Join Our Telegram channel to stay up to date on breaking news coverage

Pyth Network surged 76% to trade at at $0.2124 as of 4:04 a.m. EST after the US government selected its network, along with Chainlink, to put GDP data on-chain.

Its pump was a rare bright spot in a mostly red market, with Bitcoin sliding almost 3% to near the $110k support zone and major altcoins posting significant losses.

Cronos (CRO) plunged 14%, Hyperliquid (HYPE) 8.3%, Ethereum (ETH) 5.4%, and XRP (XRP) 4.7% in the last 24 hours, according to CoinMarketCap data.

Other top losers included SPX6900 (SPX), Aerodrome Finance (AERO), and Raydium (RAY), which dropped 11.8%, 9.2%, and 8.2%, respectively.

After PYTH, the other top gainers were Four (FORM) with a 2.8% gain, KuCoin Token (KCS), up almost 2%, and Ethena (ENA), which climbed just over 1%.

Pyth Network Price Soars After US GDP Data Goes On-chain

The US government’s move pushed Pyth Network token trading volume up 9,160% to $2.3 billion, sending the coin above $0.20 for the first time in months.

The initiative marks a historic step toward blockchain-based transparency in economic reporting.

Pyth Network spans over 100 blockchains and has 600+ applications that depend on it for trustworthy data

The U.S. Department of Commerce has selected Pyth Network to verify & distribute economic data onchain 🏛️

Today’s announcement by @howardlutnick & @realDonaldTrump marks a landmark step for the adoption of decentralization & validates Pyth’s role as a trusted data source 🧵 ⬇️ pic.twitter.com/cOvw8lDNhP

— Pyth Network 🔮 (@PythNetwork) August 28, 2025

Chainlink was also selected to provide data feeds from the Bureau of Economic Analysis (BEA), highlighting a broader push to decentralize official statistics.

