Bitcoin (BTC) is testing a key zone amid a fall in the level of the crypto king’s volatility, according to analytics platform Glassnode.

Glassnode says that since Bitcoin hit a low of around $107,000 at the beginning of September, Bitcoin’s volatility levels have fallen.

The low-volatility regime is unlikely to last for long, however, according to Glassnode.

“Such calm rarely lasts, volatility spikes tend to follow. The market is nearing a breakout point, with momentum ready to shift.”

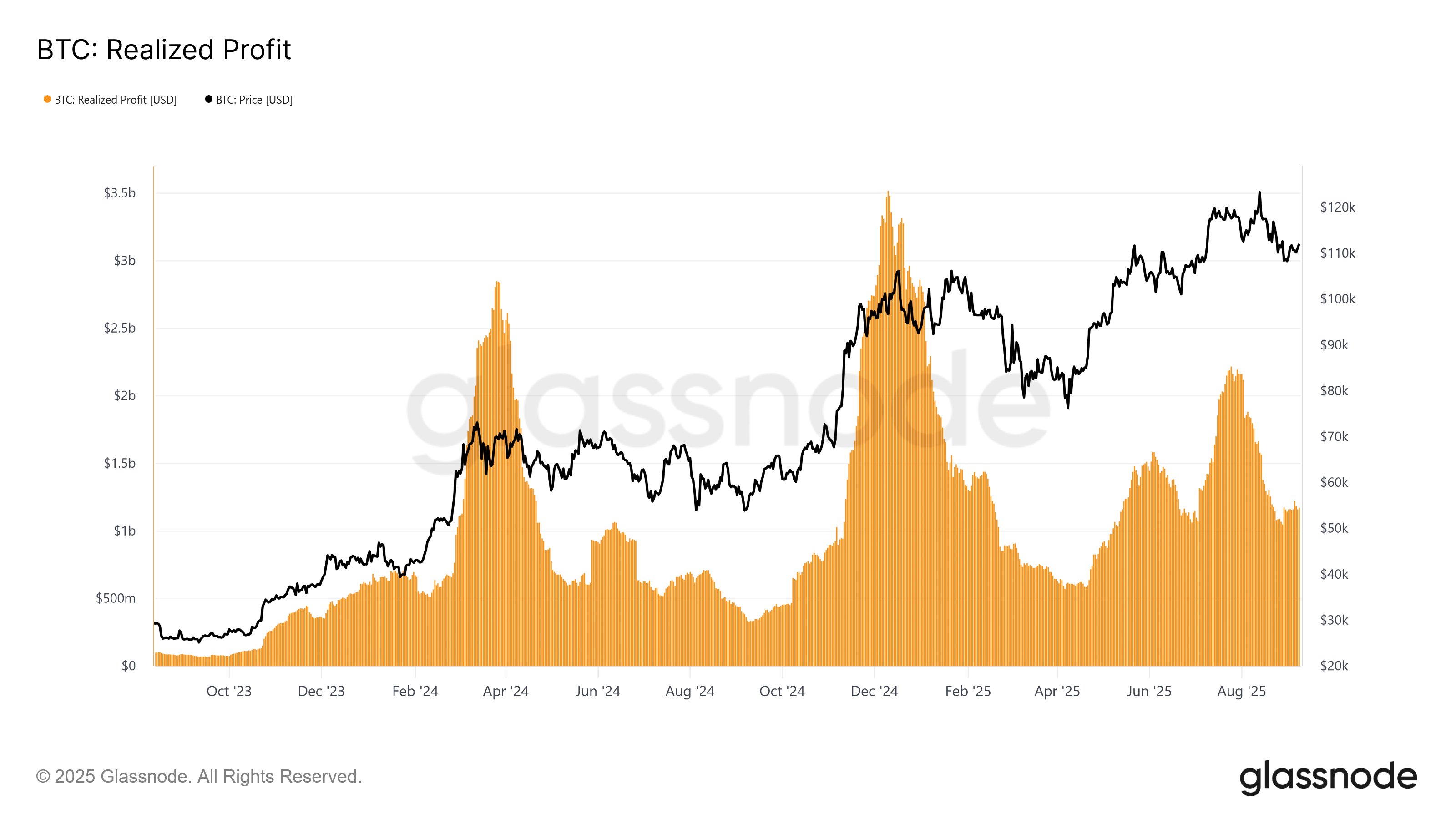

According to Glassnode, one of the metrics demonstrating the reduced momentum is the realized profit.

“It’s [realized profit] now at $1.17 billion per day, down approximately 47% from the $2.2 billion June peak, yet still above the bear-phase baseline (less than $0.8 billion). Momentum is fading, and the balance is becoming fragile.”

