Bitcoin is trading close to $78,000, continuing a sharp correction that has happened alongside heavy selling in gold and silver. The timing stands out because all three assets are falling together in a clear risk-off market, pushed by a stronger US dollar, unwinding of leveraged positions, and changing expectations for US monetary policy.

Bitcoin’s drop comes after a volatile January. Gold and silver are also falling after historic rallies that accelerated at the end of the year. This synchronized decline points to broad de-risking, not just weakness in one asset.

Bitcoin News: Liquidations and Policy Shifts Pressure BTC

Bitcoin has dropped about 6 to 7% in the last 24 hours, briefly reaching the $76,000 to $77,000 range during low weekend trading. Over $1 billion in leveraged positions have been liquidated across crypto markets, speeding up the decline.

Several factors are hurting market sentiment:

- Reduced expectations for ultra-loose US policy following President Trump’s nomination of Kevin Warsh as Fed chair

- A firmer US dollar pressuring risk assets

- Ongoing geopolitical uncertainty, including US-Iran developments

- Continued ETF outflows and institutional de-risking

Bitcoin’s reputation as “digital gold” is being questioned because it is falling along with traditional safe havens, rather than moving differently from them.

Bitcoin Technical Analysis: Can BTC Hold $78K Support?

Technically, Bitcoin price prediction is strongly bearish as BTC is at a key turning point. The daily chart shows BTC dropping below a long-term downward trendline, which means sellers are still in control. The recent attempt to rebound toward $98,000 was firmly stopped below the 100-day and 200-day EMAs, starting a new downward move.

The price is now back in the $80,400 to $78,300 range, which was previously a double-bottom base. Returning to this area increases the risk that the pattern will fail instead of moving higher.

Momentum is still weak. The RSI has dropped below 30, which means the market is oversold, but there is no sign of a bullish reversal. In trending markets, this usually means the trend will continue instead of reversing.

There are two main possible scenarios:

- A relief bounce toward $84,000–$86,000, where broken support and the descending trendline now act as resistance

- Failure to reclaim that zone, opening downside toward $75,800, then $71,600 if selling accelerates

For a positive recovery, Bitcoin would need to stay above $78,000, then form a higher low and move back above $86,000. This could open the way to $94,000 later on.

Gold and Silver: Record Rallies Meet Violent Reversals

Gold and silver have also dropped sharply after big gains. Gold went above $5,500 per ounce but has now fallen back to the $4,800 to $4,900 range because of profit-taking and a stronger dollar. Silver, which rose past $120, has dropped even more, falling to the $80 to $85 range as traders closed out speculative positions.

While both metals remain well above early-2025 levels, the speed of the reversal highlights how crowded the trade had become.

Outlook: Volatility First, Opportunity Later

Right now, Bitcoin is resetting its structure, clearing out leverage and testing long-term demand. If it stays above $78,000, a broader recovery could start. If not, lower prices may come before confidence returns.

In markets this volatile, patience is often more valuable than trying to predict what will happen next.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

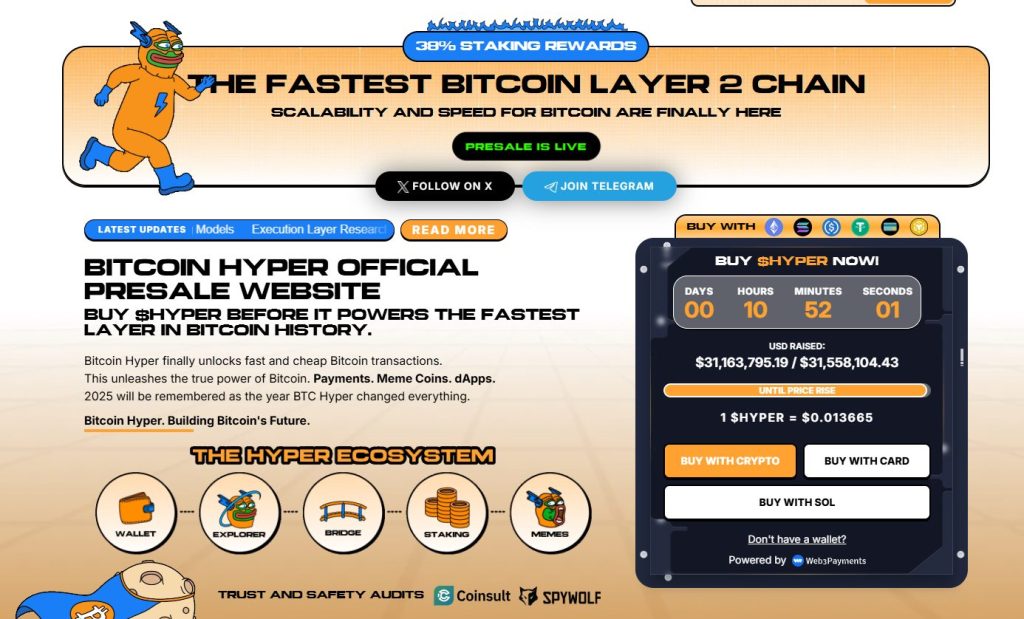

Bitcoin Hyper ($HYPER) is bringing a new phase to the BTC ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $31.4 million, with tokens priced at just $0.013665 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale