In brief

- Bitcoin has fallen 52.44% from its October all-time high, dangerously approaching the 2018 bear market drawdown of 56.26%.

- The crypto market lost 1.33% in the last 24 hours, with a total market cap at $2.33 trillion

- On Myriad, prediction market traders say there’s a 60% chance BTC touches $55K before $84K.

The crypto market is bleeding. And the wounds keep deepening.

Bitcoin trades at $67,621 today, down 1.70% in the last 24 hours. But this isn’t just another bad day—it could potentially help mark one of the most prolonged bear runs in Bitcoin history.

If February closes red, Bitcoin will complete five consecutive months of losses, the longest streak since June 2018 when Bitcoin was down for six months. With February already down 13.98%, the signs aren’t promising.

The accumulated losses from October 2025’s all-time high now reach 52.4% over 123 days. For perspective, the previous longest losing streak—that 2018 nightmare—registered a 56.26% drop over 153 days. Bitcoin is just 3.82 percentage points away from matching that record in less time.

The total cryptocurrency market capitalization stands at $2.33 trillion, down 1.33% in the last 24 hours. The Fear & Greed Index rose marginally from 8 to 12 points, but still in “extreme fear.”

The macro backdrop looks equally fragile. The S&P 500 and Nasdaq have slipped amid tech-sector jitters after Microsoft shed roughly 10% despite strong earnings, spooking investors. Meanwhile, precious metals have turned volatile: on Jan. 30, silver futures plunged about 31%—their steepest one-day drop since 1980—while gold also pulled back from recent highs.

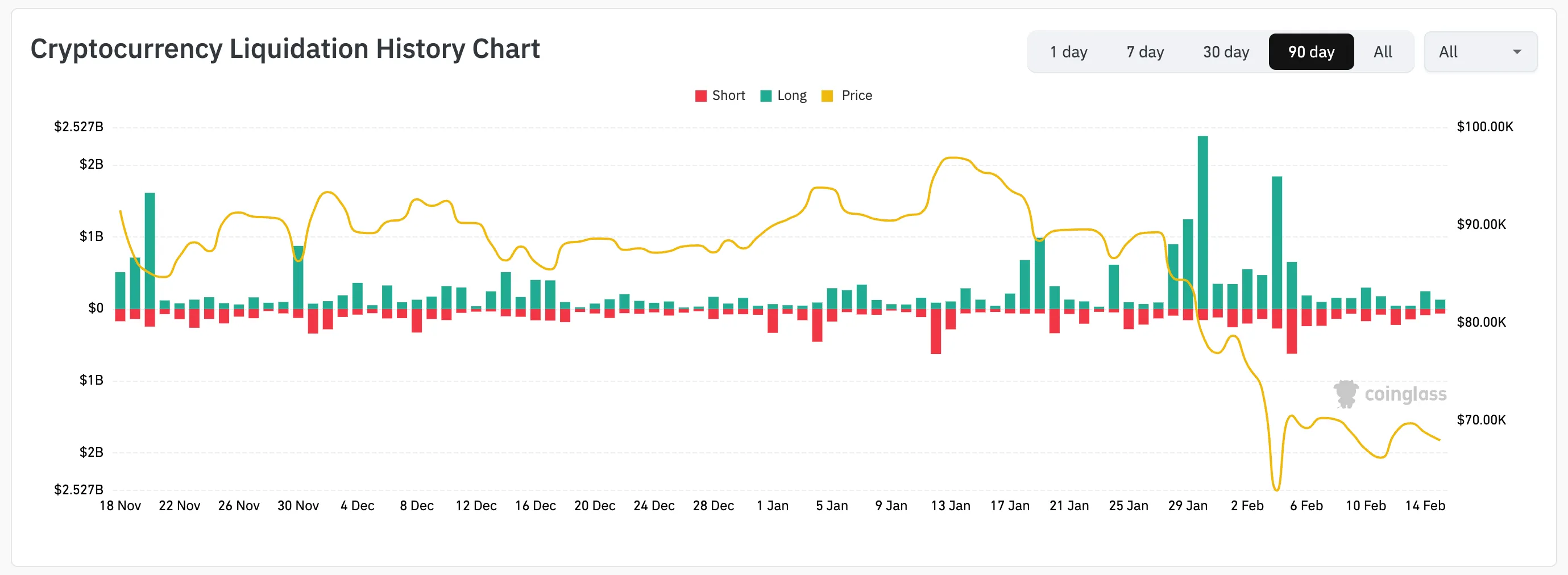

Forced liquidations—when derivatives traders’ positions are automatically closed at certain prices—continue battering the market. Since January 12, there has not been a single day in which bear liquidations beat bullish positions, according to Coinglass data.

Speaking of bearish sentiment. On Myriad, a prediction market developed by Decrypt’s parent company Dastan, odds shifted again from bullish to bearish on bets wagering on Bitcoin’s near-term future. Currently, prediction market traders are favoring a scenario where BTC touches $55K before $84K with 60% odds. That sentiment shift in prediction markets—where participants put money behind their opinions—is hard to ignore.

