The market cap of the crypto-based tokenized commodities is close to reaching the $4 billion mark. This is largely due to the fact that Gold and Silver are performing extremely well in the markets, breaking new records.

Gold and Silver Rally Provides Boost to Tokenized Commodities

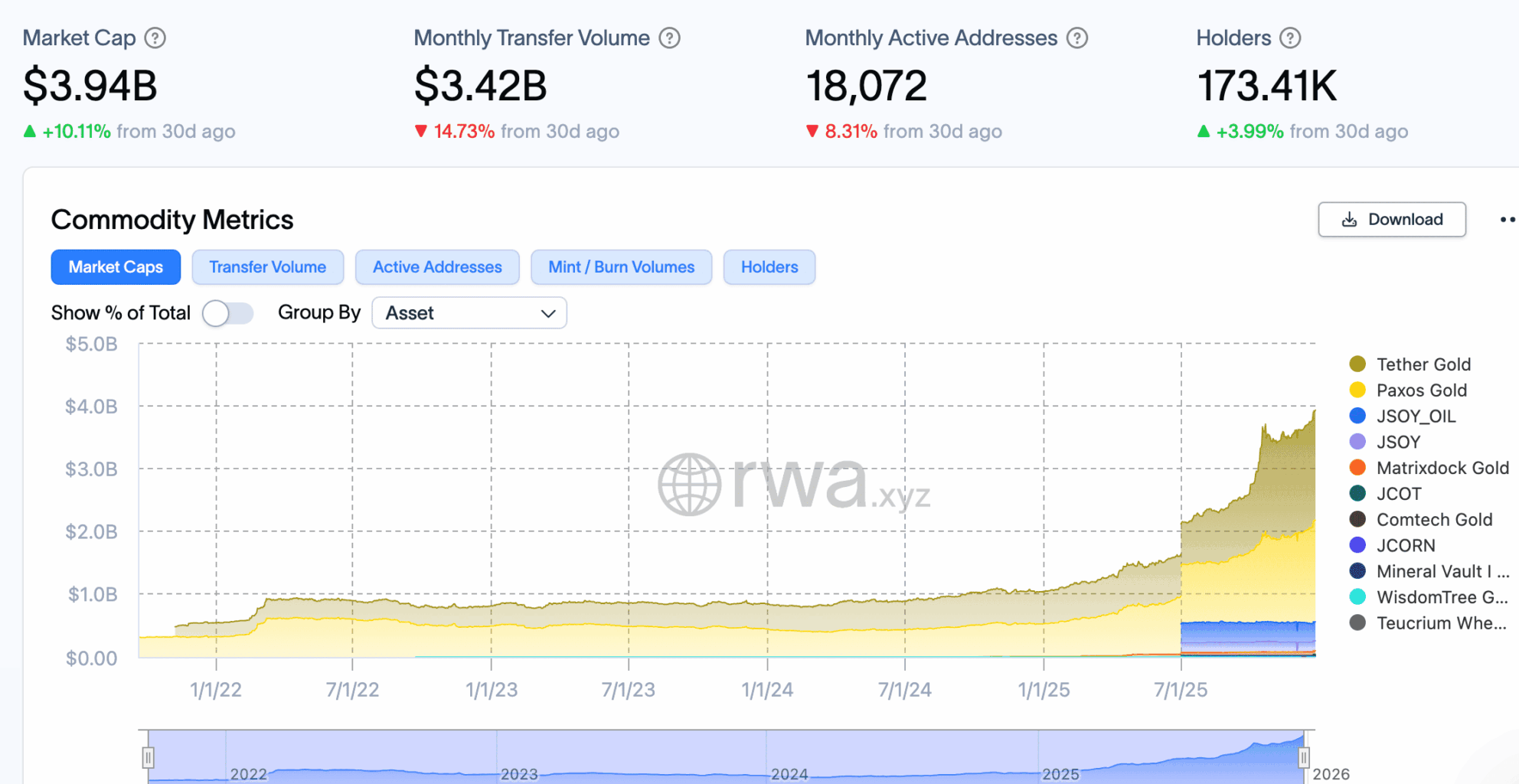

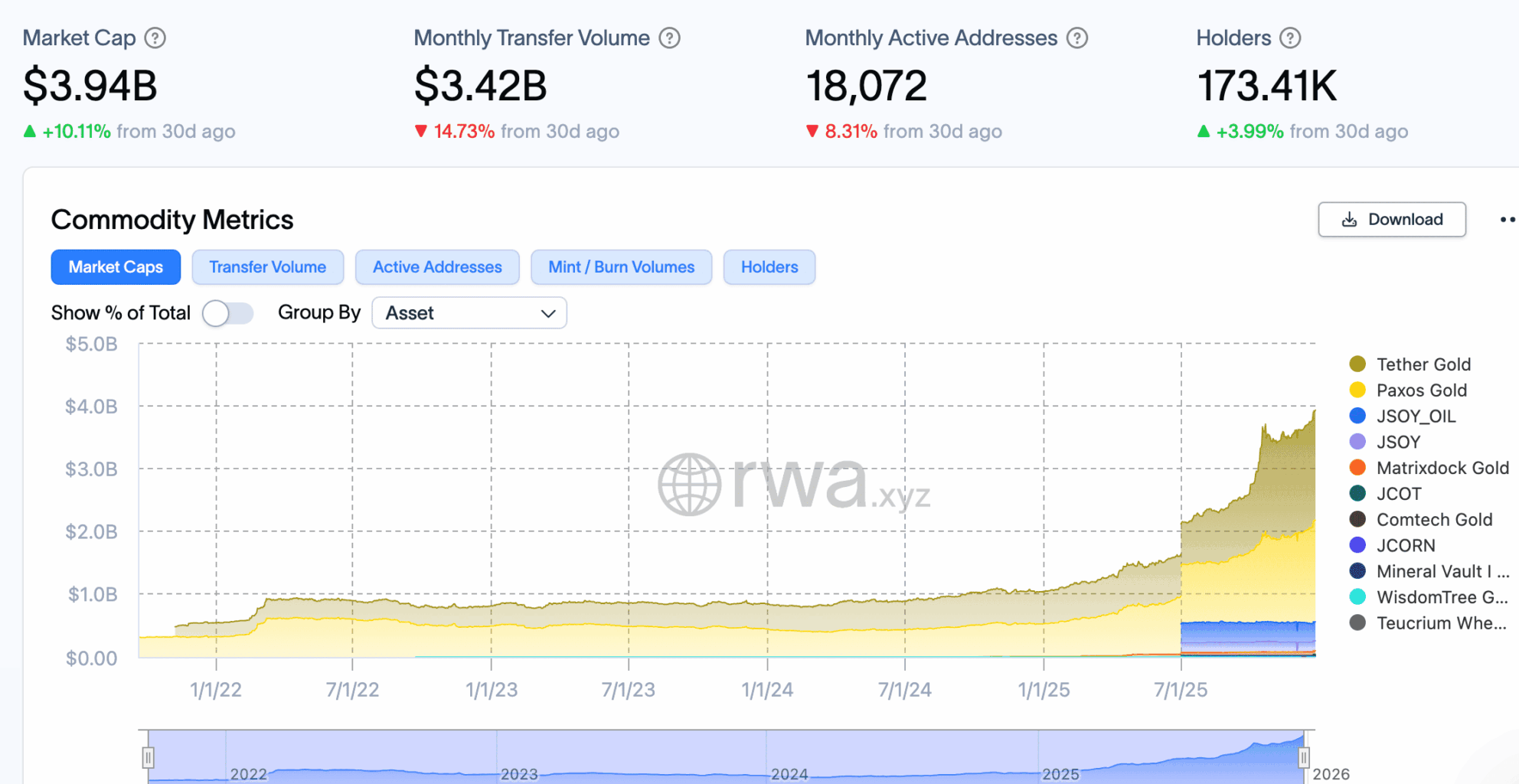

Blockchain-based tokenized commodities have appreciated with the rising trend in global precious metals markets. According to rwa.xyz, the total market value increased by 11% in the last month to around $3.94 billion.

The surge comes as gold prices had reached as high as $4,582 per ounce over the past 24 hours. This price surge had also affected digital asset markets. In this case, digital representations of physical metals are based on current prices in markets.

