Article content

Trump last month ordered his Commerce Department to investigate the nation’s imports of copper as a likely precursor to imposing duties. Since then, U.S. prices have spiked and traders have rushed to send metal to America ahead of any tariffs, in turn reducing availability in the rest of the world.

Article content

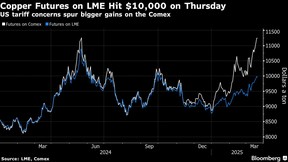

Copper on the London Metal Exchange jumped as much as a 0.6 per cent to trade at US$10,046.50 a ton earlier Thursday, while prices on New York’s Comex traded close to a record high.

“This is a round of cross-regional repricing triggered by potential U.S. tariffs,” said Wei Lai, deputy trading head at Zijin Mining Investment Shanghai Co. “Cargoes are lured to the U.S., leaving other places in shortfall. Buying sentiment is very strong.”

Copper’s surge is just one part of the turmoil unleashed by Trump’s bid to reshape global trade and bolster defences for some parts of the U.S. economy. He’s slapped 25 per cent import levies on steel and aluminum, hit Canada, Mexico and China with duties, and has promised sweeping “reciprocal” tariffs starting next month.

The investigation into copper imports is unlikely to deliver its recommendations until later this year, but Goldman Sachs Group Inc. and Citigroup Inc. are among those anticipating the U.S. will impose 25 per cent import duties by the end of 2025.

Price Spread

Comex copper prices are now up 27 per cent since the start of the year, while the LME price is about 14 per cent higher. The big gap has created a huge incentive for traders and producers to keep moving supplies to the U.S., and more than 100,000 tons may be on its way. Major commodities players including Trafigura Group and Glencore Plc are among those diverting the metal from Asia, according to people familiar with the matter.

Article content

The trade ructions have sucked copper from the LME’s global network of warehouses, but other factors are also underpinning the price rally. Copper typically benefits from a weaker dollar, and the greenback has softened notably since Trump returned to the White House.

Copper also has support from tight spots in its supply chain: smelters are suffering as a frenzy of expansions has left them fighting to secure raw materials. There have been many bold price forecasts over recent years predicated on the risk of shortages as demand from green industries expands. Major miners such as BHP Group Ltd. and Rio Tinto Group want to produce more.

Recommended from Editorial

While traders and investors are expected to reap profits from moving copper around, U.S. manufacturers are paying costs that already price in a hefty tariff. Separately, aluminum premiums in the U.S. reached a record high last week, when Trump’s blanket 25 per cent import duty came into force.

Copper traded at US$9,980 a ton on the LME by 12:00 p.m. London time. Other metals were mixed, with aluminum slightly higher and nickel mostly steady. The LMEX Index of six base metals reached a five-month high on Wednesday.

—With assistance from Jake Lloyd-Smith, Yvonne Yue Li and Jack Ryan.

Share this article in your social network