With Bitcoin breaking through $66K, are we seeing the early stages of a long-term bull market or just another temporary spike?

Bitcoin is back in action

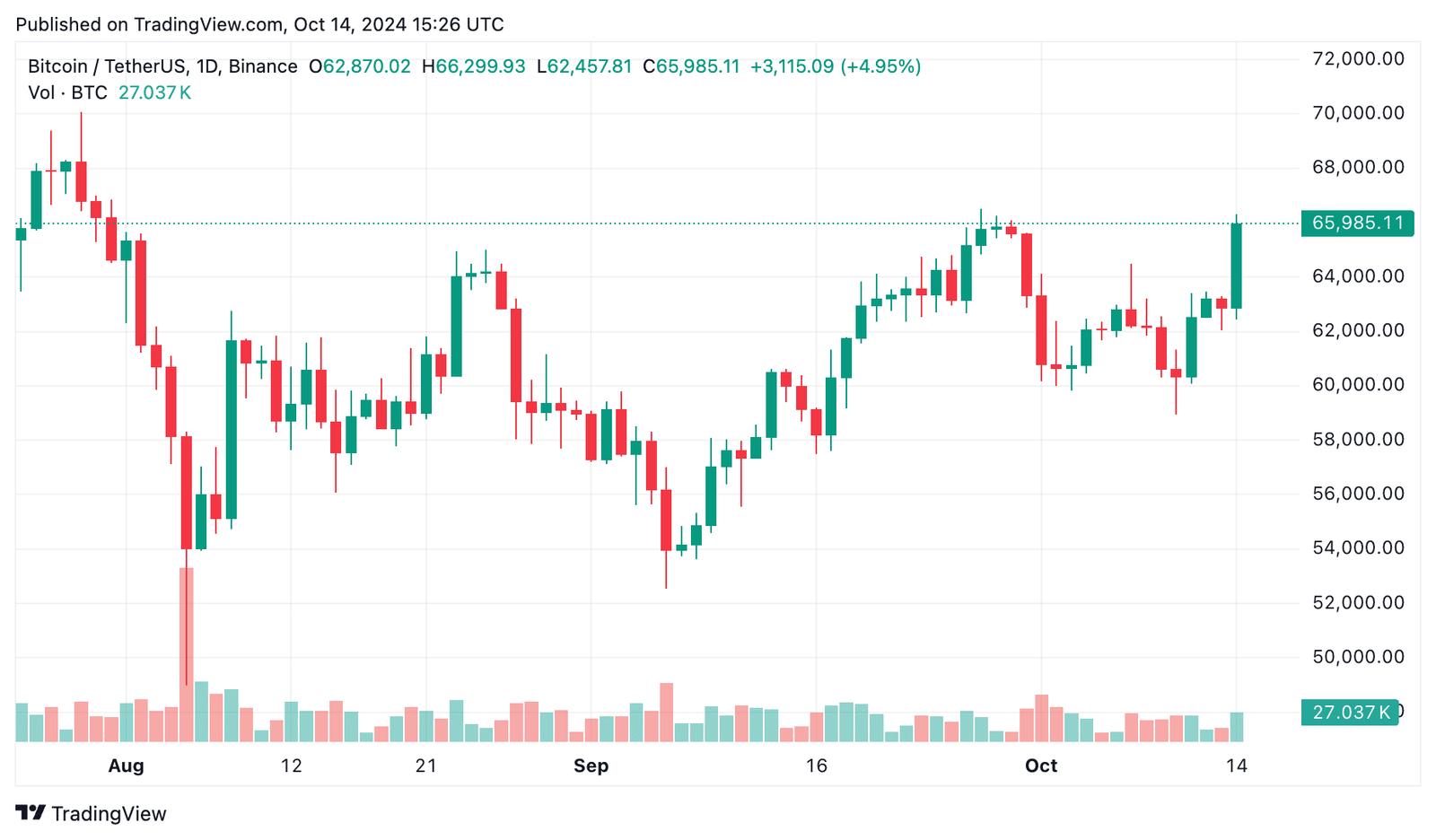

Bitcoin (BTC) is back in the spotlight, crossing the $64,000 resistance mark as the broader crypto market shows signs of recovery. As of Oct. 14, Bitcoin is trading around $66,000 levels, marking a solid 5.5% jump in the past 24 hours.

This surge follows weeks of volatility in the crypto space, largely driven by global economic concerns and rising geopolitical tensions, particularly in the Middle East.

A key driver behind this renewed momentum is global markets reacting to China’s latest economic updates. While it has been working to revive its economy, its much-anticipated stimulus announcement has left many wondering if it’s enough.

Economists suggest that China’s efforts to curb deflation are falling short, which has shifted attention to Bitcoin. According to Bloomberg, some speculators are moving away from Chinese stocks and into crypto, taking advantage of Bitcoin’s momentum.

Caroline Mauron, co-founder of Orbit Markets, highlighted that “capital rotation from Bitcoin into Chinese equities” was previously holding crypto down. Now, with this rotation easing, Bitcoin appears to be reaping the benefits.

Adding to the positive momentum, last week’s decision by the bankrupt Mt. Gox crypto exchange to delay its creditor repayment deadline by another year has relieved some market anxiety. The exchange owes nearly $2.7 billion worth of Bitcoin, and the delay has lessened fears of a large-scale sell-off.

And perhaps the most exciting factor? October — fondly dubbed “Uptober” by the crypto community — has historically been Bitcoin’s most profitable month. Since its inception, Bitcoin has posted an average gain of over 21% in October, although there were setbacks in 2014 and 2018.

So, where does this leave Bitcoin now? Let’s dive deeper into what’s next for BTC and what Bitcoin price predictions could mean for the coming days.

