Hedge funds, pensions and banks continued to lavish capital into exchange-traded funds that invest directly in Bitcoin, as more traditional investors embrace the asset class that US regulators begrudgingly helped push into the mainstream at the beginning of the year.

Article content

(Bloomberg) — Hedge funds, pensions and banks continued to lavish capital into exchange-traded funds that invest directly in Bitcoin, as more traditional investors embrace the asset class that US regulators begrudgingly helped push into the mainstream at the beginning of the year.

Among the most well-known buyers that have emerged are hedge funds like Millennium Management, which held shares in at least five Bitcoin ETFs, according to a Bloomberg analysis of second-quarter filings with the US Securities and Exchange Commission. The firm, which has $68 billion in assets under management, trimmed its stakes in the ETFs significantly from the prior quarter but remained as the top holder for most of the funds, including BlackRock’s iShares Bitcoin Trust (ticker IBIT).

Advertisement 2

Article content

Capula Investment Management, Schonfeld Strategic Advisors and Steven Cohen’s Point72 Asset Management also reported stakes in the ETFs. Other buyers ranged from the State of Wisconsin Investment Board to market makers among firms crossing geographies from Hong Kong to the Cayman Islands, Canada and Switzerland.

There were 701 new funds reporting spot-Bitcoin ETF holdings following Wednesday’s deadline to file second-quarter 13F reports with the SEC, data compiled by Bloomberg show, bringing the total number of holders to almost 1,950. Millennium, Capula, Schonfeld, SWIB and Point72 declined to comment.

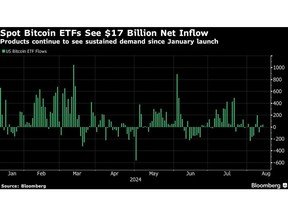

The spot-Bitcoin ETFs that debuted in January have smashed expectations in terms of flows and assets. In all, the cohort, including newer entrants, has attracted a net inflow of $17 billion this year, with BlackRock’s IBIT swelling into a $20 billion behemoth. The existence of such ETFs has given everyday investors an easier way to trade in and out of Bitcoin.

The increase in the number of holders is especially encouraging given the poor price performance — Bitcoin slid by nearly 13% in the quarter — and the fact that not many financial advisers are allowed to recommend the ETFs to their clients, according to Noelle Acheson, author of the Crypto Is Macro Now newsletter.

Article content

Advertisement 3

Article content

“This reflects a mix of conviction and investors taking time to ‘do the work,’” she said. “So far, Morgan Stanley is the only one of the large wirehouses whose financial advisers can recommend BTC spot ETF diversification positions. But others will follow, bringing not just more demand but also a longer-term view.”

In July, spot-Ether ETFs were also approved. The group has seen inflows of $1.9 billion, a figure that excludes $2.3 billion in outflows from the Grayscale Ethereum Trust (ETHE) which converted to an ETF last month, data compiled by Bloomberg show.

The 13F filings, reported every quarter by qualified institutional investment firms, only represent a snapshot in time and it’s impossible to know without confirmation why money managers were holding the ETFs. It’s likely that not all of them are Bitcoin bulls. Some may have opened positions as part of a trade meant to profit from the cryptocurrency’s volatility or offset a short position in derivatives. Others may have bought the ETFs as part of a basis trade, a popular strategy which exploits differences in prices between spot and futures markets, without the inconvenience of dealing with Bitcoin directly.

Advertisement 4

Article content

Among the buyers in the second quarter was hedge fund Hunting Hill Global Capital, which reported holdings of IBIT shares. The firm has been involved in the cryptocurrency space since 2016, according to Adam Guren, its founder and chief investment officer.

“One of our trading strategies involves providing liquidity within the ETF ecosystem,” he said. “Given the current political tailwinds, we anticipate the introduction of more products in the US, including options on Bitcoin ETFs, Solana ETFs, and potentially others. This expansion would create further opportunities for our trading strategies.”

—With assistance from Denise Cochran and Matt Mancuso.

Article content