The latest Fed rate announcement has shaken expectations in the crypto market. After trimming rates by 25 percentage points (from 4 to 4¼), many anticipated a surge in Bitcoin’s (BTC) price and volatility. Instead, the opposite happened: Bitcoin’s (BTC) swings collapsed to some of the lowest levels in months. The situation presents unique profit-making opportunities for investors, as Paydax Protocol (PDP) seeks to unlock value that traditional finance overlooks.

Stability Or Stagnation?

The lower fed rates should have fueled a risk-asset rally, yet Bitcoin (BTC) barely moved — a sign it may be entering a steadier, more institutional phase. MicroStrategy’s Michael Saylor recently suggested this shift is inevitable. As more institutional players enter the cryptocurrency space, volatility tends to fade.

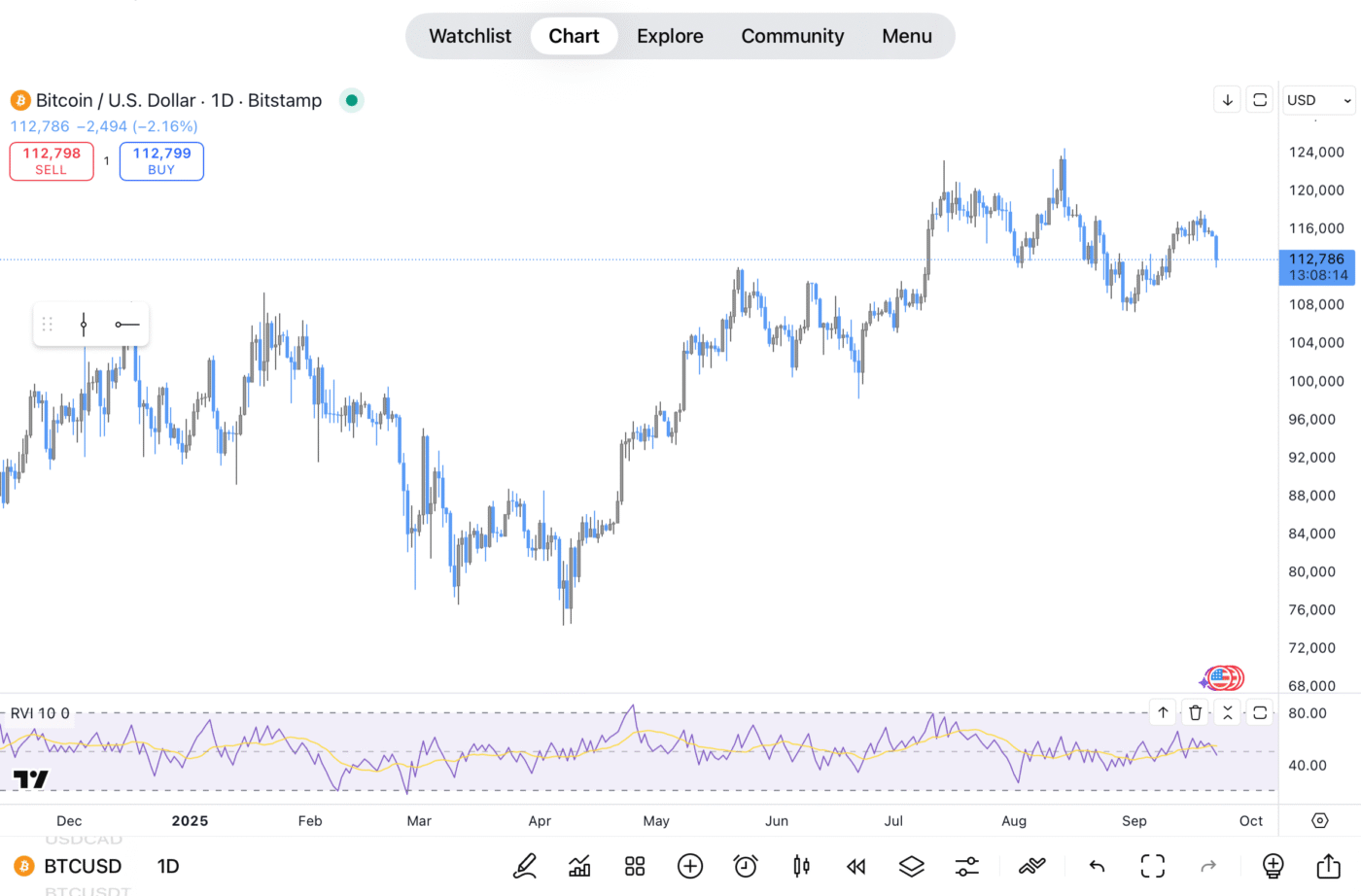

Source: TradingView

The Fed rate cut and ensuing Bitcoin stability may please Wall Street, but it leaves another problem: trillions in Bitcoin (BTC) wealth remain idle because holders still have to sell to access liquidity. For crypto investors, the opportunity now lies less in speculation and more in projects like Paydax Protocol (PDP) that focus on making those assets work without giving them up.

Paydax Protocol Courts Confidence Amid A Shifting Crypto Market

The Fed rate cut and subsequent move toward calmer markets put a spotlight on projects that offer not just returns, but real safeguards. Paydax Protocol (PDP) is built around that idea.

Borrowing Without Selling

Instead of cashing out long-term assets like Bitcoin (BTC) or Ethereum (ETH), users can borrow stablecoins against them as collateral. Paydax even extends this model to tokenized real-world assets — from gold to luxury watches — unlocking liquidity without forcing holders to sell their crypto.

Fair Crypto Lending Terms

Paydax Protocol (PDP) offers loan-to-value ratios as high as 97% and fixed APR options, so borrowers know exactly where they stand. It’s a level of clarity traditional finance rarely provides.

Layered Yield Opportunities

Lenders can earn between 6% and 20% APY through direct loans, staking PDP tokens, or even the Redemption Pool, which acts as a backstop to protect the system. Each layer offers different ways to generate income, depending on appetite for risk.

Security And Transparency

