Twenty One Capital CEO has projected that Bitcoin could increase by 200-fold in the coming years. The forecast came as BTC surged past $117,000 in the wake of the first Fed rate cut of the year.

Twenty One Capital CEO Bets Big on Bitcoin’s Future

In a NYSE TV interview, Twenty One Capital CEO Jack Mallers outlined his long-term outlook for Bitcoin. He argued that cryptocurrency is targeting a vast store-of-value market currently dominated by equities, real estate, precious metals, and fine art.

Jack Mallers says, “#Bitcoin will 200x from here.”

“Bitcoin is going after a $400-500 trillion market, and it’s only $2 trillion.” pic.twitter.com/urpR8HelFO

— Maestro (@GoMaestroOrg) September 16, 2025

“Today Bitcoin’s market value stands at around $2.5 trillion,” Mallers noted. He added that the asset has the potential to expand by 100 to 200 times if it captures even a fraction of that wealth. Additionally, he presented the token as a safeguard against monetary devaluation by framing it as the logical replacement for traditional stores of value.

Mallers’ Twenty One Capital, founded in April 2025, is structured as a BTC-only investment firm that functions as a treasury fund. This is backed by heavyweight companies like Tether, Bitfinex, and SoftBank.

As BTC continues to rise, Twenty One Capital is preparing to go public through a SPAC merger with Cantor Fitzgerald’s Cantor Equity Partners. Pending SEC approval, the firm will trade on Nasdaq under the ticker XXI. This was titled in reference to the token’s capped supply of 21 million coins.

The firm has positioned itself as a regulated gateway for institutional investors seeking exposure to the token without directly holding private keys. Each share of the company will represent a proportional stake in its reserves.

Ahead of its listing, the firm has been expanding its treasury. Twenty One Capital holdings have already reached 43,500 BTC, surpassing the holdings of early adopters like Tesla.