Bitcoin (BTC) price analysis: The signals don’t lie

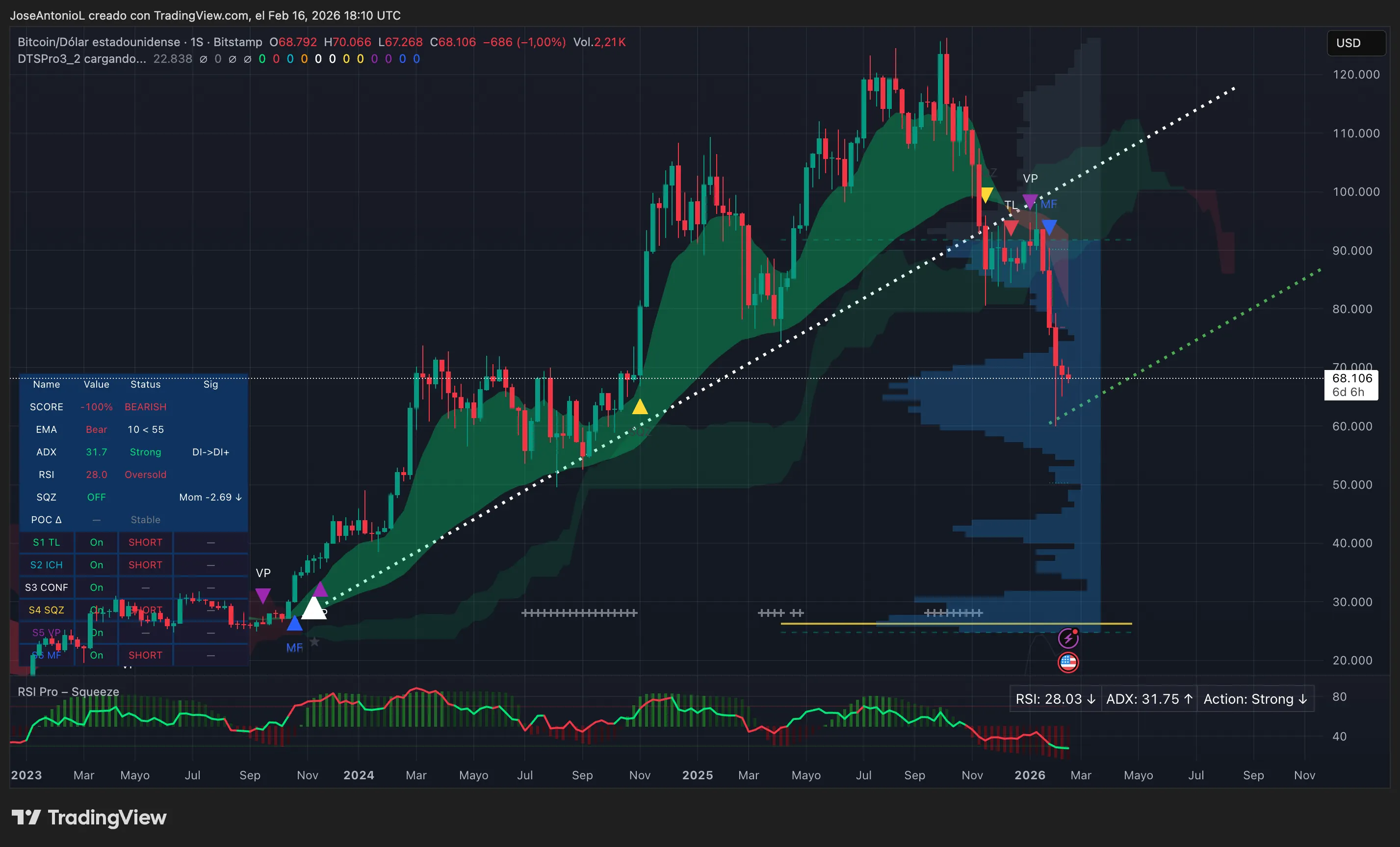

Bitcoin’s charts paint an equally grim picture on the daily timeframe. Bitcoin is currently trading sideways after the big spike on February 6. However, the price has not been able to resume an upwards trend and remains below the average price of the last 200 days, which traders identify as the EMA200. This shows how weak bulls currently are.

This setup (current price trading below the EMA200 and this being lower than the average price of the last 50 days, or EMA50) typically signals solid bearish momentum. When both EMAs, otherwise known as exponential moving averages, sit above the current price, they act as dynamic resistance—levels where sellers tend to appear.

The Relative Strength Index, or RSI, sits at 34.7. RSI measures buying and selling momentum on a 0-100 scale. An RSI of 34.7 places Bitcoin in bearish territory, though it hasn’t reached extreme oversold levels. This means negative momentum dominates, but there’s still room for further declines before technical conditions suggest a bounce.

The Average Directional Index, or ADX, stands at 56.4—well above the 25 threshold that confirms trend strength. ADX measures trend strength with readings above 25 indicating a strong trend is in place. With ADX at 56.4 and price falling, this confirms the bearish trend has very strong momentum.

Can Bitcoin Recover?

A Bitcoin bounce after such a sharp drop is definitely possible, but even if it does, it would be premature to call it a trend reversal.

For traders to begin talking about a bullish movement, the price of Bitcoin would need to show at least one of two unlikely scenarios: Either a massive recovery past the $100K mark to resume the 2024-2025 trend, or a consistent series of candlesticks with higher lows respecting at least a support similar to the one shown in the dotted green line below (extension of the previous trend).

For now, Bitcoin remains trapped in one of the most persistent downtrends in its history. And with just two weeks left in February, the clock is ticking to avoid that fifth consecutive red month.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.