Bitcoin treasury companies have been hit hard by Bitcoin’s disappointing price action throughout 2025. Publicly traded firms holding significant BTC reserves are suffering the most, with leaders like (Micro)Strategy pushing aggressive accumulation amid headwinds—yet most now trade below net asset value, creating a rare opportunity for risk-tolerant strategic investors.

The Bitcoin Treasury Companies Landscape

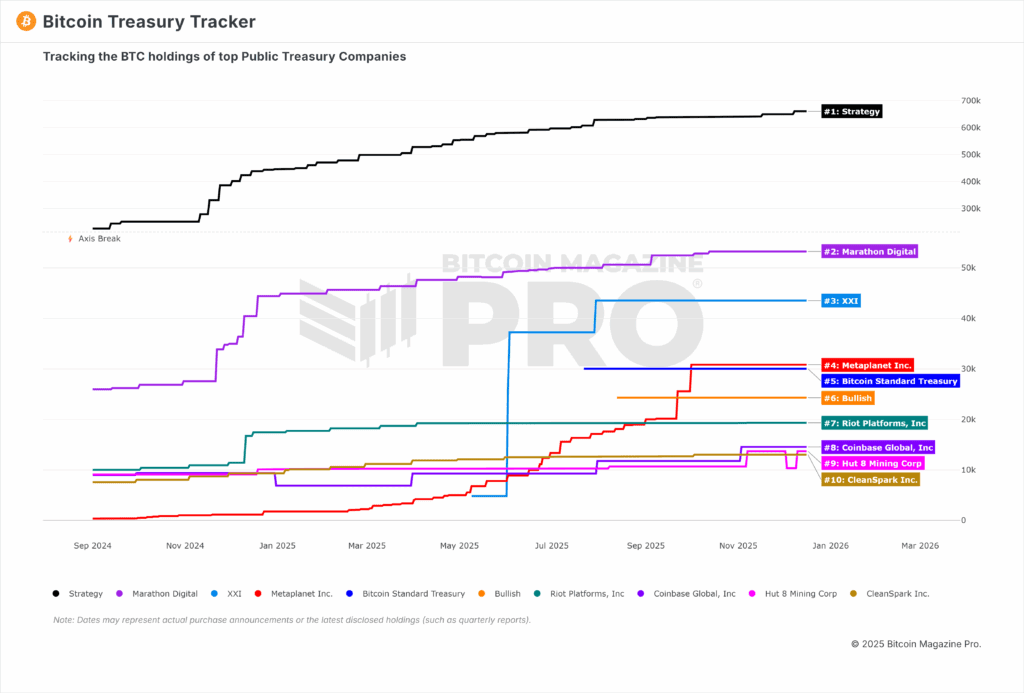

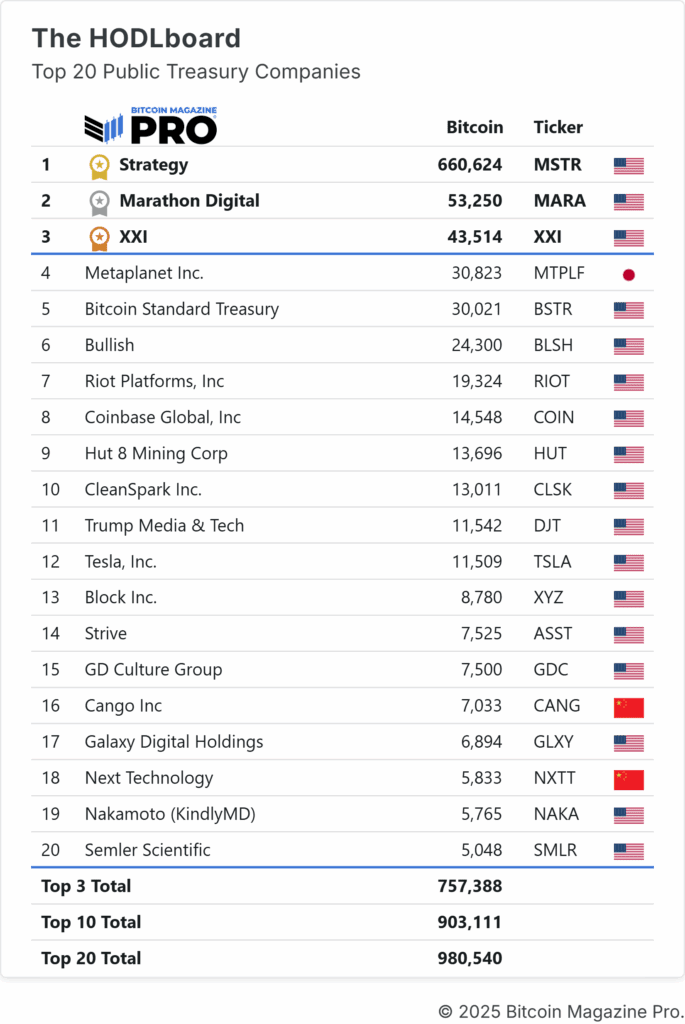

Not all Bitcoin treasury companies are created equally. Strategy stands apart as the industry standard-bearer, the “Bitcoin among treasury companies,” as it were. The company has maintained its accumulation discipline even as its stock has suffered, recently announcing a $1.44 billion USD reserve specifically designed to pay dividends and debt obligations without forcing Bitcoin sales.

This capital buffer theoretically eliminates the need for excessive dilutive share issuance or forced BTC liquidation, a critical distinction from weaker competitors. Many will likely face shareholder pressure and potential forced selling as their stock prices decline, creating a cascade of supply pressure that could paradoxically benefit the strongest players like MSTR.

Valuation Dynamics of Bitcoin Treasury Companies

The most compelling aspect of current treasury company valuations is that they now trade below net asset value on a per-share basis. In practical terms, you can currently purchase one dollar’s worth of Bitcoin for less than one dollar through treasury company stock. This represents an arbitrage opportunity for investors, though one accompanied by elevated volatility and company-specific risks.

Strategy currently sits at a net asset value premium of less than 1, meaning the company’s market capitalization is below the value of its Bitcoin holdings alone. The upside scenario is striking. If Bitcoin reclaims its previous all-time high around $126,000, Strategy continues accumulating toward 700,000 BTC, and the market assigns even a modest 1.5x to 1.75x net asset value premium, Strategy could approach the $500 region per share.

From Weak to Strong: The Future of Bitcoin Treasury Companies

Examining Strategy’s performance during the previous Bitcoin bear market and overlaying it onto the current cycle reveals eerie alignment. The bar patterns suggest current price levels represent reasonable support, with only a catastrophic final flush justified by Bitcoin weakness providing reason to expect substantially lower levels.

As weaker treasury companies face forced selling, a consolidation thesis emerges, that Strategy and similar strong-positioned players will potentially accumulate cheap Bitcoin from distressed sellers, further concentrating holdings in the most disciplined accumulators. This dynamic mirrors Bitcoin’s own consolidation process, weaker hands sell, stronger hands accumulate, and the asset becomes more concentrated among conviction holders.

Conclusion: Opportunity in Bitcoin Treasury Companies

Bitcoin treasury companies have for the most part delivered disappointing returns in 2025, but this performance has created a window of exceptional opportunity for disciplined investors. At current valuations, Strategy is essentially selling one dollar of Bitcoin for approximately 90 cents, a discount that becomes even more attractive if Bitcoin experiences one final capitulation flush. The probability of this scenario combined with Strategy’s positioned upside creates asymmetric risk-reward worthy of small, carefully-sized positions within aggressive portfolios.

For deeper data, charts, and professional insights into bitcoin price trends, visit BitcoinMagazinePro.com. Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.