Bitcoin has been at a critical support level, since early 2025, and has been able to remain above the $80,000 mark on all monthly closes. This area has continued to provide a source of stability in prices. However, the latest market reports indicate defying trends as U.S. driven volumes remain sold and long-term holders reduce their distributions.

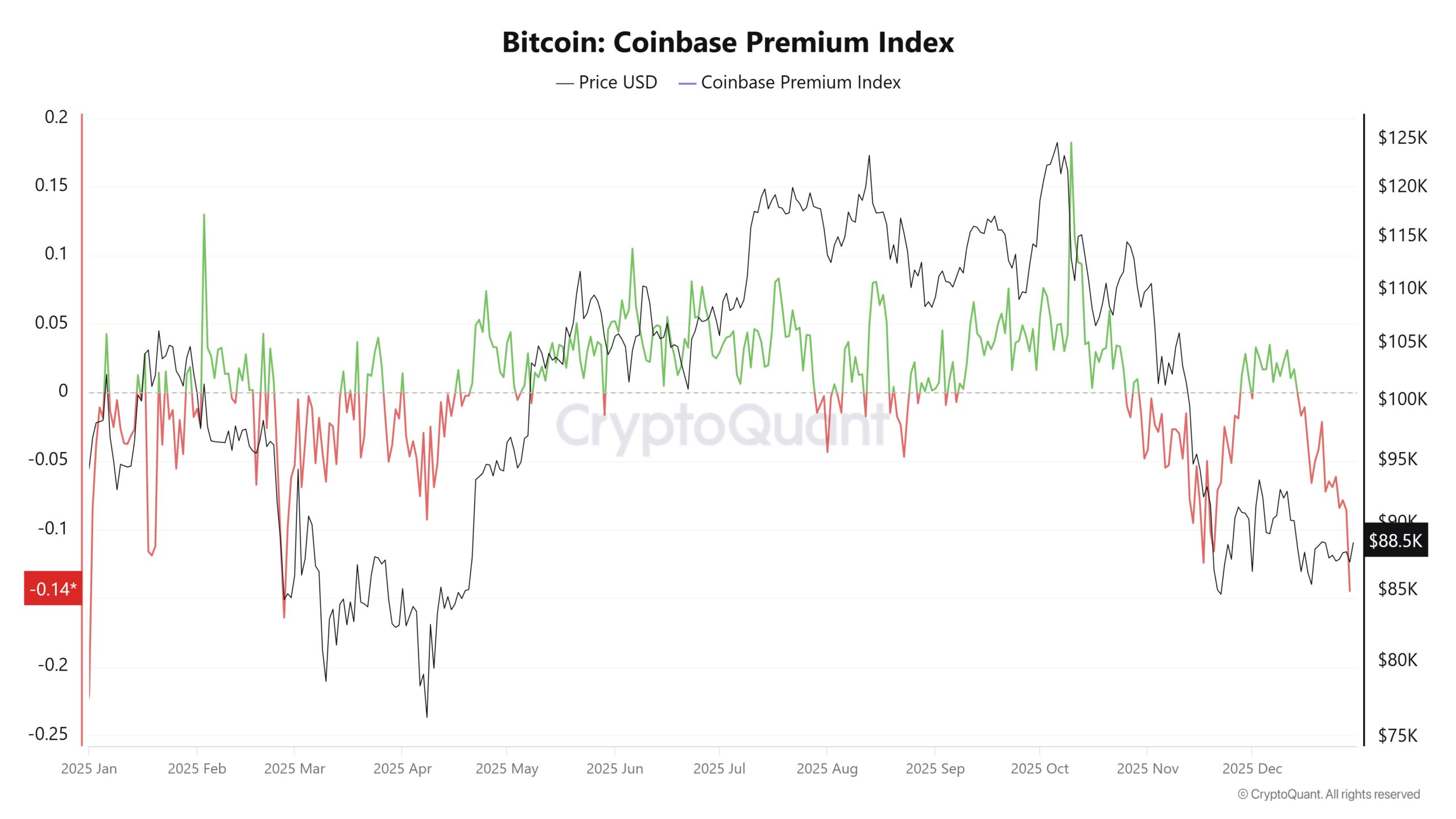

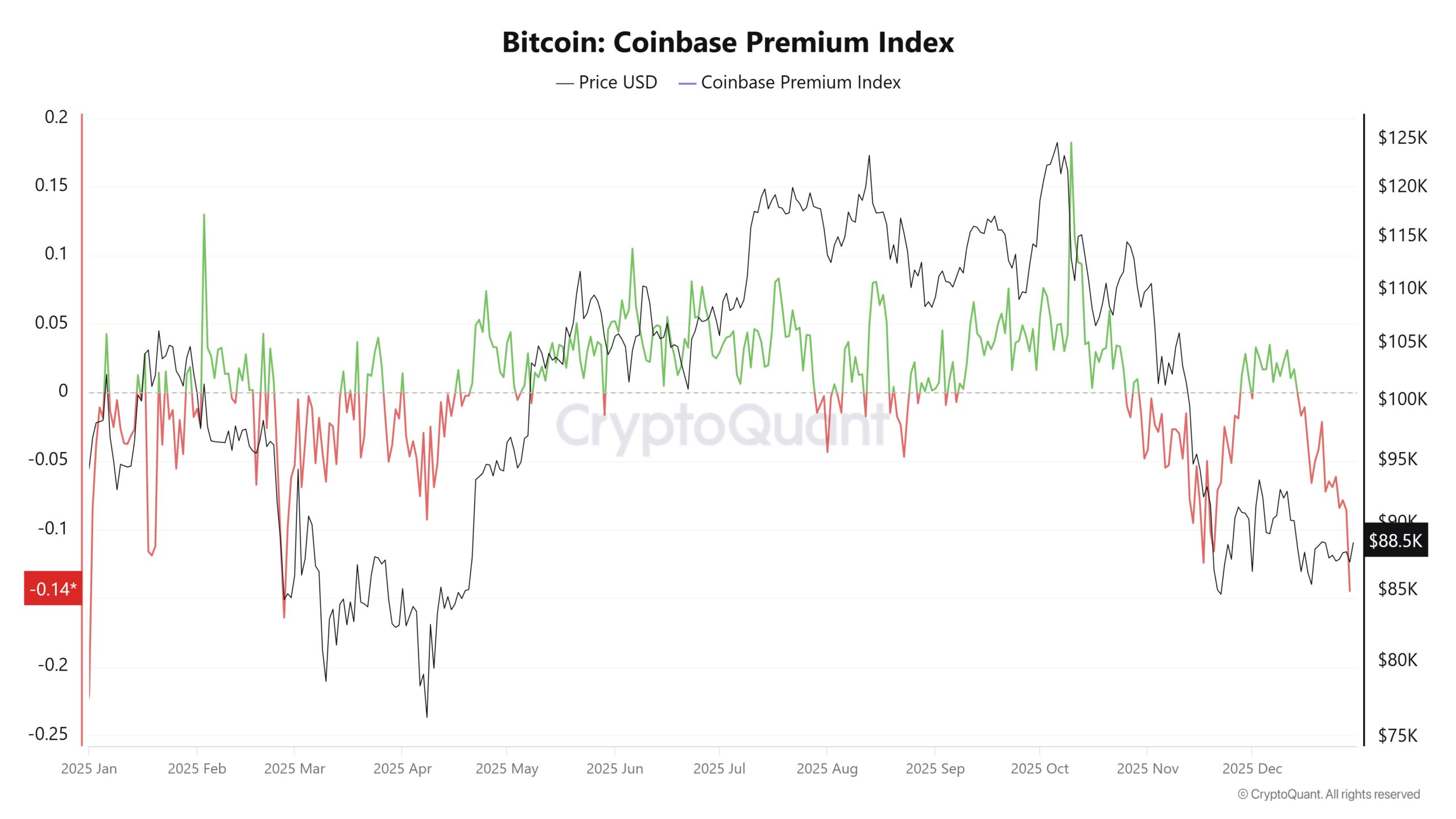

The Coinbase Premium indicator is a measure of the relative Bitcoin price difference between Coinbase and Binance that is used to monitor the demand of U.S. institutional investors. A negative index implies that the U.S. side has a stronger selling pressure.

Bitcoin Coinbase Premium Weakens Bottom Outlook

According to CryptoQuant data, the index stood at -0.14 on December 30. That was the weakest reading since February. The index was in the red for 16 straight days to end December. During the same stretch, Bitcoin failed to record a weekly close above $90,000.

Analysts say the prolonged weakness reduces confidence that a market bottom is already in place. U.S driven selling pressure has shown persistence, with no clear reversal signal yet. Analyst Johnny said in an X post that “The biggest indicator of a local bottom to be in will be when Coinbase premium returns.”

A comparable setup unfolded earlier in the year. A sharp drop in the Coinbase Premium Index emerged in February, where Bitcoin tumbled below $80,000. The price recovered shortly afterward. Analysts believe the current extreme reading could lead to a similar outcome.

ETF Outflows Slow as Bitcoin Holders Accumulate

ETF flow data further complicates the picture. The second consecutive outflows of Spot Bitcoin ETF took place in December. Nonetheless, the scale of withdrawals continued to decline significantly since November. Analysts reported a similar decline in selling in February and early March 2025.

This trend means that sales pressure could be decelerating significantly. Such conditions can be used to stabilize. Analysts point out that Bitcoin can still recover even when it temporarily declines below the value of $80,000 in case the selling force is not strong.

On-chain records of long-term holders have attracted interest. CryptoQuant claims that the long-term holder supply has shifted to accumulation instead of distribution at the end of December. Roughly 10,700 Bitcoin shifted into long-term holding status.

CryptoQuant founder Ki Young Ju explained that “Bitcoin long-term holders stopped selling.” Nevertheless, the period of consolidation or recovery has occurred in past instances with a market wide perspective as darkfost analyst pointed out.

The U.S. selling signals are still apparent, based on the Coinbase Premium Index and ETF data. In the meantime, there is a counterweight of behavior among long-term holders. Bitcoin might experience further decrease below $80,000, yet structural indicators are that it may experience a bounce.