Bitcoin’s rally has stalled in recent months after the price rocketed into 2024 (though one Wall Street giant has quietly predicted it’s about to soar).

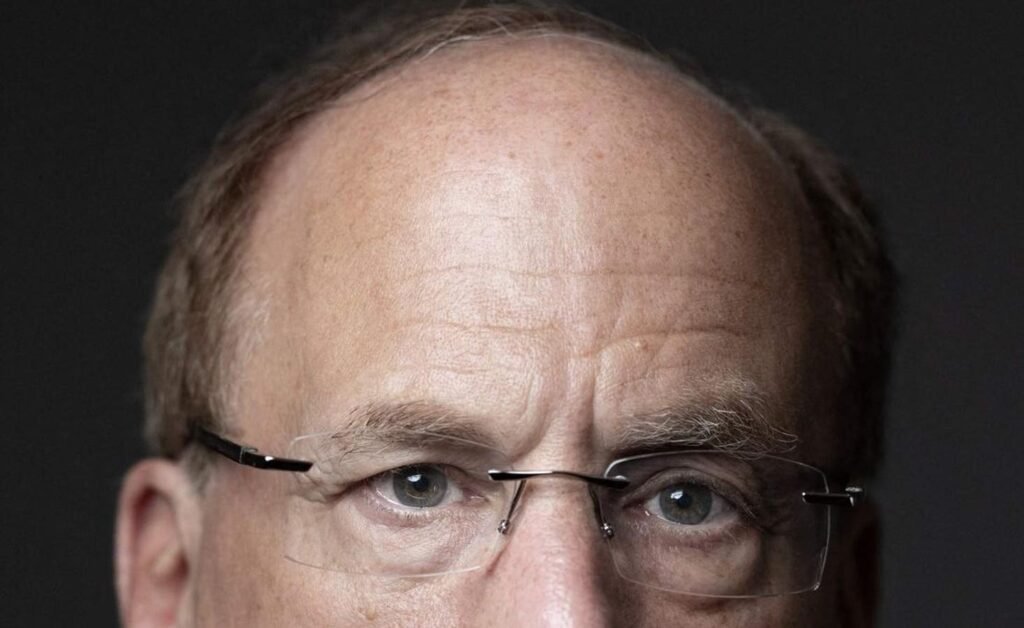

The bitcoin price has fallen back from a 2024 all-time high of over $70,000 per bitcoin, reached on a tidal wave of interest in BlackRock’s spot bitcoin exchange-traded fund (ETF)—with the $11 trillion asset manager chief executive Larry Fink issuing a “crazy” Federal Reserve warning last week.

Now, as MicroStrategy’s Michael Saylor reveals his $100 trillion “end game,” Fink has outlined his plan for bitcoin, ethereum and crypto—predicting “digitizing the dollar” is going to be “under discussion.”

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

BlackRock chief executive Larry Fink has predicted bitcoin will spark a digital revolution on Wall … [+]

“We believe bitcoin is asset class in itself, it is an alternative to other commodities like gold,” Fink, who last year led the charge on Wall Street to bring a fully-fledged spot bitcoin ETF to U.S. markets, said during BlackRock’s third quarter earnings call, predicting bitcoin, ethereum and crypto will “overlay” with artificial intelligence.

“And so I think the application of this form of investment will be expanded. Two, the role of ethereum as a blockchain can grow dramatically. So if we can create more acceptability, more transparency, more analytics related to these assets, then it will be expanded.”

Bitcoin and ethereum, via the new crypto ETFs that offer exposure to crypto without having to deal with exchanges or risk self-custody, have helped BlackRock’s assets under management to top $11 trillion for the first time over the third quarter. BlackRock’s IBIT has seen net inflows of $21.7 billion since January, far outpacing Fidelity’s second-largest spot bitcoin ETF with $10 billion of inflows, according to SoSoValue data.

“When major players like BlackRock and Fidelity launch bitcoin ETFs, and begin selling that idea to their institutional and individual investors, I think it’s very positive,” Anthony Scaramucci, the founder of hedge fund SkyBridge Capital, said in a interview with investment platform Saxo—putting his bitcoin price target at $170,000.

The arrival of a fleet of spot bitcoin ETFs on Wall Street this year was the first step in what Fink branded a digital “revolution” when he revealed his crypto ambitions for BlackRock last year—which includes a radical new, blockchain-based alternative to the U.S. dollar.

Sign up now for CryptoCodex—A free, daily newsletter for the crypto-curious

The bitcoin price has surged this year, helped by BlackRock, setting a new all-time high over … [+]

“I truly believe we will see a broadening of the market of these digital assets,” Fink said, pointing to BlackRock’s experience with the mortgage market that grew along with data and analytics—”And then we’ll see how does each and every country looks at their own digital currency. That’s a very different asset than a bitcoin in itself. But I do believe what we’re going to witness as we build out better analytics.”

Fink called attempts in India and Brazil to digitize their currencies as a “big success.”

“How do we see in [the U.S.] the role of digitizing the dollar? And what role does that play,” Fink asked. “That’s a very different question related to, let’s say, bitcoin and other items like that. But all of that is going to be under discussion.”

The debate around a digital dollar, also known as a central bank digital currency (CBDC), was electrified in 2019 when Facebook (now Meta) announced it was planning to launch a bitcoin-inspired digital currency before it was shut down by regulators.

The possibility of a digital dollar, often compared to the digital yuan that’s already widely used in China and used to monitor people’s every day transactions, has sparked privacy concerns as well as questions over how it would impact the commercial, deposit-based financial system.

Federal Reserve chair Jerome Powell has said the Fed won’t create a digital dollar without the express authorization from Congress.