Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin Cash (BCH) has been navigating a tight trading range, hinting at a potential shift in market direction. While prices have eased slightly from recent peaks, the coin remains well above its lows, reflecting steady support. Is BCH preparing for a fresh upward move, or will sellers seize control in the coming sessions?

BCH Key Statistics

- Current Price: $598

- Market Cap: $12 billion

- Trading Volume (24h): $623 million

- Circulating Supply: 20 million BCH

- Total Supply: 20 million BCH

- CoinMarketCap Ranking: #14

Bitcoin Cash (BCH) is trading below its recent highs, down 4.57% from the 30-day peak and 1.03% from the 7-day high. However, it remains 13.14% above its lowest price in the same period, showing that buyers are still supporting the market and keeping the broader uptrend intact.

BCH/USD Market

Key Levels

- Resistance: $600, $620, $633

- Support: $580, $550, $520

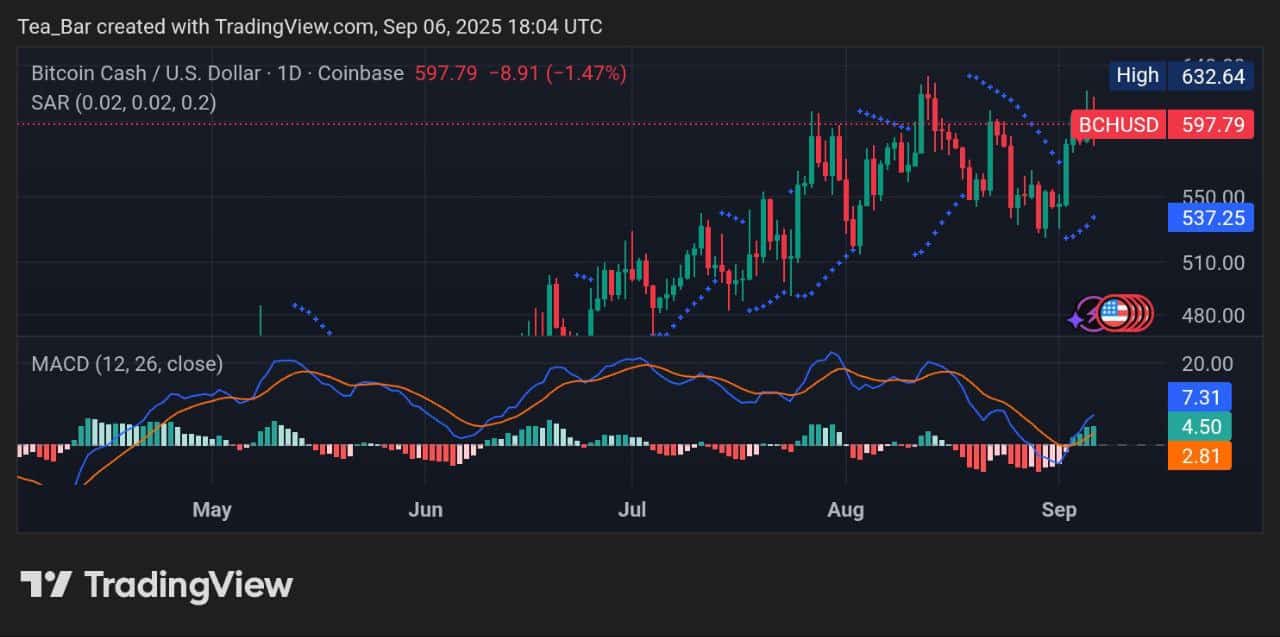

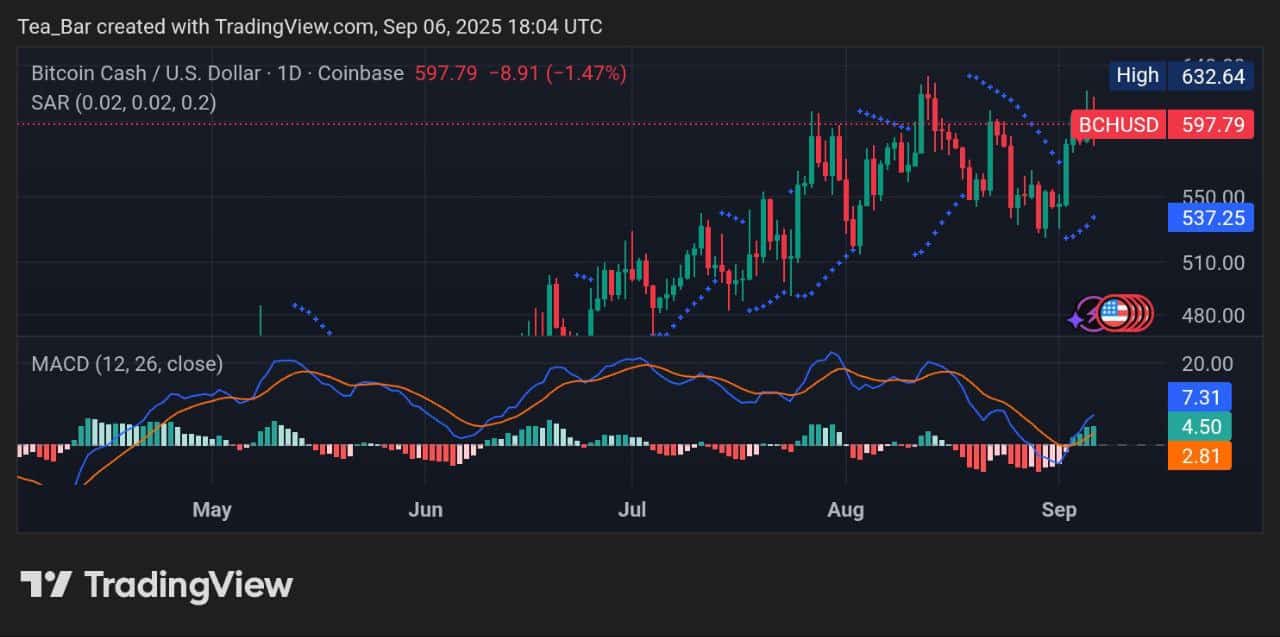

Bitcoin Cash currently trades at $598, showing mild retreat but with a key bullish clue—the MACD histogram remains green, signaling underlying buying interest persists despite the dip. The parabolic SAR dots above price, however, suggest near-term caution. Resistance levels are visible at $600 (immediate psychological barrier), $620 (recent high), and $633 (August peak). Support lies at $580 (local base), $550 (stronger floor), and $520 (long-term buffer). If BCH holds above $580, the green MACD momentum could help push price toward $600, and a break above may quickly target $620.

The market feels like it’s pausing to gather strength—a calm that often precedes a meaningful move. A sustained hold above $580 supported by the MACD’s positive vibe could encourage buyers to challenge $600. However, if selling pressure mounts and $580 fails, a slide toward $550 may follow, where the bulls would need to step in firmly. With the MACD still green, there’s quiet confidence that dips could attract interest. Will BCH use this energy to climb, or will it need more time to consolidate? The balance is delicate, but momentum leans cautiously hopeful.

BCH/BTC Performance Insights

BCHBTC is trading at 0.00527181, posting a 4.19% decline as sellers dominate the market. The Parabolic SAR dots have flipped above the candles, signaling potential bearish momentum, but the MACD remains near a bullish crossover with green histogram bars still in play. This suggests that underlying buying pressure could support a recovery. Key levels to watch are the immediate support at 0.00504181 and resistance near 0.00555000, which will be crucial in determining the next significant price direction.

