GameStop moves entire Bitcoin stash, signaling potential sale: CryptoQuant

GameStop has transferred its entire Bitcoin holdings to Coinbase’s institutional trading platform, sparking speculation that the video game retailer may be reconsidering its Bitcoin treasury strategy.

“GameStop throws in the towel?” blockchain intelligence platform CryptoQuant asked in a post to X on Friday after noticing that GameStop moved its entire 4,710 Bitcoin stash worth more than $422 million to Coinbase Prime.

CryptoQuant said the transfer was “likely to sell” the holdings, noting that a sale with Bitcoin at $90,800 would mean GameStop realizing around $76 million in losses from its Bitcoin bet.

GameStop accumulated 4,710 Bitcoin across several investments in May at an average purchasing price of $107,900.

Ethereum prepares for quantum era with new security team and funding

The Ethereum Foundation has made post-quantum security a central focus of the network’s long-term roadmap, announcing the formation of a dedicated Post Quantum (PQ) team.

The new team will be led by Thomas Coratger, a cryptographic engineer at the Ethereum Foundation, with support from Emile, a cryptographer closely associated with leanVM, according to crypto researcher Justin Drake.

“After years of quiet R&D, EF management has officially declared PQ security a top strategic priority,” Drake said in a Saturday post on X. “It’s now 2026, timelines are accelerating. Time to go full PQ.”

The researcher described leanVM, a specialized, minimalist zero-knowledge proof virtual machine, as a core building block of Ethereum post-quantum strategy.

UBS weighing crypto trading for private banking clients: Report

The world’s biggest global wealth manager, UBS, is reportedly exploring a move to open crypto trading to its wealthiest clients.

Bloomberg reported Friday, citing a person familiar with the matter, that the Swiss banking giant aims to let select private banking clients in Switzerland trade Bitcoin and Ether first, with a possible rollout to the Asia‑Pacific region and the United States later.

The person also reportedly said that UBS was currently selecting partners for its crypto offering, although the bank has not publicly confirmed the details.

UBS already runs tokenization pilots such as the uMINT tokenized US dollar money market fund on Ethereum and a Swift-UBS-Chainlink tokenized fund settlement trial, experimenting with putting traditional fund products on blockchain rails even before considering offering spot crypto trading.

CertiK keeps IPO on the table as valuation hits $2B, CEO says

Blockchain security company CertiK is keeping the door open to a future initial public offering, according to co-founder and CEO Ronghui Gu.

Speaking in an interview with Acumen Media on Thursday at the World Economic Forum in Davos, Switzerland, Gu said CertiK’s valuation stands at about $2 billion and that pursuing a public listing would be a natural step for the company. However, the CEO said the company would need “investment, lots of strategic partnerships” to achieve this goal.

“We still do not have a very concrete IPO plan, but this is definitely the goal we are pursuing,” said Gu, adding that CertiK going public would represent a significant step for Web3 infrastructure companies:

“Many people want to see the success of CertiK, want to see the successful IPO of CertiK, because they view [it as] important not only for CertiK but also for the industry.”

SEC dismisses civil action against Gemini with prejudice

The US Securities and Exchange Commission’s civil lawsuit against Gemini Trust Company and Genesis Global Capital in the Earn-related unregistered securities case has been dismissed with prejudice.

Court filings show the parties submitted a joint stipulation to dismiss the action on Friday in the US District Court in the Southern District of New York, effectively ending the SEC’s claim over Gemini’s crypto lending program with Genesis.

A federal judge still needs to sign off on the joint stipulation to dismiss.

The dismissal comes about nine months after the SEC paused the civil action in April 2024 when then-acting chairman Mark Uyeda was leading the agency.

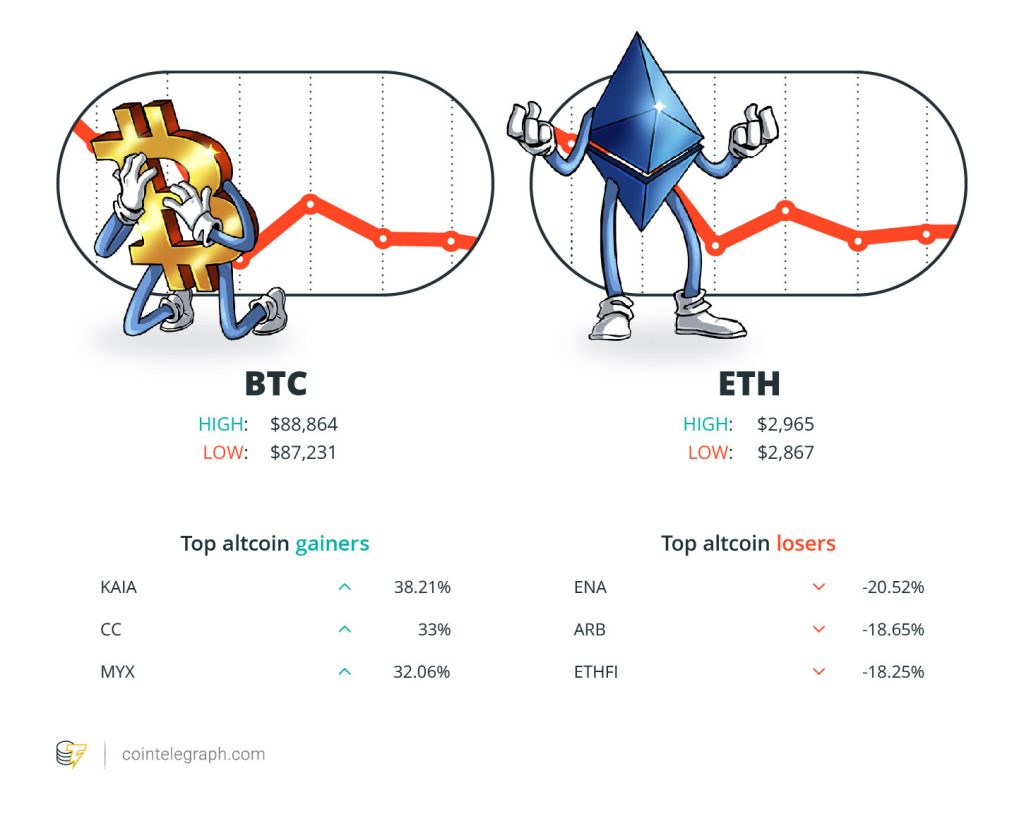

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $88,864 Ether (ETH) at $2,964 and XRP at $1.89. The total market cap is at $3.23 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Kaia (KAIA) at 38.21%, Canton (CC) at 33.% and MYX Finance (MYX) at 32.06%.

The top three altcoin losers of the week are Ethena (ENA) at 20.52%, Arbitrum (ARB) at 18.65%, and ether.fi (ETHFI) at 18.25%. For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“They need an economic system. They need a financial system. They need a payment system. There is no other alternative, in my view, other than stablecoins to do that right now.”

Jeremy Allaire, CEO of stablecoin issuer Circle

“Now, Congress is working very hard on crypto market structure legislation — Bitcoin, all of them — which I hope to sign very soon, unlocking new pathways for Americans to reach financial freedom.”

Donald Trump, US President

“What stands out is that 2024 and 2025 record the highest annual revived supply from long-term holders in Bitcoin’s history.”

Kripto Mevsimi, CryptoQuant contributor

“I’m talking with probably a dozen governments about tokenizing some of their assets, because this way the government can actually realize the financial gains first and use that to develop those industries.”

Changpeng “CZ” Zhao, former CEO of Binance

“650 million people don’t have access to a bank account in Africa. With a smartphone you have access to stablecoins, so you can save in a currency that is not exposed to fluctuations of inflation and making you poor.”

Vera Songwe, a former UN under-secretary-general

“While crypto networks are borderless, adoption is not.”

Top FUD of The Week

‘Bitcoin trade is over,’ Bloomberg strategist says in 2026 macro outlook

Bloomberg Intelligence strategist Mike McGlone said he has reversed his long-term outlook on Bitcoin and the broader crypto market, arguing that investors should “sell the rallies” across risk assets in 2026.

Read also

In McGlone’s view, the conditions that once made Bitcoin compelling have changed fundamentally. What began as a scarce, disruptive asset has become part of a crowded and highly speculative ecosystem, increasingly correlated with equities and vulnerable to the same macro forces that drive traditional markets.

He draws parallels with past market peaks, pointing to excessive speculation, the approval of exchange-traded funds and historically low volatility as warning signs. Bitcoin, he argues, has gone from being a hedge against the system to being firmly inside it, and that changes everything.

BitGo’s IPO pop turns volatile as shares slip below offer price

Shares of digital asset custodian BitGo Holdings have swung sharply since the company’s public debut on the New York Stock Exchange on Thursday, with early gains quickly reversing as initial IPO enthusiasm cooled and investors moved to lock in profits.

BitGo priced its initial public offering at $18 a share and it jumped about 25% in its first day of trading, reflecting strong early demand. While the stock closed only modestly higher in its first full session, the rally proved short-lived.

Shares have since fallen below their IPO price, declining as much as 13.4% on Friday, according to Yahoo Finance data.

French authorities investigate data breach of crypto tax platform

Authorities in France have started a preliminary investigation into a breach of cryptocurrency tax platform Waltio that could have compromised users’ personal data.

Read also

According to a Thursday notice by French cybersecurity authorities, the Paris Public Prosecutor’s Office and the country’s National Cyber Unit were investigating the nature of the stolen data and identities of Waltio users.

The notice warned that users affected by the breach could be targeted in an attempt to move their digital assets under the guise of legitimate security concerns.

According to a Friday report from Le Parisien, a group of hackers called ShinyHunters sent a ransom demand to Waltio following the attack. The hackers obtained personal data from about 50,000 Waltio users, the majority of whom were based in France.

Top Magazine Stories of The Week

A ‘tsunami’ of wealth is headed for crypto: Nansen’s Alex Svanevik

Nansen co-founder Alex Svanevik reveals why he thinks “crypto is fundamentally inevitable” and predicts trillions are set to enter.

The critical reason you should never ask ChatGPT for legal advice

ChatGPT can be a source of inexpensive legal advice, but the chat logs can also be used against you in court.

‘If you want to be great, make enemies’: Solana economist Max Resnick

Max Resnick can be controversial, but Ethereum did refocus on L1 scaling after his campaign, and he’s making Solana better by reducing MEV.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Editorial Staff

Cointelegraph Magazine writers and reporters contributed to this article.

Read also

Bakkt stock goes parabolic, GBTC outpaces BITO ETF and Tom Brady offers 1 BTC for 600th touchdown ball: Hodler’s Digest, Oct. 24-30

The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — one week on Cointelegraph in one link!

CZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

Binance and former CEO CZ face lawsuit by investors over unrecoverable assets; RFK Jr. suspends, but doesn’t end, campaign: Hodler’s Digest.