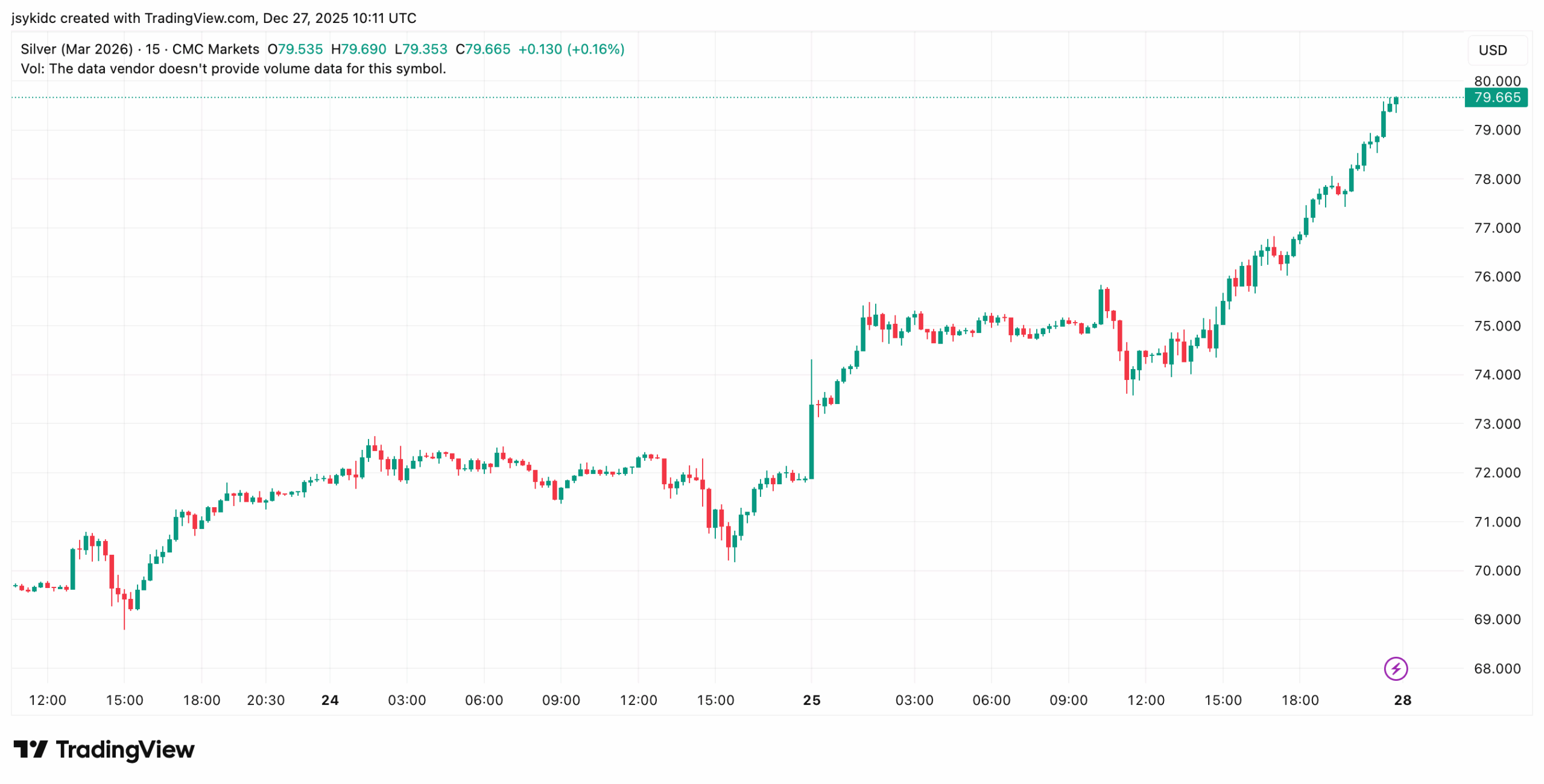

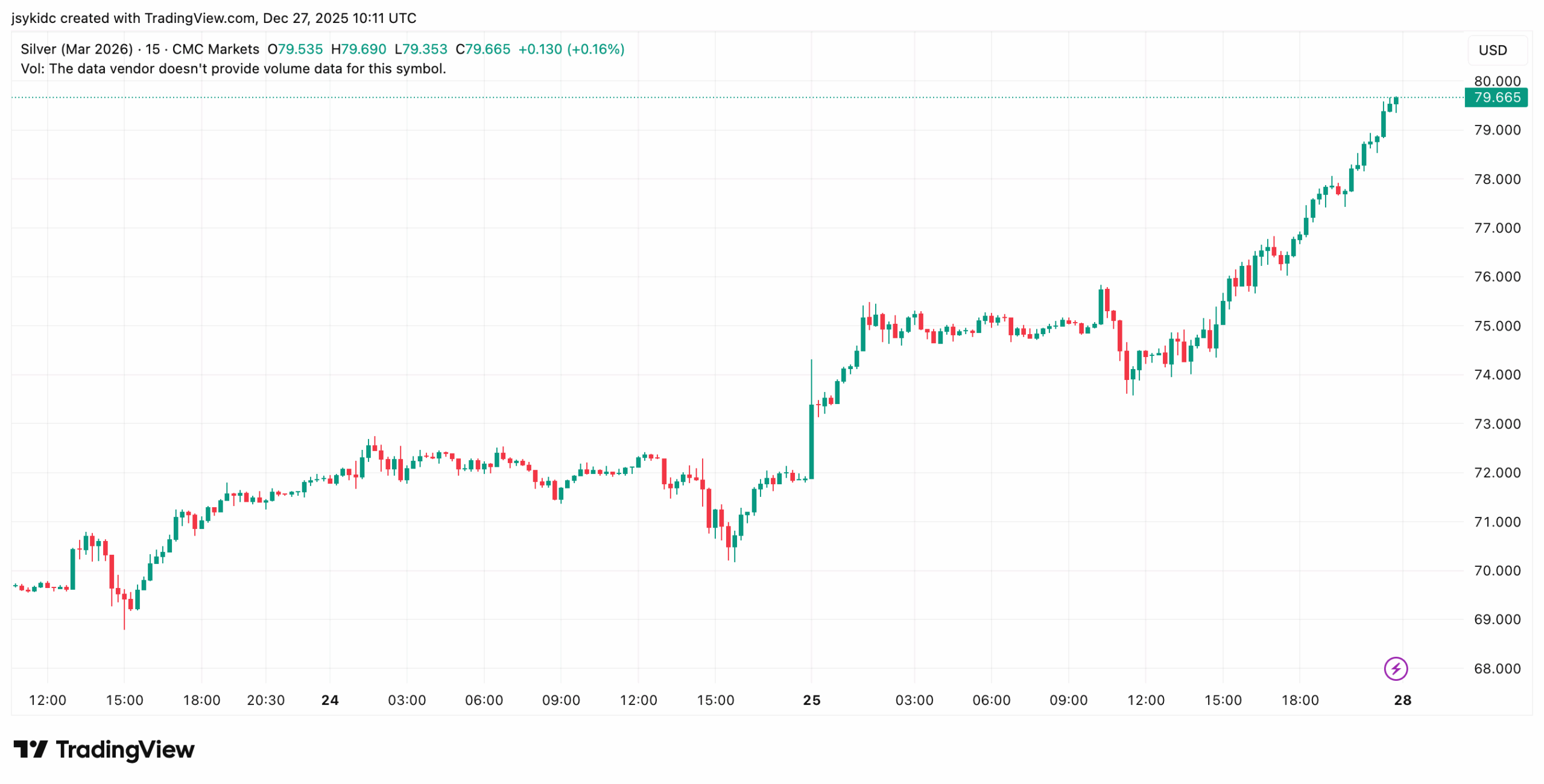

It has been even more dramatic for Silver, which closed closer to $79.6. It posted almost a 10% gain in a single trading day, with an accumulation of over 170% since the opening of the year. Analysts have ascribed the surge to escalating shortages of the item and the ensuing demands from the solar industry, electric cars, among others.

China’s Silver Export Limits Tighten Supply

The supply narrative around silver has been fueled by new developments. According to The Kobeissi Letter, China has declared new export limits that mandate special government licenses on shipments of silver starting from the 1st of January 2026.

This change of policy has already changed price spreads in the region. Shanghai silver is trading at about $85/oz, about 5% more than the U.S. spot prices. This is consistent with wider market indicators with popular gold advocate Peter Schiff adamant that there would be a Bitcoin crash soon as these metals soar.

Elon Musk replied to the update saying that many processes in industries need silver. His comment reflects increased worries about possible disruptions in silver supply and increasing operational costs in the industrial sector.

Robert Kiyosaki also shared that he expects the price of the metal to “break above $80.”

SILVER To Break $80.

Happy New Year ….smart silver stackers.

Your patience has paid off.

Now we get richer.

Happy 2026

Silver is hotter than gold.

— Robert Kiyosaki (@theRealKiyosaki) December 27, 2025

The rally is propelling tokenized commodities into one of the most significant periods of growth in tokens linked to gold since it was launched on blockchain.

Currently, Tether is leading with a market cap of $1.7 billion. This is followed by Paxos with a market cap of approximately $1.61 billion. These two are backed by physical bullion in custody. This means investors could benefit from prices without necessarily owning physical bars or coins.

Unlike conventional commodity markets, tokenized assets are traded 24/7 on-chain. The flexibility is an advantage but is pegged to conventional bullion infrastructure and redemption schemes.

Regulation and 2025’s Tokenization Push

There are developments in regulation that continue to push the idea of tokenized commodities. There was an announcement in July that the SEC would make an update to the regulation of securities to help facilitate markets on blockchain. This they called “Project Crypto” at the time.

Also, projects being carried out on different blockchains are witnessing the growth in the use of tokenization of assets. In October, XRP Ledger introduced a new standard that makes it easier to issue RWAs. Also, in October, World Liberty Financial revealed its plans to issue commodities such as oil, gas, cotton, and wood.

To add, Ethereum became the mainstream blockchain for tokenizing real-world assets. Its market share for tokenized real-world assets accounts for around 65%. BNB Chain is the runner-up with a 10% share, followed by other blockchains experimenting with standards.