple Hurdles to Jump Before UK Rates Can Follow the US Lower

Markets now only see 10bp of BoE cuts this year, whereas for the Fed, this has increased to three more 25bp cuts. Sterling rates have tended to follow the US quite closely over the past year, but we face a clear break since the sharp deterioration in US job numbers. Whilst we think the UK curve should come down too, we acknowledge that the bar to achieve this has increased.

A decision to reduce the pace of QT will reduce the upward pressure on longer-dated Gilt yields, but while inflation stays hot and economic data decent, we struggle to see a more material decline. Add the uncertainty from the autumn budget, and rates should stay elevated for now.

The Tight Correlation Between US and UK 2Y Interest Rates Has Broken

Source: ING, Macrobond

Sterling Can Hold Steady

For all the furore of Gilt yields hitting the highest levels since 1998 and the UK needing an IMF bailout, sterling has been performing quite well. Ever since the July US jobs report sealed a restart to the easing cycle and a weaker , sterling has been sitting in the top half of the table for G10 currency performance.

The BoE’s hawkish pivot in August has certainly played a big role here – preserving sterling as one of the few currencies still paying 4% per annum in one-week deposits. As above, the BoE look unlikely to turn more dovish at the September meeting and this should not present a downside risk to sterling.

For , we see the bearish dollar story dominating from October onwards and GBP/USD ending the year towards the top of the 1.32-38 range. We’re cognisant of the big event risk around the 26 November UK budget, but expect the cleaner dollar bear trend to be the dominant factor at this point.

remains well contained in a 0.86-87 range. We doubt it will move too far, but would say we see slightly greater risks on the upside here into year-end should UK fiscal and monetary policy turn tighter and looser respectively.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more