The bitcoin price surged above $97,000 this week, marking its strongest level in more than two months, on a mix of economic news and renewed inflows into U.S. spot Bitcoin exchange-traded funds (ETFs.

Crypto investors appear to be kicking off 2026 with a familiar playbook: allocating heavily to Bitcoin ETFs.

On Tuesday, the dozen U.S.-listed spot Bitcoin funds recorded roughly $760 million in net inflows, the largest single-day total since October. Fidelity’s Wise Origin Bitcoin Fund (FBTC) led the pack, absorbing about $351 million, while Bitwise’s BITB and BlackRock’s iShares Bitcoin Trust (IBIT) also posted strong gains.

The momentum accelerated on Wednesday. Data from SoSoValue shows spot Bitcoin ETFs took in another $843.6 million, extending the positive streak to three consecutive days and bringing total inflows over that period to approximately $1.71 billion.

Eight of the 12 funds reported net inflows, with BlackRock’s IBIT alone drawing in $648 million, underscoring its dominance among institutional allocators.

Bitcoin’s price action reflected that renewed interest. After spending much of November and December trading below $92,000, BTC broke decisively higher this week, reclaiming the $94,000–$97,000 range and pushing toward $100,000.

The move triggered roughly $700 million in short liquidations, amplifying volatility and accelerating the rally, according to Bitcoin Magazine Data.

ETF flows have become a key barometer of institutional sentiment since spot products launched in early 2024. While cumulative inflows reached more than $56 billion by mid-January, flows turned negative in late December amid typical year-end caution.

The sharp reversal this week suggests investors are once again viewing Bitcoin as both a growth asset and a diversification tool. This reflects in a growing bitcoin price.

Economic conditions affecting the bitcoin price

Macro conditions have also played a role. A softer-than-expected U.S. Consumer Price Index (CPI) reading released on January 13 eased fears of further aggressive monetary tightening, lifting “risk-on” sentiment.

At the same time, escalating geopolitical tensions and political uncertainty in the U.S. have boosted interest in alternative stores of value, including the Bitcoin price.

Still, volatility risks remain. Markets are closely watching a potential U.S. Supreme Court ruling on President Donald Trump’s tariffs, which could inject fresh uncertainty into global trade and financial markets.

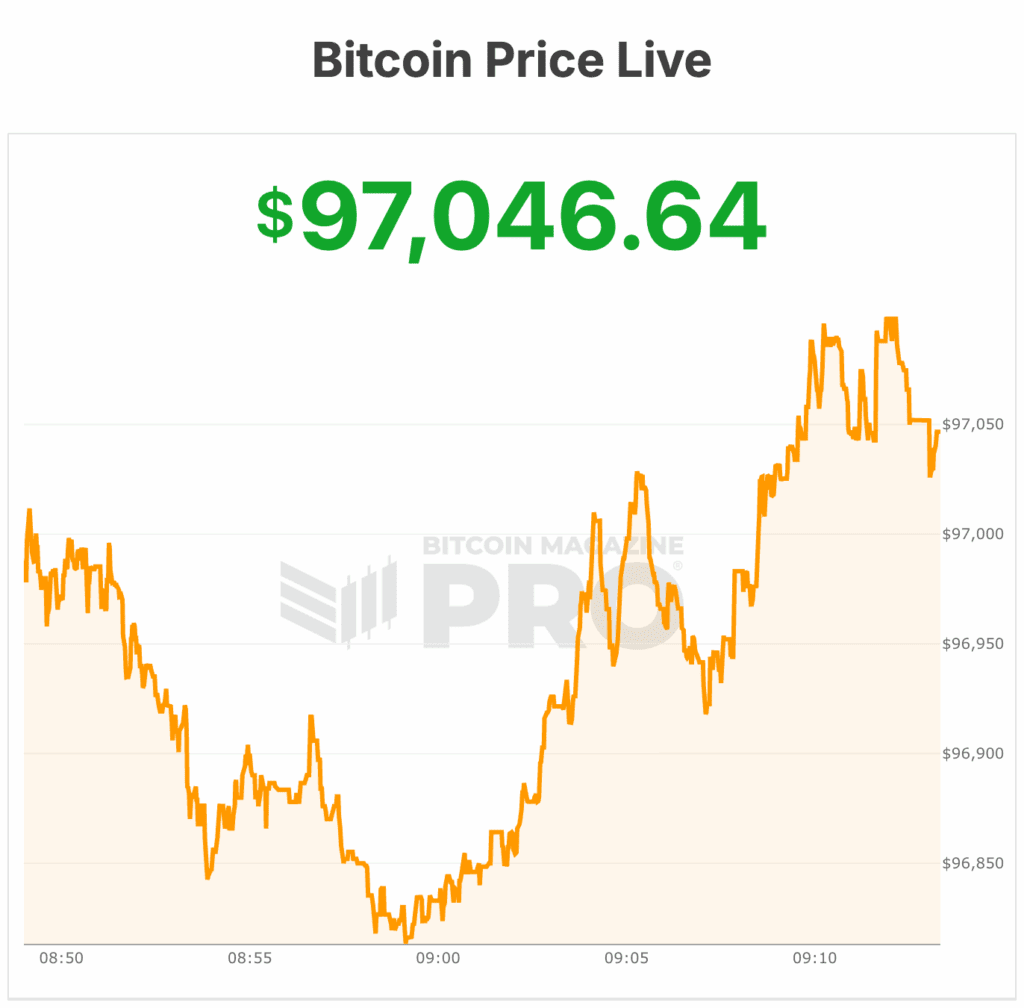

At the time of writing, Bitcoin price is trading at $97,046, up 2% over the past 24 hours, with roughly $67 billion in daily trading volume.

The asset is sitting about 1% below its seven-day high of $97,705 and 2% above its seven-day low of $95,318. Bitcoin’s circulating supply stands at 19.98 million BTC, giving it a total market capitalization of approximately $1.94 trillion, also up 2% on the day.