Key Notes

- Bitcoin fails to hold $113K, flashing a bearish divergence similar to 2021.

- Long-term holders are distributing while short-term traders fuel BTC demand.

- Whales remain cautious, leaving ETH as the preferred rotation play.

Bitcoin

BTC

$110 033

24h volatility:

2.7%

Market cap:

$2.19 T

Vol. 24h:

$37.39 B

has once again failed to hold above the critical $113,000 mark, slipping back to $111,139 at press time, a 1.6% decline over the past 24 hours.

The move has led to speculations of the leading digital asset reaching its cycle top, with signs of capital rotation into Ethereum

ETH

$4 363

24h volatility:

5.3%

Market cap:

$527.03 B

Vol. 24h:

$29.35 B

becoming increasingly evident.

Divergence Signals Echo the 2021 Cycle Top

Ali Martinez highlighted a worrying technical signal on Bitcoin’s weekly chart, i.e., a bearish divergence between price and Relative Strength Index (RSI).

While Bitcoin continues to print higher highs, RSI has trended lower, a classic sign that momentum is weakening even as price climbs.

Bitcoin $BTC is making higher highs while RSI makes lower lows. This is the same divergence seen before the 2021 cycle top! pic.twitter.com/tR0IT25AVf

— Ali (@ali_charts) August 29, 2025

Martinez noted that this setup mirrors the divergence seen just before the 2021 market top, where Bitcoin peaked around $69,000 before entering a prolonged bear cycle, also known as the crypto winter.

Short-Term Optimism, Long-Term Caution

Swissblock’s Altcoin Vector shared a breakdown of Bitcoin’s net position change across different market participants:

- Long-Term Holders (LTHs) are distributing.

- Short-Term Holders (STHs) are accumulating aggressively.

- Whales remain indecisive, not committing significant inflows to Bitcoin just yet.

- Exchanges show mild outflows, though not enough to signal large-scale distribution.

It’s no secret that profit-taking is happening in $BTC, with much of that capital rotating into $ETH.https://t.co/UeAvwWOydf

— Bitcoin Vector (@bitcoinvector) August 28, 2025

Altcoin Vector added that, “Until whales commit decisively, BTC upside stays capped and ETH-led rotation dominates.”

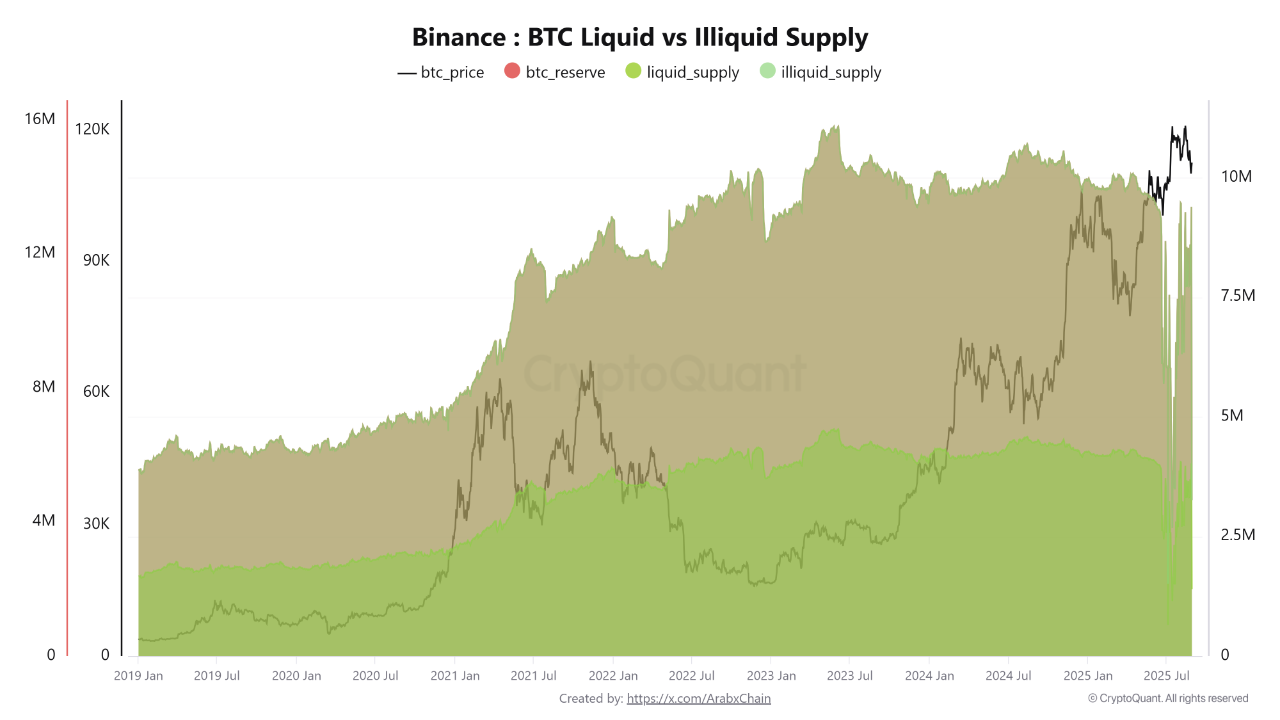

Liquidity Scarcity: A Fragile Bull Run

Data from CryptoQuant shows that Bitcoin’s illiquid supply has surged to historically high levels, while liquid supply has dropped sharply. This basically means that more Bitcoin is locked away in wallets not actively selling, reducing available market supply and supporting higher prices.

The scarcity dynamic partly explains why Bitcoin managed to break above $120,000 earlier this year, explained the CryptoQuant post, adding that the same scarcity also creates market fragility.

If whales or institutions were to suddenly sell, the limited liquidity could amplify the correction.

CryptoQuant analysts argue that Bitcoin is in a “fragile bull run,” structurally supported by long-term holders but vulnerable to sharp pullbacks and forecasted two paths forward.

Firstly, if illiquid supply continues rising, Bitcoin could push toward $150,000 in 2025. This places BTC as one of the best crypto to buy in 2025. However, if liquid supply returns due to large-scale sell-offs, BTC could correct sharply toward the $90,000–$100,000 range.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.