Independent audits from Assure DeFi, the gold standard in smart contract auditing, provide the system with an additional layer of assurance. But it doesn’t stop there — Paydax’s KYC process holds leadership publicly accountable. By verifying the team’s identity, Paydax Protocol (PDP) strengthens trust, demonstrates professionalism, and facilitates compliance with the standards required by top cryptocurrency exchanges.

Source: PayDax Protocol

Real-World Use Cases

The Fed rate cut lowered the bar for traditional savings — banks now offer even lower interest rates, pushing investors to look elsewhere for meaningful returns. This is where Paydax Protocol’s structure becomes more than theory.

- Whales With Idle Wealth: Michael Saylor described the challenge perfectly — “people look rich on paper, but in reality, they need to sell Bitcoin (BTC) to pay bills.” Paydax Protocol rewrites that reality. A crypto whale holding $10 million in Bitcoin (BTC) can unlock up to $9.7 million in stablecoins without selling a single satoshi.

- Lenders in a Low-Rate World: While the Fed rate cut will shrink interest on savings accounts to fractions of a percent, Paydax lenders can earn up to 15.2% APY on peer-to-peer crypto loans. Those willing to insure loans through the Stability Pool can push returns even higher, capturing premiums that simply don’t exist in traditional banking.

- DeFi Users Seeking Stability: Fixed APR loans cut through the chaos of volatile markets. Whether future Fed rate announcements bring further cuts or not, borrowers know their costs upfront, while lenders earn predictable income streams.

The Role Of PDP — Join The Presale Today

At the center of it all is the PDP token. It powers governance, rewards stakers with fee-sharing, unlocks better borrowing terms, and secures the Stability Pool. By design, every activity on the platform requires PDP, creating natural demand.

For presale investors, that means PDP isn’t just about speculation; it’s built for constant use in a growing financial ecosystem. Michael Saylor is right — paper wealth without liquidity isn’t enough, and the Fed rate cut simply highlights an inefficiency in the market.

Paydax Protocol (PDP) provides the missing bridge, enabling holders to unlock value without selling their Bitcoin (BTC) and offering lenders meaningful yields in a low-interest-rate environment. With PDP at the heart of the system and prices at their lowest ($0.015), there is no better time to join the presale than now.

Join The Paydax Protocol (PDP) presale and community:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.