- Bitcoin price closes above the $116,000 resistance, with bulls setting sights on the $120,000 level.

- Trump signs an executive order enabling cryptocurrency assets in 401(k) retirement accounts.

- SBI Holdings announced that the company has filed for a dual-asset crypto ETF for BTC and XRP.

Bitcoin (BTC) looks set to close the week in the green, breaking above the $116,000 resistance, as market optimism swelled after United States President Donald Trump signed an executive order to include alternative assets, including crypto, in US 401(k) retirement accounts.

Adding to this, Japan’s SBI Holdings made headlines by filing for a dual-asset crypto ETF, which, if approved, would provide more exposure to both BTC and XRP..

Trump’s 401(k) crypto plan boosts Bitcoin price

Bitcoin price started the week on a positive note, recovering slightly from its decline last week. This recovery got a boost on Thursday as US President Donald Trump signed an executive order that aims to allow cryptocurrency, private equity, and real estate in 401(k)s, causing BTC to close above its critical resistance at $116,000.

Critics have faulted the move, saying that it would create instability in retirement accounts while the details of the directive remain under wraps.

The order would allow for the provision of digital assets, precious metals such as Gold, and private loans in retirement plans to serve as alternatives to the traditional portfolio of Stocks and Bonds.

Apart from this bullish narrative circling the market, the rising demand for stablecoin from China also supported the crypto market outlook. The Financial Times reported this week that China is planning to roll out its first stablecoins as part of a broader strategy to internationalize its currency, the Renminbi (CNY), and reduce reliance on the US Dollar in global payments.

Hong Kong is emerging as the testing ground for China’s cryptocurrency bet, as the industry is banned on the mainland, with the passing of a new stablecoin regulation recently.

This interest in stablecoin by China comes after Trump introduced the first regulatory framework for stablecoins (GENIUS Act). The rising demand for stablecoin by the two global economies acts as a bullish outlook for Bitcoin and other cryptocurrencies, as stablecoins are considered the gateway to crypto.

Market participants expect a rate cut in September

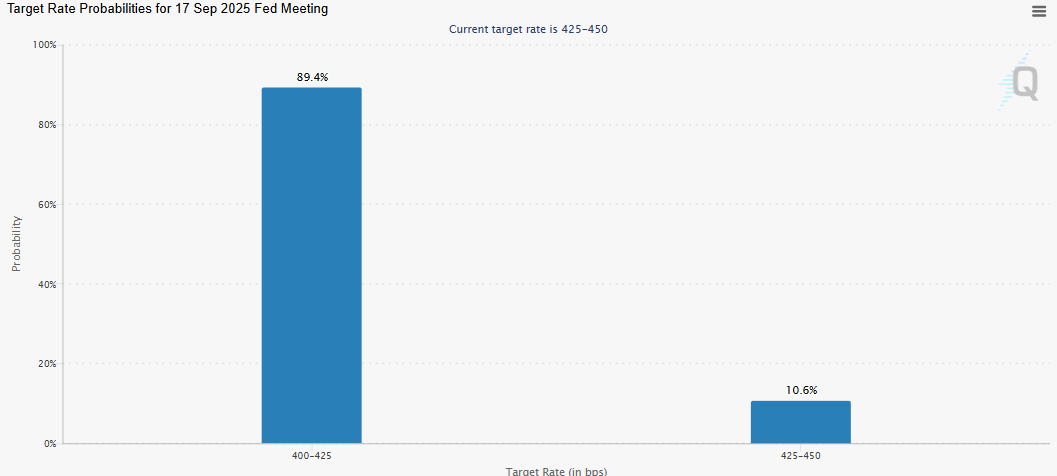

Despite no directional bias and low volatility seen in Bitcoin this week, the growing acceptance that the US Federal Reserve (Fed) will resume its rate-cutting cycle in September adds some optimism to riskier assets such as Bitcoin.

According to the CME Group’s FedWatch Tool, market participants see a roughly 90% chance that the US central bank will lower borrowing costs at the next monetary policy meeting in September. Moreover, the Fed is expected to deliver at least two 25-basis-point rate cuts by the end of this year.

US trade tariffs came into effect

Donald Trump’s fresh tariff threats this week keep investors on edge and add a fresh layer of risk, introducing volatility across crypto markets.

Trump imposed additional levies on Indian imports as “punishment” for buying oil from Russia, taking the total tariffs to 50%. Trump had also announced this week that tariffs on semiconductors and pharmaceuticals will be imposed within the next week or so.

SBI Holding files for BTC and XRP ETFs

Japan’s investment firm SBI Holdings announced on its Q2 2025 earnings report this week that the company has filed for a dual-asset crypto Exchange Traded Fund (ETF) for BTC and XRP in Japan’s financial markets.

If approved, it could be bullish in the longer term for Bitcoin and Ripple as it would offer direct exposure to BTC and XRP.

This positive narrative is further supported by the US Securities and Exchange Commission (SEC) statement on Tuesday that clarified that crypto liquid staking activities do not constitute a securities offering, marking a step toward clearer digital asset regulation.

The SEC’s guidance on liquid staking comes as Chair Paul Atkins shared the agency’s commitment to providing clearer guidance on how federal securities laws apply to crypto.

Will BTC hit a new all-time high?

Bitcoin closed above its key resistance $116,000 on Thursday and it hovers at around $116,900 at the time of writing on Friday.

If $116,000 holds as support, BTC could extend the rally toward its key psychological level at $120,000. A close above this level could extend the rally toward its all-time high of $123,218 from July 14.

The Relative Strength Index (RSI) moved above its neutral level of 50 on Thursday and currently reads 54, indicating fading bearish momentum. Still, for the bullish momentum to be sustained, the RSI must continue moving upward. The Moving Average Convergence Divergence (MACD) lines are nearing each other on the daily chart. The red histogram bar below the neutral level is also decreasing, suggesting a decline in selling pressure.

BTC/USDT daily chart

If BTC fails to find support around the $116,000 and closes below, it could extend the decline toward its 50-day EMA at $113,422.