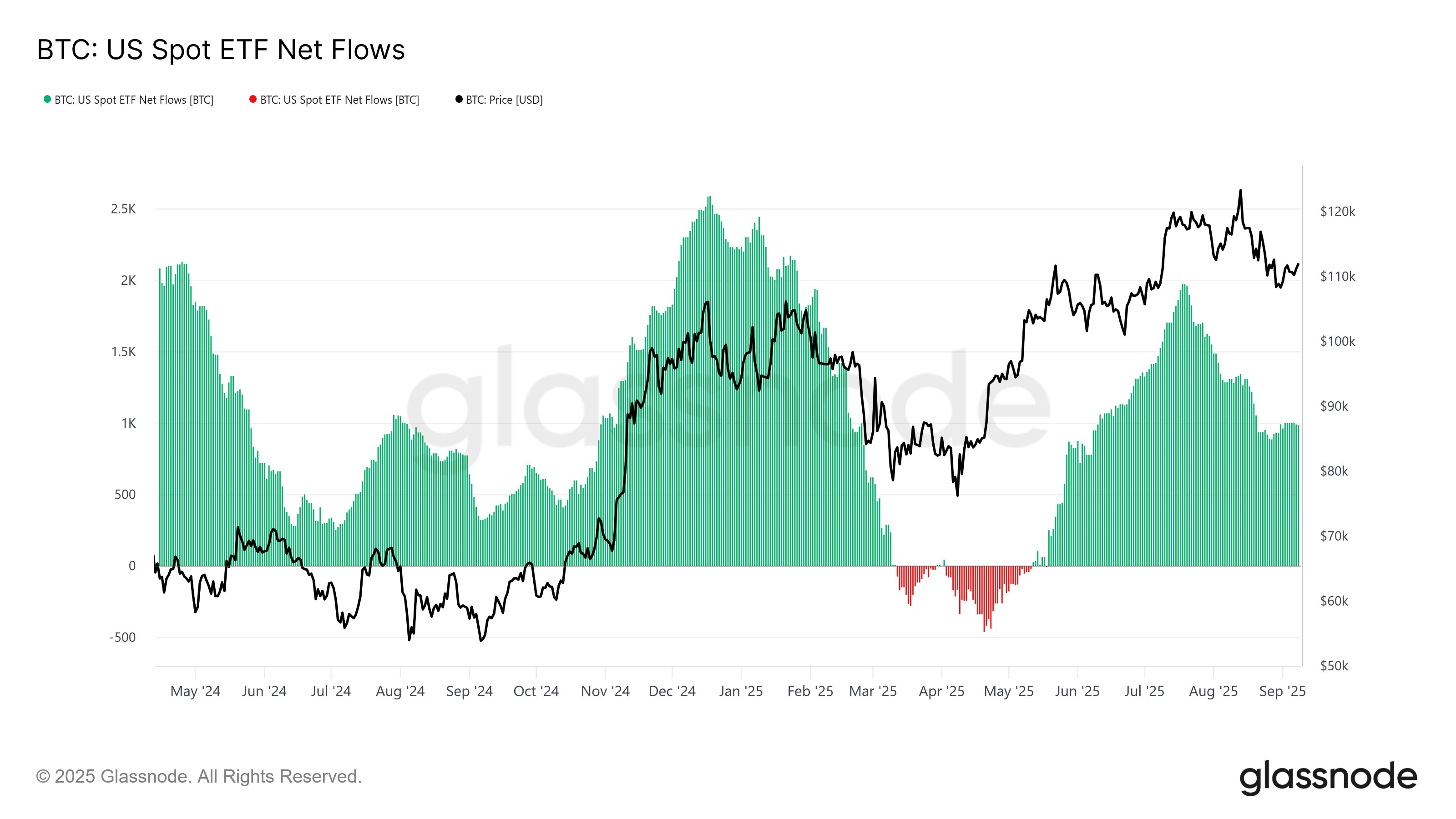

Glassnode also says that capital inflows are signaling the decline in momentum, as evidenced by net inflows into US spot exchange-traded funds (ETFs).

“A similar trend appears in Netflow to US Spot ETFs (90-day smooth moving average), now at approximately 980 BTC per day – down approximately 50% from the July peak of 1,960 BTC per day. This marks a clear decline in [traditional finance] TradFi buy-side momentum, signaling weakening institutional demand.”

On Bitcoin’s outlook amid a decline in momentum, Glassnode says,

“However, the drop to $107,000 triggered fear-driven selling from top buyers, forming a textbook setup for local bounce-backs. A short-term rally toward $114,000 is likely, but as long as price trades below that level, the broader bias leans toward bearish continuation.”

Bitcoin is trading at $112,390 at time of writing.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney