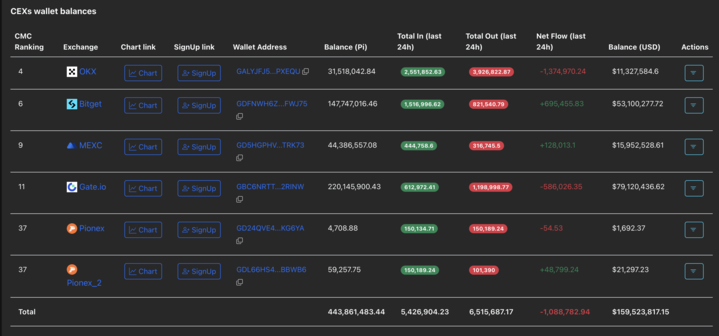

Pi Network (PI) consolidates above $0.3500 for the fifth consecutive day, as the recently launched AI-powered Know Your Customer (KYC) fails to uplift investors’ sentiment. Still, a decline in Centralized Exchanges (CEXs) wallet balances and the moves from whales suggest that large-wallet investors are buying the dip.

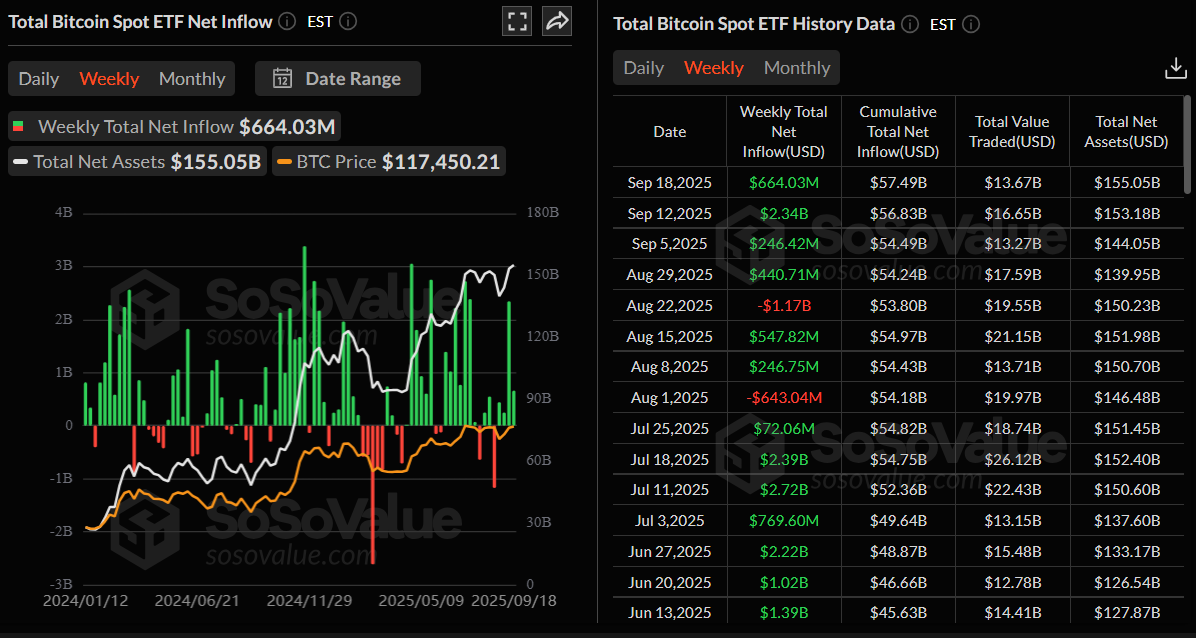

Bitcoin (BTC) shows strength, continuing its three consecutive weeks of recovery and holding steady above $116,000 at the time of writing on Friday. The recovery extends following the dovish Federal Reserve (Fed) stance, highlighted by a 25 basis points (bps) interest rate cut and expectations of further easing in 2025, which has fueled risk-on sentiment. Additionally, institutional and corporate demand adds further strength to BTC’s bullish outlook.

Polkadot (DOT) extends its gains, trading above $4.65 at the time of writing on Friday after successfully retesting a key breakout point earlier this week. A bullish outlook emerges, with scarcity reinforced by DOT’s fixed supply of 2.1 billion, which was announced on Sunday, along with rising open interest and trading volumes. On the technical side, a continuation of the rally is favored, targeting $6.52.