Binance has become the largest platform for Bitcoin futures open interest, overtaking CME. This shift happened as institutional interest has dropped immensely, as evidenced by ongoing outflows from spot Bitcoin ETFs in the United States.

Binance Reclaims Top Spot from CME in Bitcoin Futures Open Interest

CME Group, the largest derivatives marketplace, has lost its place as the top exchange for Bitcoin (BTC) futures open interest (OI). Binance has now overtaken CME to reclaim its position as the largest venue by open interest, according to CoinGlass data.

Binance has about 129,080 BTC open interest worth $11.28 billion. Meanwhile, CME has 112,340 BTC open interest valued at $9.81 billion. Bitcoin OI on CME has dropped below $10 billion for the first time since early 2024.

CME’s open interest started falling just before the October 10 crypto market crash. The downfall from $17 billion to $9.80 billion was sharp as the profitability of the basis trade decreased. Traders buy spot Bitcoin and sell futures in a basis trade to make profits from the price premium.

While open interest on Binance has also dropped significantly since early October. It has increased in December amid Bitcoin buy-the-dip sentiment among retail investors.

CME Bitcoin open interest hit a record high of almost $23 billion as BTC price climbed toward $100,000 after President Donald Trump’s election win. The annualized basis rate has dropped from 15% to almost 3%, according to Velo data. This shows lower returns for institutional investors.

Persistent Spot Bitcoin ETF Outflows

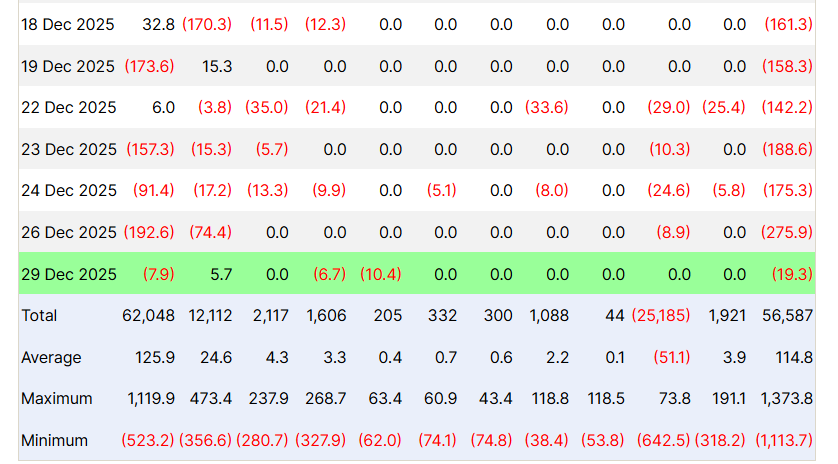

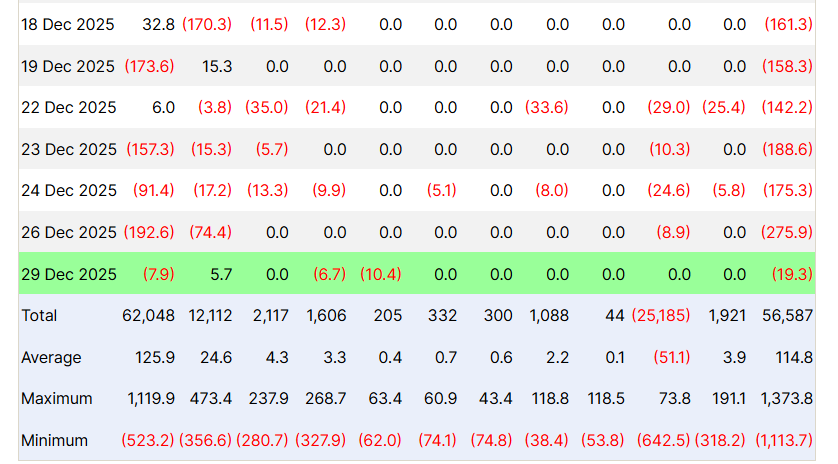

Spot Bitcoin ETFs in the United States saw a net outflow of $19.3 million on Monday, marking the 7th consecutive day of BTC outflows amid thin liquidity, according to Farside Investors.

BlackRock’s iShares Bitcoin ETF (IBIT) saw a $7.9 million in selloffs by investors. However, Fidelity’s FBTC saw $5.7 million in inflows. Institutional redemptions are also noted in ARK 21Shares’ ARKB and Invesco Galaxy’s BTCO.

The outflows come as investors brace for bearish price predictions from experts. It also signals tax-loss harvesting by institutional investors.

Bitcoin Price Holds Near $87K

BTC price fell more than 2% in the past 24 hours, with the price currently trading at $87,200. The 24-hour low and high are $86,717 and $90,299, respectively. Furthermore, trading volume has increased by 40% over the last 24 hours, showing a rise in interest among traders.

Crypto analyst Dan Crypto Trades highlighted that Bitcoin is close to dropping into the lower bound of the regression trend/rainbow chart. Typically, BTC sits in the zone during its bear market. Currently, the zone sits between $60K and $80K.

CoinGlass data showed mixed sentiment in the derivatives market. The 24-hour BTC futures open interest dropped more than 5% to $57.41 billion. BTC futures OI on CME dropped 9% and climbed 1% on Binance in the last 4 hours.