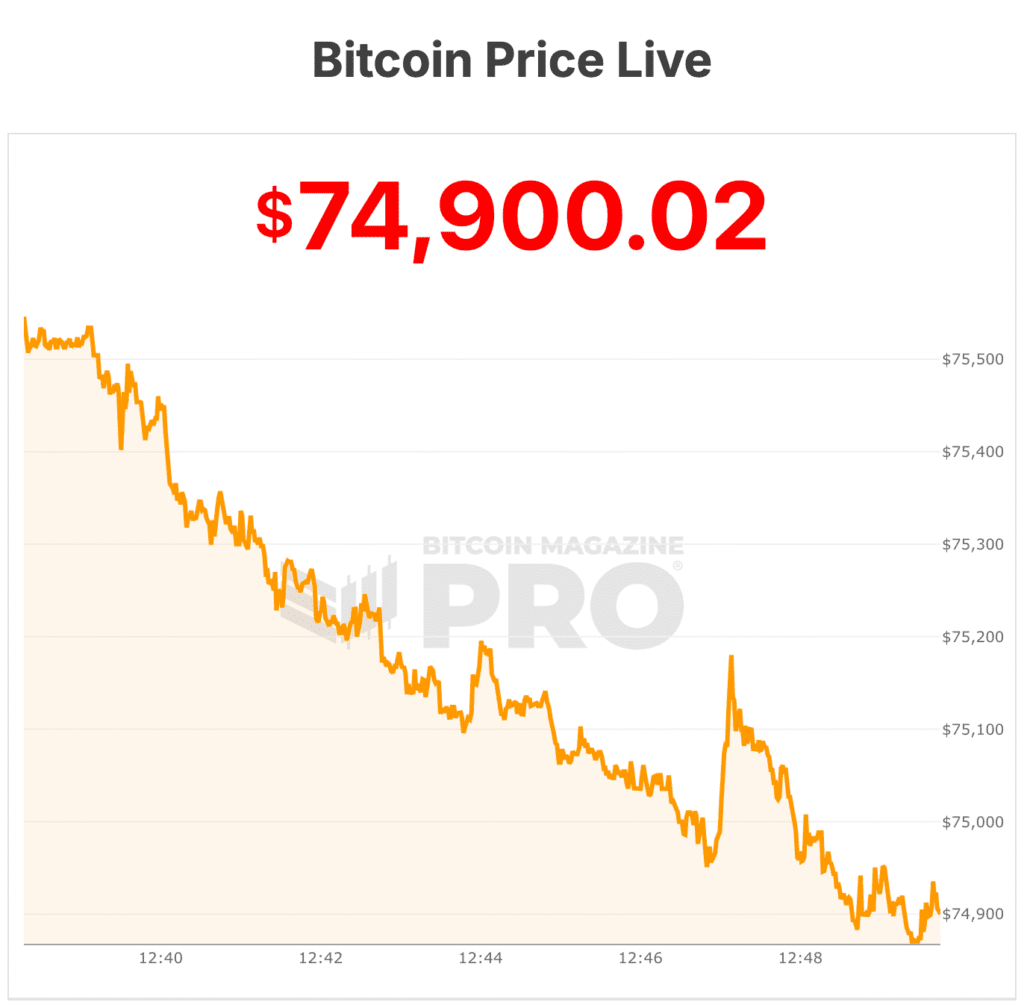

Bitcoin’s price dropped below $75,000 today, its lowest level in nearly a year, as global crypto markets endured a sustained wave of selling triggered by broader financial stresses and shifting investor appetite.

The bitcoin price has now retraced more than 40% from its all‑time highs reached in late 2025. According to Bitcoin Magazine Pro data, the one-year low for the bitcoin price is $74,747. Bitcoin is dancing near that number.

Recent trading data showed Bitcoin price slipping through key technical support levels, driving forced liquidations across derivatives markets and intensifying downside price pressure. Over roughly the past 24 hours, around $2.56 billion in Bitcoin positions were liquidated, according to market data.

This follows weeks of risk‑off sentiment across global asset classes.

The downturn in cryptocurrencies has coincided with stress in other markets like precious metals, tech sell-offs, and losses in equities.

Institutional players report losses as policy signals remain dubious

The market slide has had tangible impacts on key industry participants. Galaxy Digital, a major crypto investment firm led by Michael Novogratz, reported a $482 million loss for the fourth quarter of 2025, earlier today.

The firm attributed this to the decline in digital asset prices and a sharp drop in trading volumes, which fell more than 40% from the prior quarter. Galaxy’s stock traded lower following the earnings release, reflecting investor concern about the broader bitcoin price and crypto downturn.

Also, Bitcoin price currently trades below $76,000, which is roughly the average price at which Strategy acquired a portion of its BTC holdings and well below the cost of many of its accumulated coins.

Since Strategy owns hundreds of thousands of bitcoins at higher average purchase prices, the current market value is less than what was paid for much of its inventory, leaving a significant portion of its holdings “underwater.”

Market participants have also pointed to U.S. monetary policy developments as a significant driver of the sell‑off.

The recent nomination of Kevin Warsh as chair of the U.S. Federal Reserve by President Donald Trump has prompted forecasts of tighter monetary conditions.

A strengthening U.S. dollar in response to monetary policy shifts has also weighed on Bitcoin. A firmer dollar typically makes non‑yielding assets like Bitcoin less attractive, reducing inflows from investors seeking currency‑neutral hedges. Analysts noted that the dollar’s recent performance provided technical headwinds that amplified the crypto market’s decline.

The Trump administration has continued to engage with industry leaders on digital asset policy, including efforts to advance regulatory clarity through legislation such as the Digital Asset Market Clarity Act.

This dialogue has really slowed down over the last couple of months, it has not yet translated into stabilizing price action amid current conditions.

Bitcoin price in genuine ‘crypto winter’

Despite this, Bitwise CIO Matt Hougan said in a recent memo that the crypto market has been in a genuine “crypto winter” since early 2025, rather than experiencing a short-lived correction.

Hougan highlighted that bearish sentiment remains strong, as evidenced by the Crypto Fear and Greed Index, which shows near all-time fear levels despite positive developments like the appointment of a bitcoin-friendly Fed chair.

Hougan noted that institutional flows helped mask the severity of the downturn. U.S. spot bitcoin ETFs and digital asset treasury vehicles purchased over 744,000 BTC during this period—roughly $75 billion in demand — cushioning bitcoin price’s drawdown, which he estimated could have reached nearly 60% without this support.

He compared the current environment to previous downturns in 2018 and 2022, where markets remained depressed despite incremental positive news.

Looking ahead, Hougan suggested that crypto winters often end not with exuberance but with exhaustion. In his words, “It’s always darkest before the dawn.”

Bitcoin price is currently at $74,800, with a 24-hour trading volume of 55 B. BTC is -5% in the last 24 hours. It is currently -5% from its 7-day all-time high of $78,994.