On-chain data shows that Bitcoin long-term holders have potentially been selling recently, something that may explain BTC’s continued bearish momentum.

Bitcoin Exchange Inflow CDD Has Registered Huge Spikes Recently

As an analyst in a CryptoQuant Quicktake post explained, old cryptocurrency tokens have recently been deposited in large quantities in centralized exchanges.

The on-chain metric of interest here is the “Exchange Inflow Coin Days Destroyed (CDD).” A “coin day” refers to a quantity that 1 BTC accumulates after staying dormant on the blockchain for 1 day.

When a coin that had been sitting still inside a wallet is finally moved, its coin days counter naturally resets back to zero, and the coin days it had been carrying before the move are said to be “destroyed.”

The CDD keeps track of the total amount of coin days being reset in this manner across the network. In the context of the current topic, though, the general CDD isn’t the one of focus, but rather the Exchange Inflow CDD, which only keeps track of the coin days being destroyed through transactions into wallets connected to exchanges.

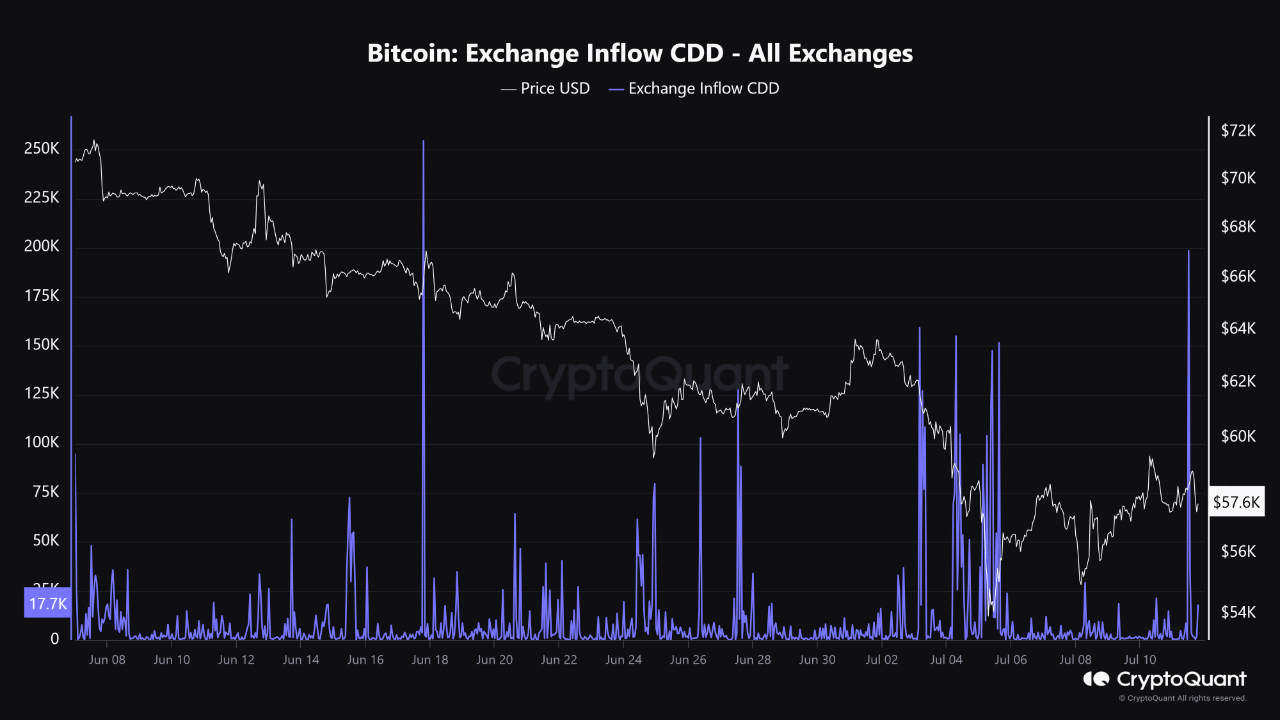

Now, here is a chart that shows the trend in the Bitcoin Exchange Inflow CDD over the past month or so:

As is visible in the above graph, the Bitcoin Exchange Inflow CDD has registered some spikes of considerable scale this month. This would imply that many dormant coins have recently seen deposits into exchanges.

Generally, spikes in the CDD correlate to movement from the long-term holders (LTHs), as these HODLers tend to accumulate large amounts of coin days. Therefore, the recent spikes in the Exchange Inflow CDD suggest that these diamond hands have been transferred to exchanges.

Holders make transactions into exchanges when they want to use one of the services these platforms provide, which can include selling. The chart shows that the spikes earlier in the month had come when Bitcoin had plunged towards its lows, implying that the selling pressure from this cohort may have played a role in the crash.

The latest spike, larger in scale than the others, has come while BTC has been trying to start a recovery rally from these recent lows. So far, BTC has had no luck, suggesting that the selling from the LTHs has potentially been holding the coin back.

It remains to be seen how the Exchange Inflow CDD behaves in the coming days and if any potential further spikes would impede Bitcoin in its path to recovery.

BTC Price

At the time of writing, Bitcoin is trading at around $57,900, up more than 4% over the past week.

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com