Factors fueling the market momentum

Bitcoin has been gaining steam lately, driven by several key factors.

One of the clearest signs of positive momentum is the inflows into spot Bitcoin exchange-traded funds. After a brief period of outflows, spot BTC ETFs saw a monumental shift on Oct. 11, recording their largest inflow in two weeks—surpassing $253 million.

This suggests that the recent selling pressure on Bitcoin might be easing, with investors regaining confidence. ETF inflows often indicate institutional interest, hinting at brighter days ahead for Bitcoin.

The US presidential race is also adding to Bitcoin’s rise. Prediction markets have flipped, now favoring pro-crypto Republican candidate Donald Trump over Democratic Vice President Kamala Harris.

As of Oct. 14, Trump’s odds of victory on Polymarket stand at 54%, while Harris’s have dropped to 45%, marking her lowest point since launching her campaign. A Trump win is seen as favorable for the crypto industry, potentially leading to more crypto-friendly policies.

Meanwhile, Bitcoin’s biggest corporate backer, MicroStrategy (MSTR), continues to outperform the market. Since adopting its Bitcoin-centric strategy in August 2020, MicroStrategy’s stock has surged 1,620%, vastly outpacing Bitcoin, the “Magnificent 7” tech giants, and the S&P 500.

Executive Chairman Michael Saylor remains bullish, recently tweeting, ‘the only thing better than bitcoin is more bitcoin.’

However, Bitcoin mining has seen mixed results lately. While BTC prices have risen by 5% this month, the network’s hashrate also climbed by 11%, slightly impacting miners’ profitability.

Analysts at Jefferies noted that miner revenue per exahash fell by 2.6% in September, and October could be more challenging unless prices surge.

Bitcoin’s momentum is further fueled by recent moves by the Federal Reserve. On Sep. 18, the Fed cut its interest rate by 50 basis points, bringing the short-term benchmark rate to 4.75%-5.00%.

The market is also pricing in additional cuts, with an 86% chance of a 25 basis point cut in November and December. Lower rates generally benefit risk assets like Bitcoin, as cheaper borrowing costs drive investors toward higher-yielding alternatives.

What to expect next?

Looking at both macro and crypto-specific data, a few key observations are emerging about the potential direction of the market. Let’s take a look at some critical insights.

Whale accumulation and minimal resistance

According to IntoTheBlock’s “In/Out of the Money Around Price” data, Bitcoin faces minimal resistance in the $55,000 to $64,000 range.

Over 4.3 million BTC in volume is “in the money” here, meaning many holders are sitting in profitable positions, reinforcing the importance of this range.

A key takeaway from this data is that whales — large Bitcoin holders — are steadily increasing their positions below the $60,000 mark.

Slim Daddy, a crypto market observer, notes, “Whales have significantly increased their accumulation in the sub-$60K range.” This pattern suggests that major investors believe Bitcoin is undervalued and poised for a breakout.

Historically, whale accumulation often signals upcoming bullish rallies, as their buying power creates upward pressure on the price. From a technical standpoint, this strengthens the case for a breakout, especially as Bitcoin holds above $62,000.

Key resistance at $64,000

Crypto analyst Michaël van de Poppe views Bitcoin’s recent test of $62,000 as a precursor to an even larger move. He predicts that a “massive build-up” is underway and that “a test of $64,000 will likely bring the big breakout the market is looking for.”

The $64,000 level is critical for both psychological and technical reasons. Psychologically, it represents a key area where many traders set stop-losses or take-profits. Technically, this is a resistance zone where strong selling pressure could emerge.

If Bitcoin breaks through $64,000 decisively, it may pave the way for a sustained rally toward previous all-time highs. However, failure to breach this level could result in a pullback.

While whale accumulation under $60,000 offers some support, a failure at $64,000 could lead to temporary consolidation or a short-term dip.

Bitcoin price predictions: 2024 and beyond

With Bitcoin currently regaining momentum, the big question on everyone’s mind is: Where could Bitcoin go next?

Analysts and market experts have offered several predictions, each based on different data models. Let’s explore what they’re saying about Bitcoin’s future, starting with 2024.

Bitcoin price prediction for 2024

One of the more conservative predictions comes from Coincodex, which forecasts Bitcoin reaching a new all-time high of $89,885 by November 2024—a 38% upside from current levels, surpassing the previous high of $73,750 in March 2024.

Another model from DigitalCoinPrice offers a broader range, estimating Bitcoin’s price to fall between $59,195 and $144,380. On average, they predict Bitcoin will hover around $137,331 in 2024.

Bitcoin price prediction for 2025

According to Coincodex, Bitcoin is expected to trade between $65,494 and $102,794 in 2025. DigitalCoinPrice offers a more bullish outlook, forecasting a range of $141,620 to $169,264.

Titan of Crypto also predicts Bitcoin could push toward $105,000 in 2025, based on Fibonacci circle analysis. He suggests this is a conservative estimate, hinting at the potential for even higher gains depending on market conditions.

Bitcoin price prediction for 2030

Bitcoin price predictions for 2030 become more dramatic. By then, Coincodex predicts Bitcoin could trade between $118,333 and $305,028. DigitalCoinPrice, on the higher end, sees Bitcoin reaching nearly $493,000 — a massive increase from current levels.

If Bitcoin continues gaining institutional adoption and favor as a mainstream financial asset, reaching these high figures by 2030 is not out of the question. However, caution is necessary.

The road ahead

While these predictions paint an exciting picture of Bitcoin’s future, it’s important to approach them with caution. Bitcoin’s volatility means large swings in either direction are always possible. Market psychology, global financial conditions, and unexpected events can quickly alter these forecasts.

For investors, staying informed and keeping a long-term perspective is key. Always consider your risk tolerance and the broader market before making investment decisions. Never invest more than you can afford to lose.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.