Adding to the technical setup, a recent post on X pointed out that Bitcoin Cash is breaking out of a two-year falling channel with strong weekly momentum. The post also mentioned that the current structure resembles a cup-and-handle pattern on the macro chart, which is considered a bullish signal and could pave the way for a sustained upward trend in BCH if momentum continues.

#BCH Massive Breakout Watch 🚀

Bitcoin Cash is breaking out of a 2-year falling channel with strong weekly momentum 💥

This structure looks like a cup and handle on a macro scale — and that’s bullish 🧠📈🎯 Targets in play:

• $776 — Minor resistance

• $960 — Major… pic.twitter.com/R4ETmHyKOV— Rose Premium Signals 🌹 (@VipRoseTr) September 5, 2025

Can Bitcoin Cash Carve Out a Lasting Niche in the Crypto Ecosystem?

Bitcoin Cash could experience a resurgence if its core value proposition as a fast, low-cost payment network aligns with growing demand for practical blockchain utility. Increased merchant adoption, particularly in regions with volatile currencies or limited banking access, might drive organic usage beyond speculation. Technological upgrades like CashTokens and ongoing improvements to scalability could attract developers and users seeking alternatives to more congested or expensive networks. If regulatory clarity favors coins with clear use cases and Bitcoin’s high fees return, BCH could position itself as a pragmatic solution for everyday transactions.

Bitcoin Cash (BCH) Price: More Technical Insights

However, Bitcoin Cash faces significant challenges from both established and emerging competitors. Lightning Network and other Layer 2 solutions may undermine its payment advantage, while centralization concerns around development and mining could deter community trust. If real-world adoption fails to materialize or regulatory pressure targets proof-of-work chains, BCH might struggle to maintain relevance. Its success likely depends on executing its vision more effectively than rivals—can Bitcoin Cash prove that on-chain scaling remains the best path for peer-to-peer electronic cash, or will it become a relic of an earlier crypto era?

Related News

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage