Fundamental

Overview

Bitcoin has been rallying

steadily in the last few weeks as Trump winning odds continued to soar in

betting markets. The price eventually consolidated around a key trendline as

the market might want to wait for the election result now before breaking out.

A Trump victory is seen as

bullish for Bitcoin given his embracement of the crypto industry and promised de-regulation.

Harris, on the other hand, did embraced the industry as well, but it’s been

more of a political move to attract voters rather than a strong support.

Bitcoin

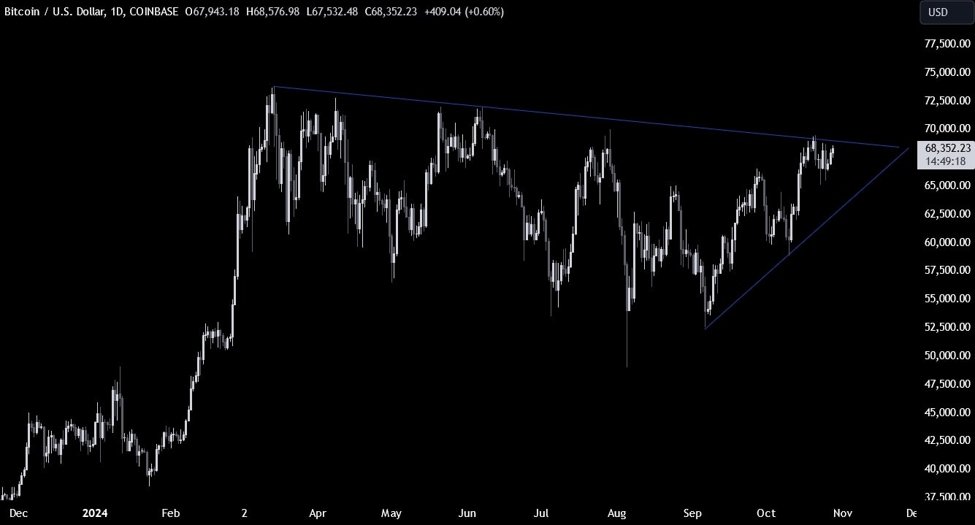

Technical Analysis – Daily Timeframe

Bitcoin Daily

On the daily chart, we can

see that Bitcoin is trading near a key long term downward trendline

that’s been defining the consolidation that started in March. The buyers will

want to see the price breaking higher to increase the bullish bets into a new

all-time high, while the sellers will likely lean on it to position for a

pullback into the upward minor trendline.

Bitcoin Technical

Analysis – 4 hour Timeframe

Bitcoin 4 hour

On the 4 hour chart, we can

see that the price is consolidating around the highs as the market is probably waiting

for the US election result. From a risk management perspective, the buyers will

have a better risk to reward setup around the minor upward trendline where they

will also find the Fibonacci

retracement levels for confluence.

The sellers, on the other hand, will want to see the price breaking below the trendline

to increase the bearish bets into new lows.

Bitcoin Technical

Analysis – 1 hour Timeframe

Bitcoin 1 hour

On the 1 hour chart, we can

see that we have another minor upward trendline defining the bullish momentum

on this timeframe. The buyers will likely keep on leaning on it to position for

further upside, while the sellers will look for a break lower to increase the

bearish bets into the major upward trendline around the 64K level. The red

lines define the average daily range for today.

Upcoming

Catalysts

Tomorrow we have the US Job Openings and the US Consumer Confidence report. On

Wednesday, we get the US ADP and the US GDP. On Thursday, we have the US PCE,

the US Jobless Claims and the US Employment Cost Index data. Finally, on

Friday, we conclude the week with the US NFP and the US ISM Manufacturing PMI.