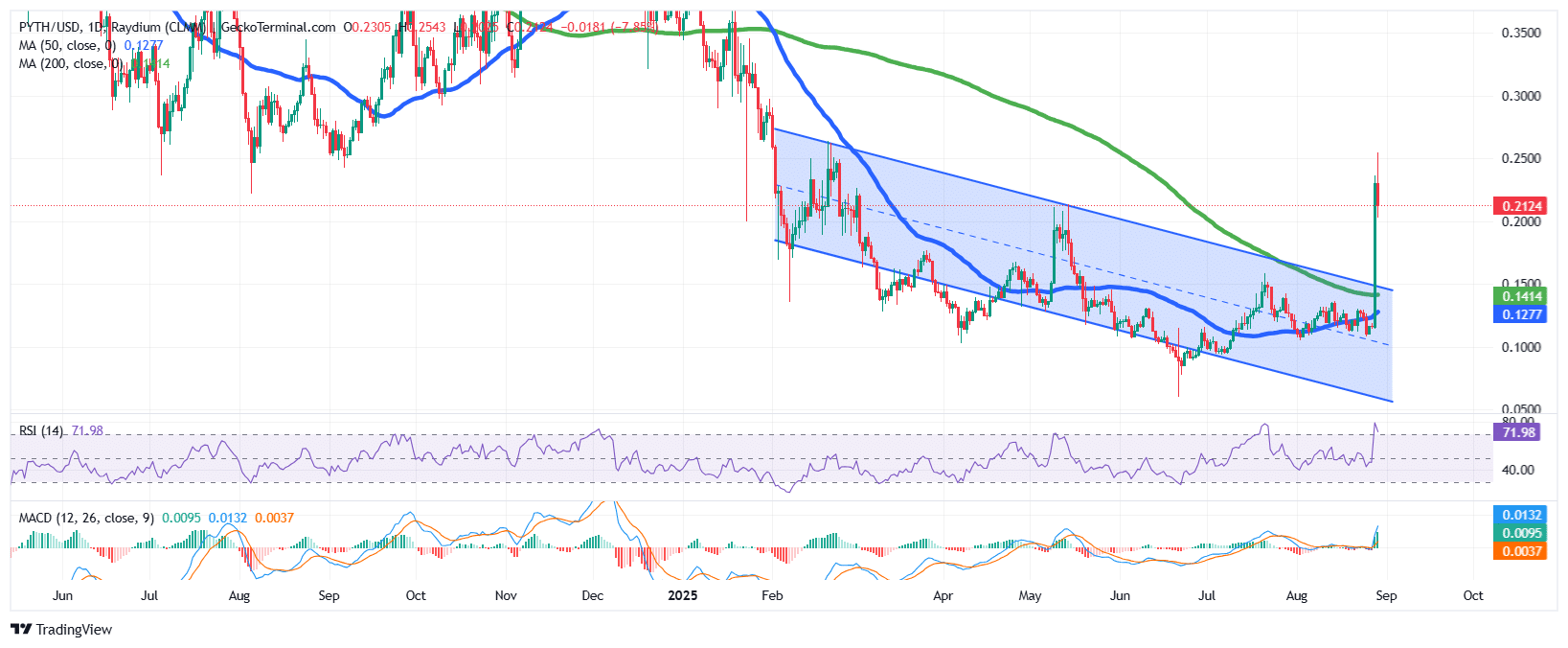

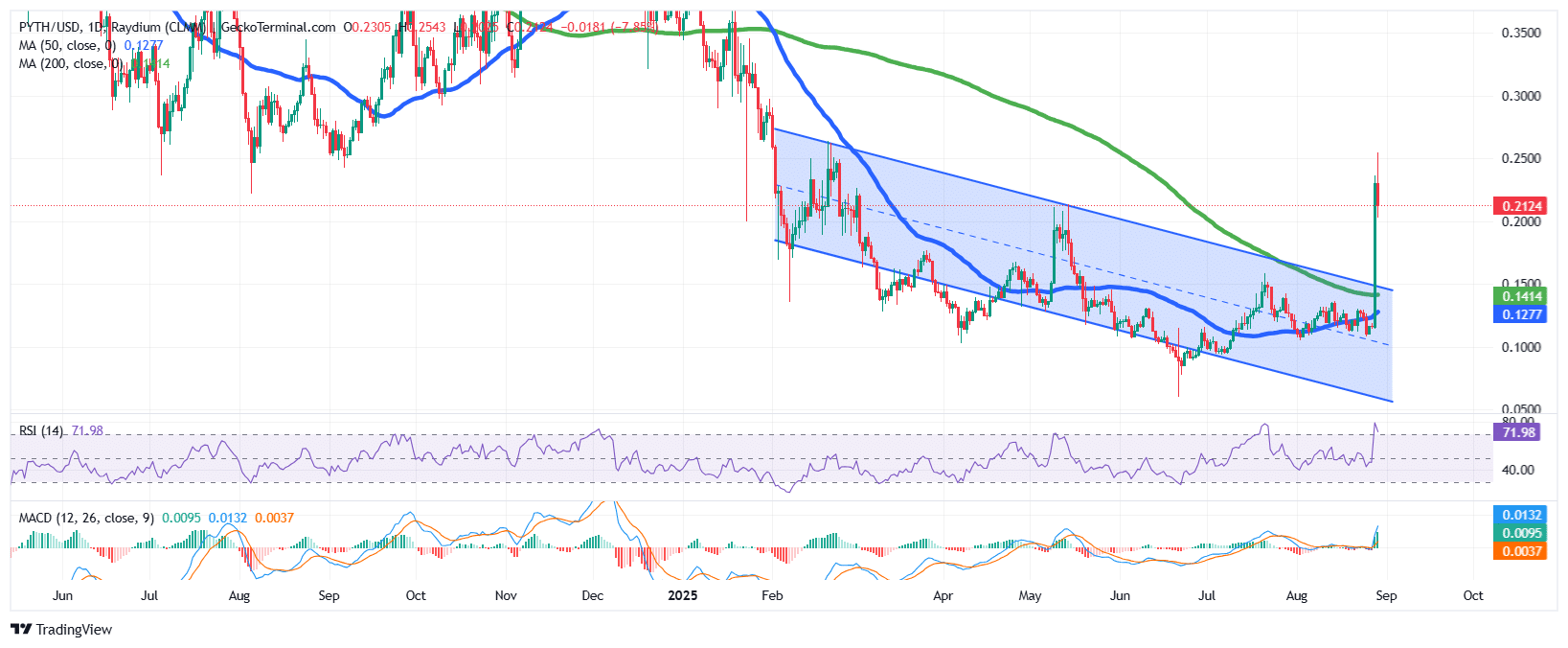

PYTH Price Signals Potential Trend Reversal

After the announcement, the PYTH price chart shows a decisive breakout from a prolonged falling channel pattern, signaling a potential trend reversal.

Pyth Network token price surged above both the 50-day and 200-day Simple Moving Averages (SMAs), breaking previous resistance levels.

The Relative Strength Index (RSI) sits near 72, placing PYTH in overbought territory, suggesting that momentum is strong but may face short-term pullbacks.

Meanwhile, the blue Moving Average Convergence Divergence (MACD) line is crossing bullishly above the orange signal line, further confirming upside momentum.

If buying pressure sustains, PYTH could test resistance near $0.25–$0.28, though short-term corrections are likely.

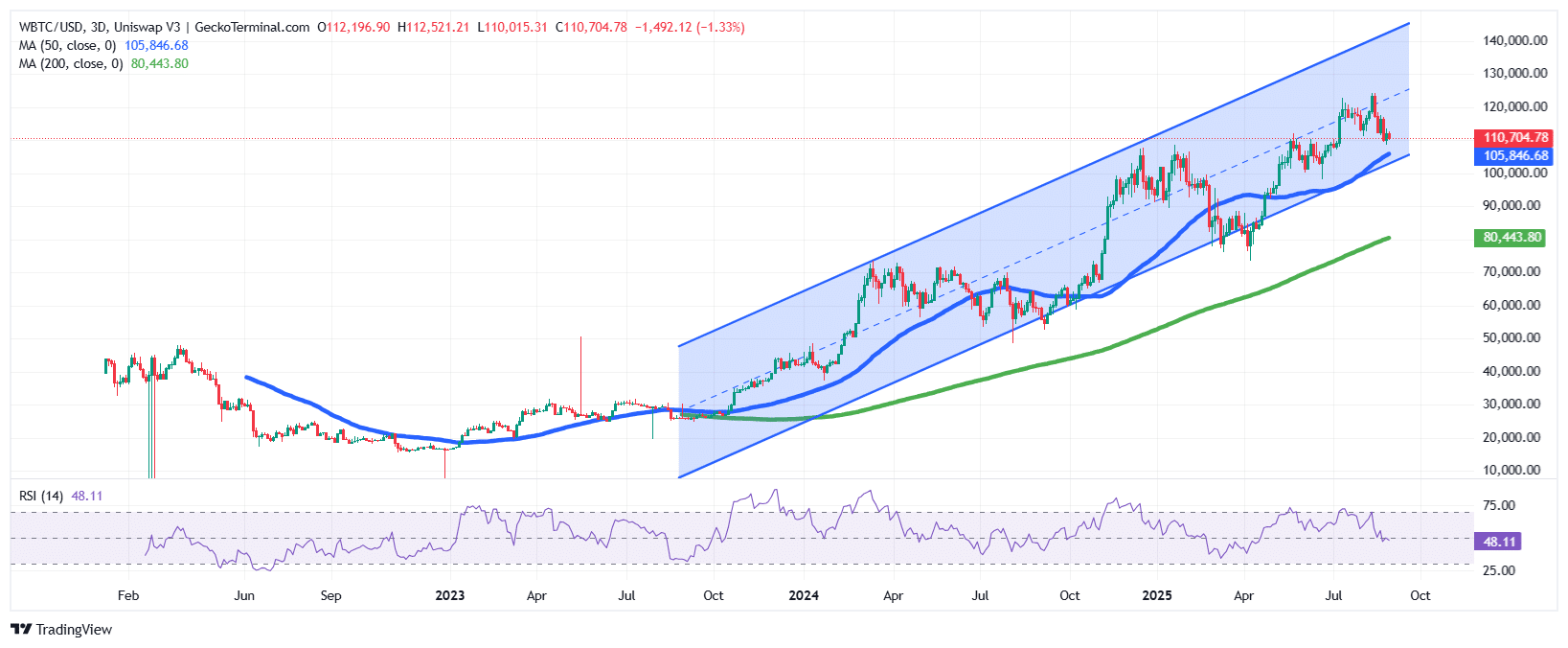

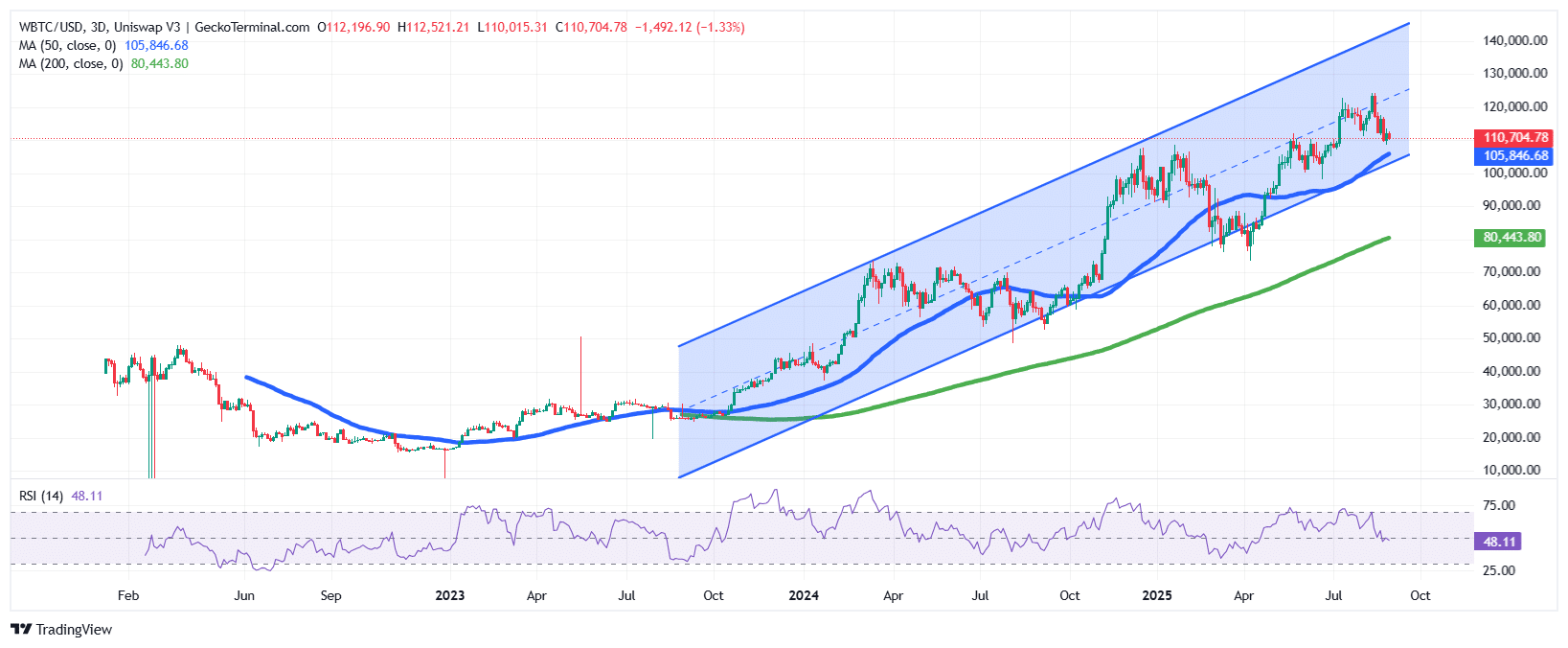

BTC Price Consolidates Near $110K Amid Short-Term Correction Risks

As the Bitcoin price nears the $110,000 support zone, the BTC/USD chart shows Bitcoin has maintained its movements within a rising channel pattern since late 2023.

Despite recent pullbacks, the overall structure remains bullish, with higher highs and higher lows intact.

BTC price is currently consolidating near $110,000, slightly below the midline of the channel, suggesting a cooling phase after extended rallies.

The 50-day SMA at $105,800 has acted as dynamic support, while the 200-day SMA at $80,400 reflects a long-term bullish foundation.

The RSI sits near 48, signaling a neutral momentum stance after previously overbought conditions, indicating room for either continuation or further correction.

If buyers defend the 50-day SMA, the price of Bitcoin could rebound toward the upper channel boundary near $125,000–$130,000. However, if support fails, a retest of $100,000 is possible.

According to Matrixport, the current consolidation of the Bitcoin price may continue for another two to three weeks.

📃#MatrixOnTarget Report – August 29, 2025 ⬇️

Will The Bitcoin Consolidation Continue into September?#Matrixport #Bitcoin #OnChainData #CryptoMarket #Seasonality #Fed #MacroOutlook pic.twitter.com/ymvAjLg2zs

— Matrixport Official (@Matrixport_EN) August 29, 2025

Meanwhile, popular crypto analyst Michaël van de Poppe believes that BTC will fall in coming days.

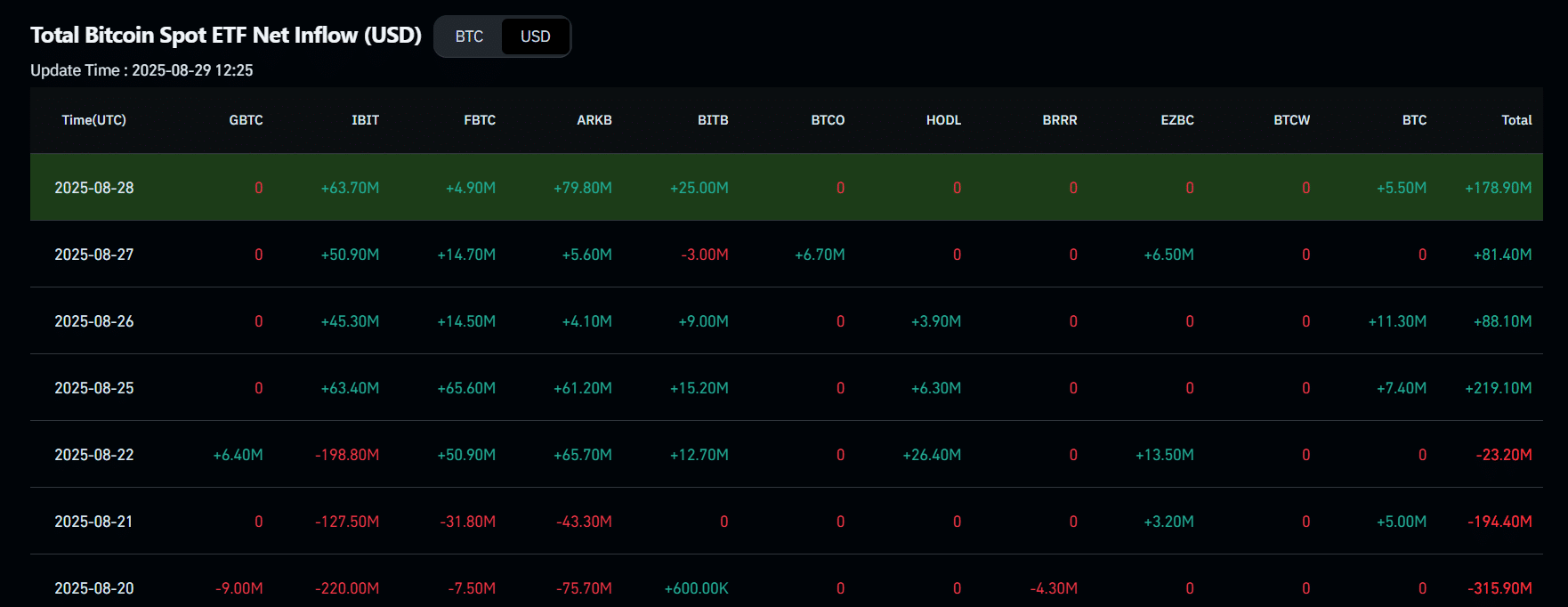

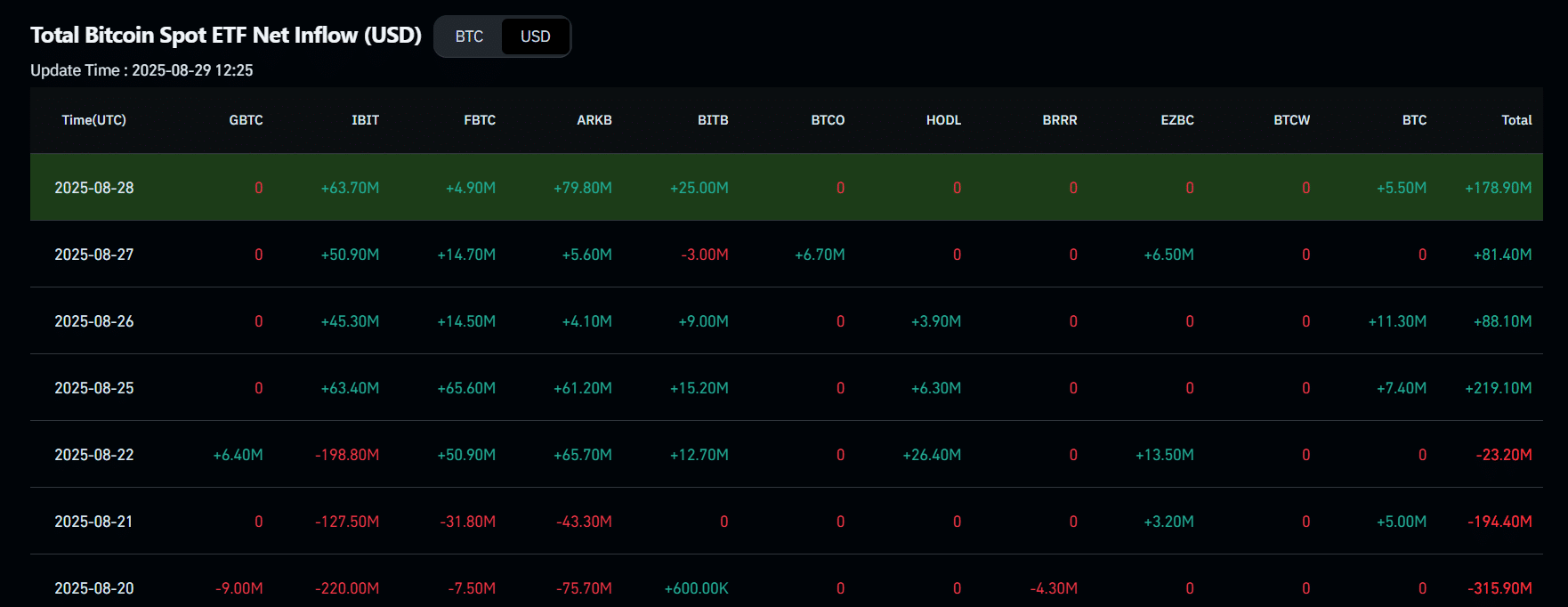

Despite that, spot BTC exchange-traded funds (EFTs) recorded positive net inflows for a fourth consecutive day with over $178 million on August 28, according to Coinglass data.

Altcoin Prices Drop As CRO Falls Back To Earth, HYPE, ETH, XRP Tumble

The crypto space has plunged over 3% in the last 24 hours to a $3.85 trillion market capitalization, according to Coingecko data.

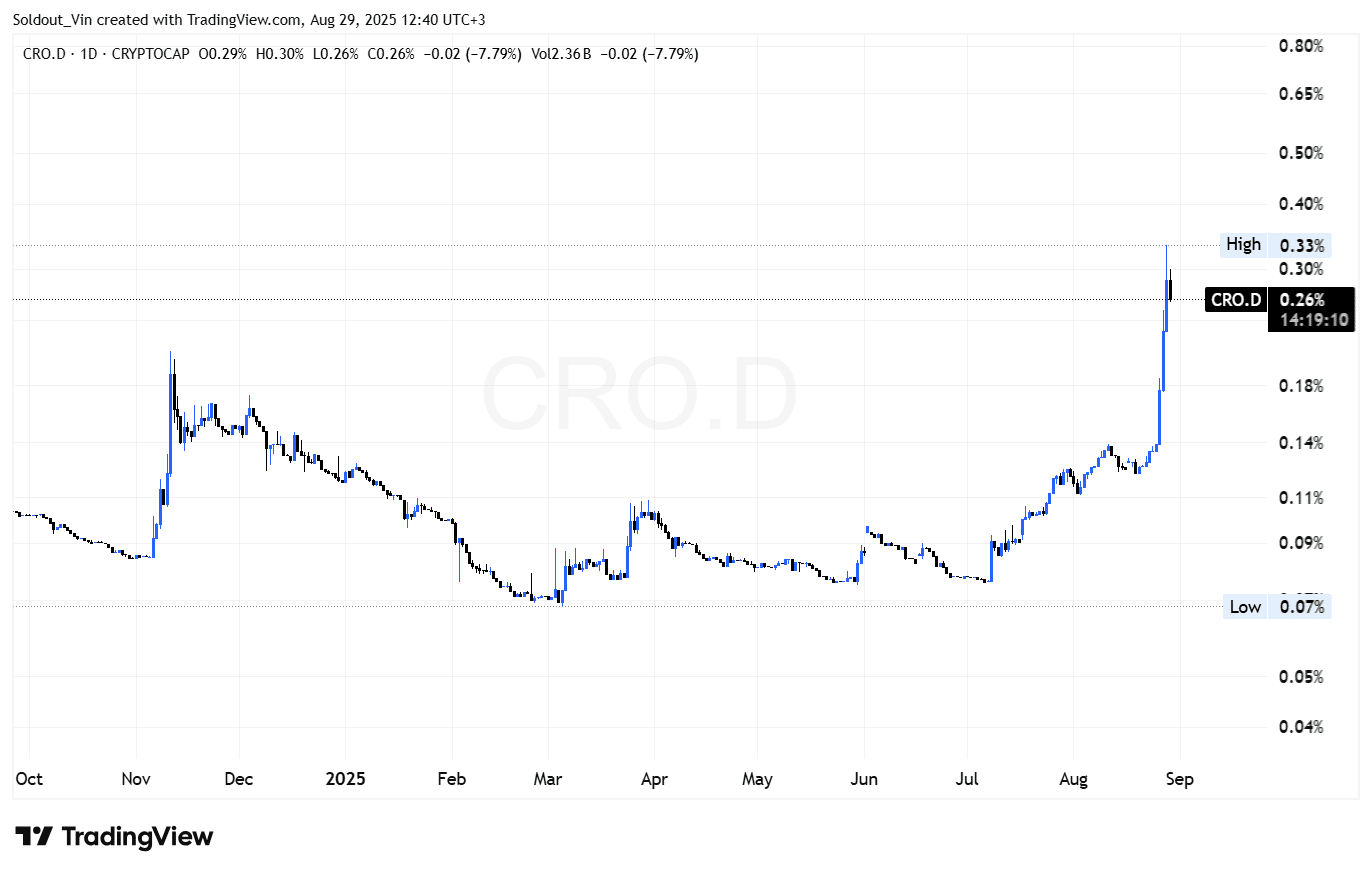

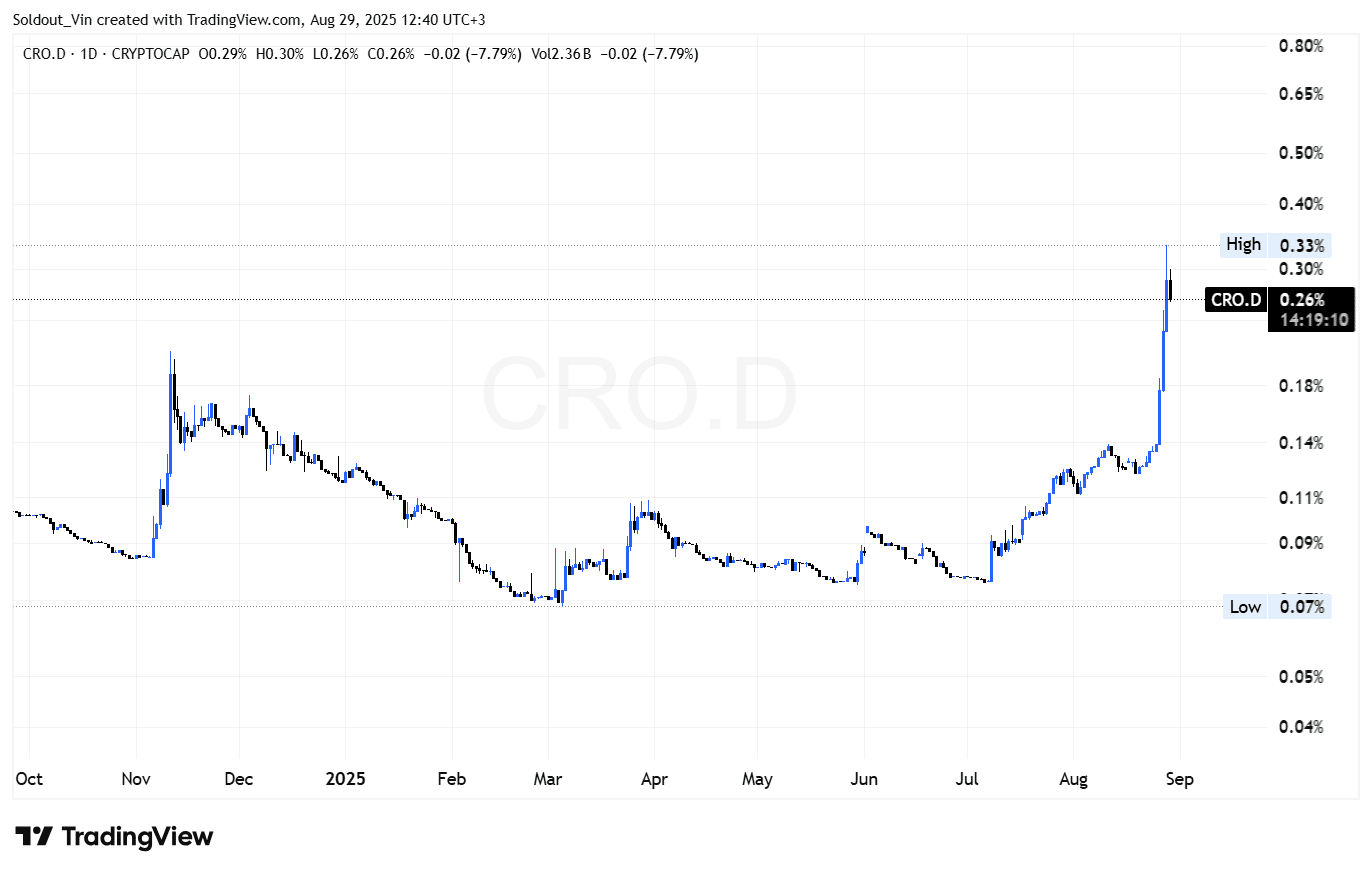

One notable casualty was CRO, which went on a tear after Trump Media and Crypto.com announced a plan for a huge CRO treasury firm earlier in the week.

Cronos is still up 101% in the last week despite the 14% drop in the previous day to trade at $0.299 as traders take profits.

CRO’s dominance on TradingView is still high at 0.26%, which suggests the current downtrend may be a phase before another rally.

After the HYPE price hit a new all-time high (ATH) at $50.99 on August 27, it underwent a 13.5% correction to currently trade at $44.21.

This comes as data from Lookonchain shows that a whale deposited 10M USDC into Hyperliquid to go long $XPL.

Don’t short $XPL on #Hyperliquid unless you can survive a liquidation.

Whale is attempting to manipulate $XPL to liquidate short positions.

In the past 3 hours, a whale (possibly the same whale from last time) created 4 wallets and deposited 10M $USDC into #Hyperliquid to go… pic.twitter.com/KHMkxqNRZu