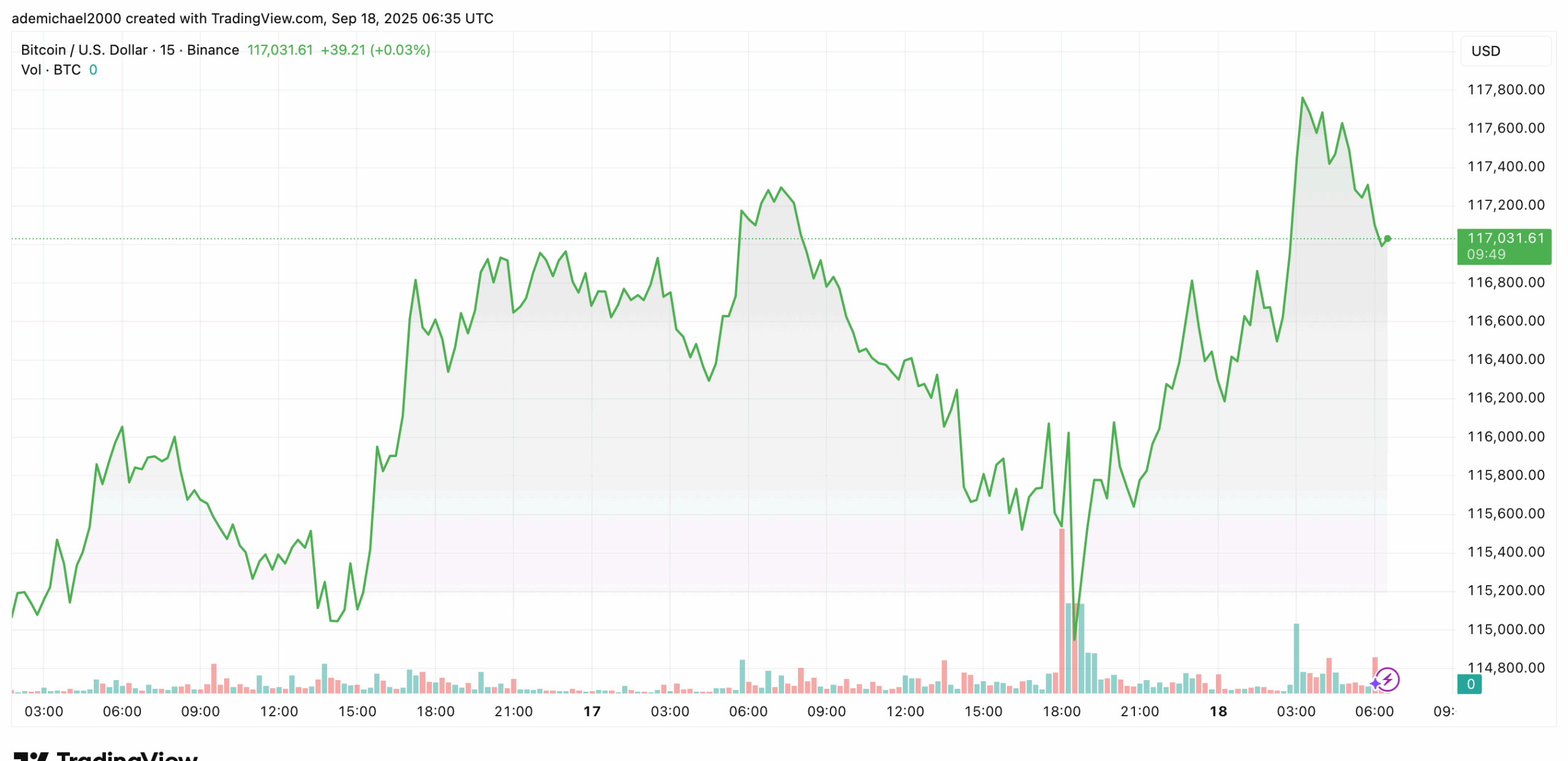

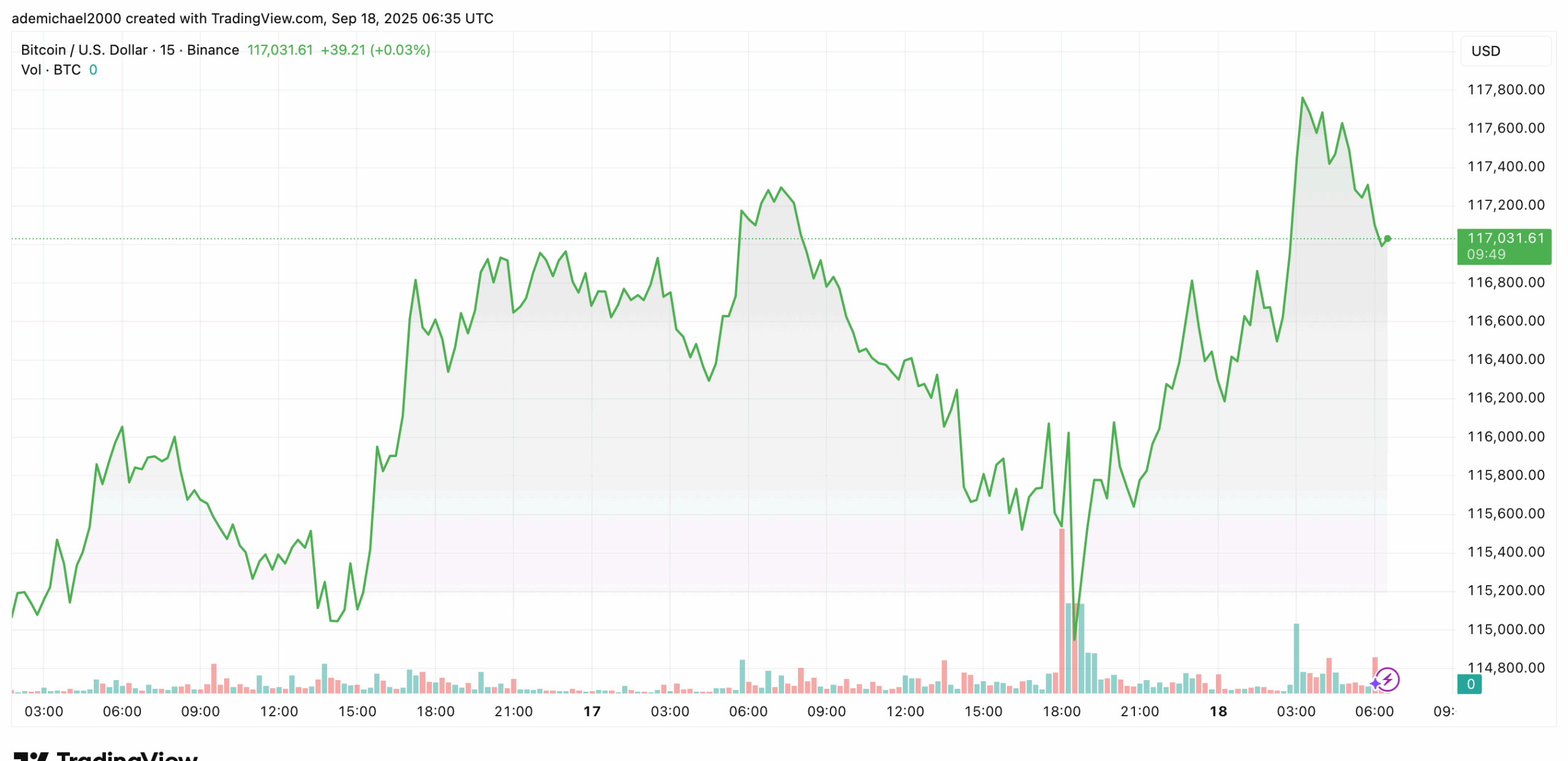

Fed Rate Cut Pushes BTC Beyond $117K

Bitcoin’s rally gained further fuel from macroeconomic policy shifts. On Thursday, the Fed made the first rate cut in 2025, reducing it by a 25 basis point. This lowers its benchmark range to 4–4.25%.

The token briefly dipped to $115,000 following Fed Chair Jerome Powell’s comments that further cuts are not guaranteed, depending on inflation and labor market data.

However, the cryptocurrency quickly rebounded, trading at $117,400 by late evening. The broader crypto market also saw gains, with Ethereum climbing 2% to $4,633 and XRP advancing nearly 3% to $3.11.

Analysts noted that the Fed’s cautious stance reflects its balancing act to support growth while trying to avoid reigniting inflation. Lower interest rates would generally enhance the token’s appeal as an alternative asset. This especially applies to institutional investors seeking non-sovereign stores of value.