— Lookonchain (@lookonchain) August 29, 2025

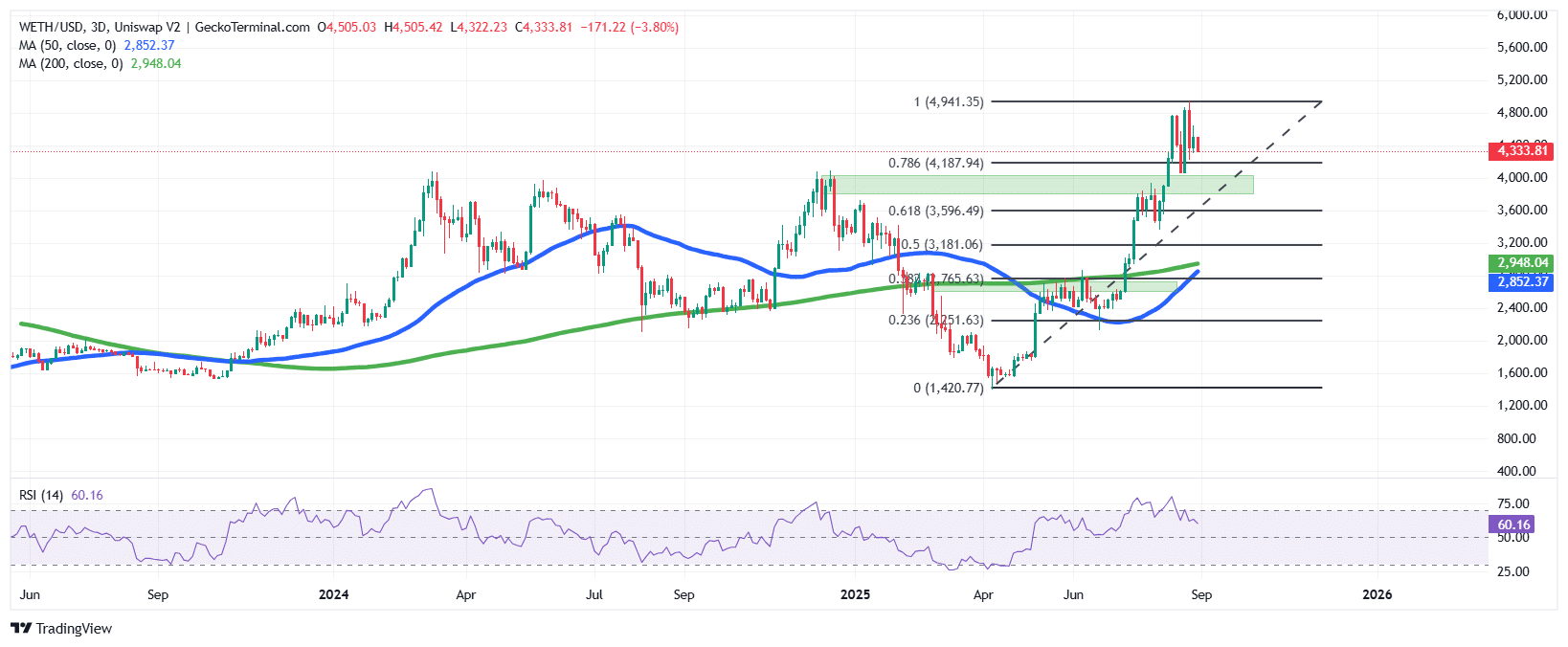

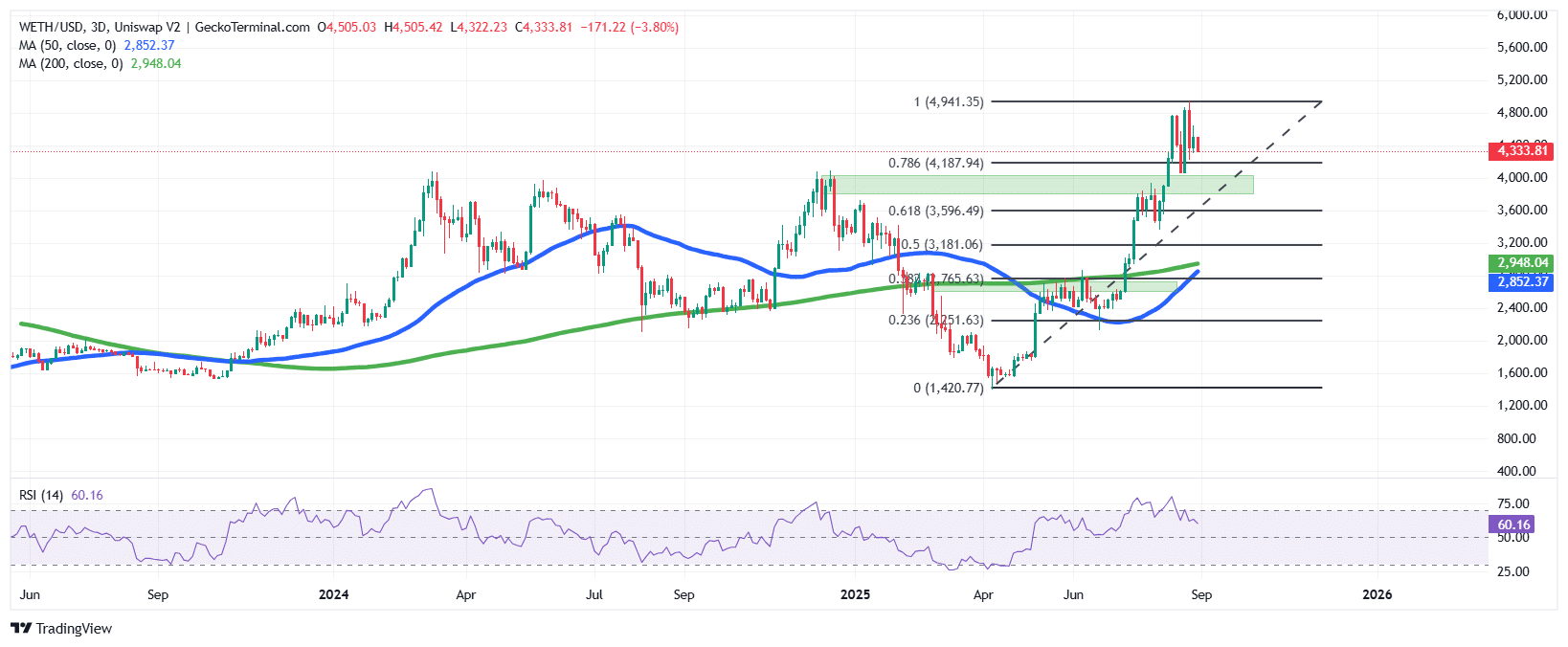

Meanwhile, the ETH price has rallied strongly, reclaiming key Fibonacci levels and now consolidating near $4,300 despite the previous 24-hour drop after testing resistance at $4,940.

The 50-day and 200-day SMAs show bullish alignment, while the RSI at 60 suggests healthy momentum.

If support at $4,180 holds, the price of Ethereum could retest $4,900; otherwise, $3,600 offers downside cushioning.

XRP shows a recent rejection near the 0.618 Fibonacci level at $2.99, slipping below its 50-day SMA to currently trade at $2.88. The RSI at 44 signals weak momentum, while the price of the Ripple token holds above the 200-day SMA at $2.47.

Unless it reclaims the $3 level, the XRP price risks further downside toward $2.58 before a potential recovery.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage