Cathie Wood’s ARK Invest has laid out one of its clearest long-term views yet on Bitcoin and Nvidia, two assets that defined the 2024–2025 market cycle. The firm’s latest Big Ideas 2026 report predicts that the Bitcoin market cap will increase by 700% over the next four years.

It also predicts that Nvidia’s dominance in AI hardware may face growing pressure from competitors.

Sponsored

Sponsored

Bitcoin Price to Hit $800,000?

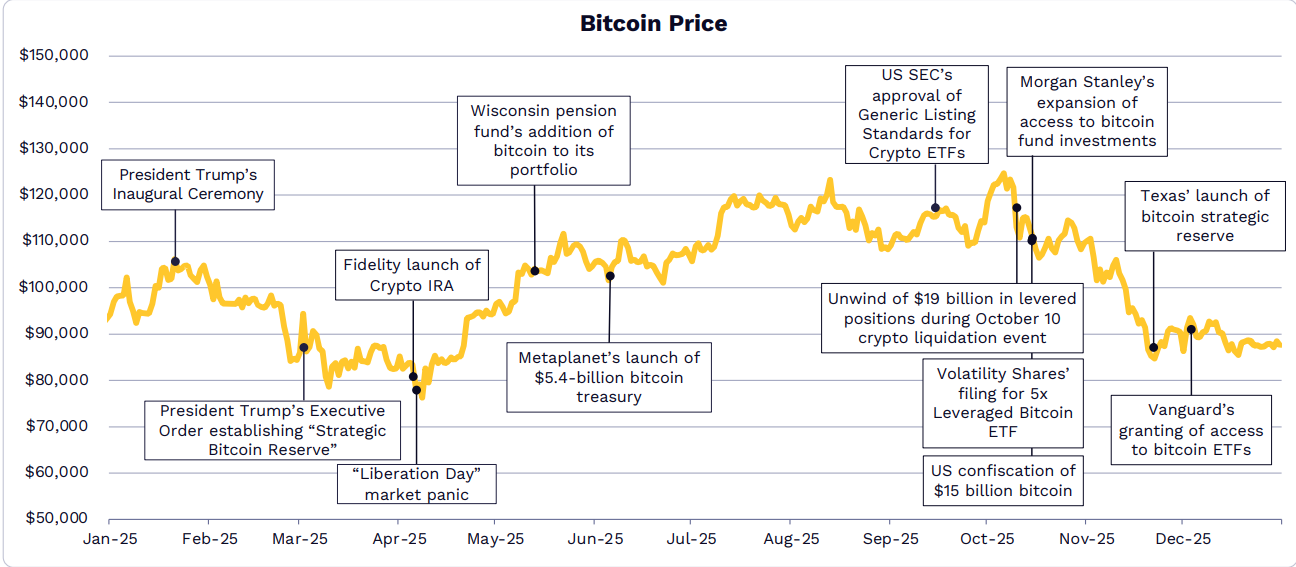

ARK argues that Bitcoin’s behavior changed meaningfully in 2025. Its drawdowns were smaller, volatility declined, and risk-adjusted returns improved compared to past cycles.

Measured by the Sharpe Ratio, Bitcoin outperformed Ethereum, Solana, and the broader CoinDesk 10 Index across multiple time frames. That shift supports ARK’s view that Bitcoin is increasingly acting like a safe-haven asset rather than a purely speculative one.

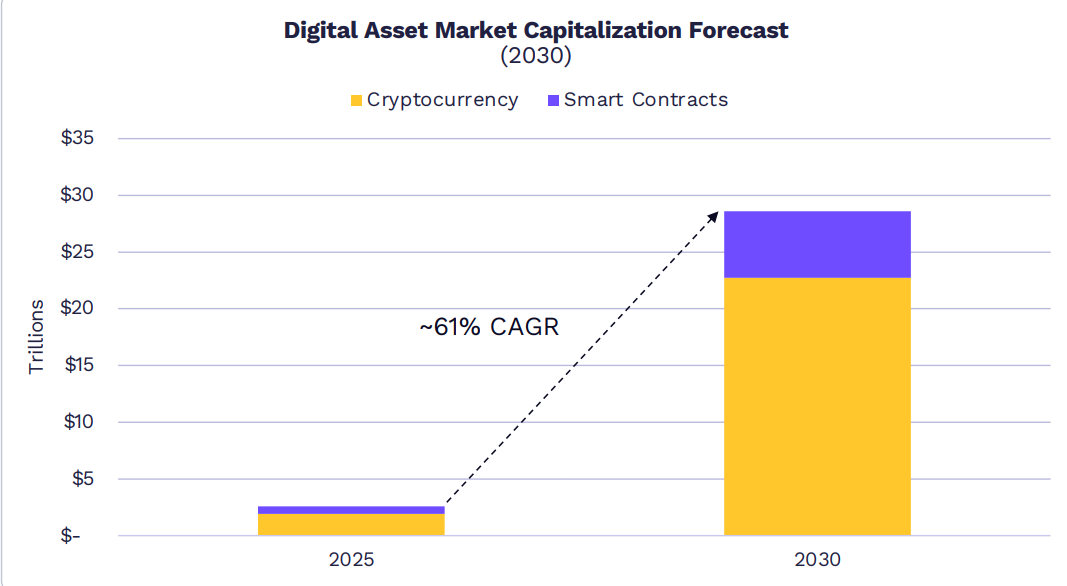

As a result, ARK expects Bitcoin to dominate a rapidly expanding crypto market. The firm estimates total cryptocurrency market capitalization could reach $28 trillion by 2030, growing at roughly 61% annually.

Crucially, ARK believes Bitcoin could account for 70% of that market, lifting its market capitalization to around $16 trillion by the end of the decade.

Based on current supply projections, that implies a Bitcoin price of roughly $800,000 per coin. That’s a near nine-fold increase from today’s $90,000 levels.

Sponsored

Sponsored

However, ARK’s forecast is not purely bullish across all use cases. The firm reduced its expectations for Bitcoin adoption as an emerging-market safe haven, citing the rapid rise of dollar-backed stablecoins.

Instead, ARK increased its “digital gold” assumption after gold’s market cap surged sharply in 2025.

Nvidia Growth Continues, But Competition Tightens

ARK’s outlook for Nvidia is more cautious in tone, even as AI demand continues to surge.

The firm expects global AI infrastructure spending to exceed $1.4 trillion by 2030, driven mainly by accelerated servers. That trend supports long-term demand for AI chips, including Nvidia’s GPUs.

Sponsored

Sponsored

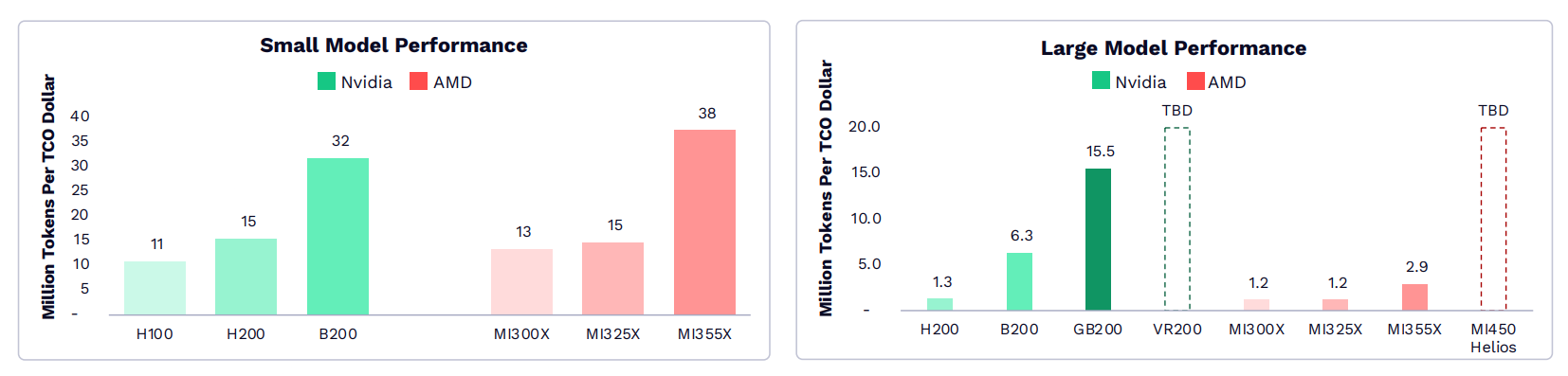

But ARK highlights a key shift. Hyperscalers and AI labs are increasingly focused on total cost of ownership, not raw performance alone.

That opens the door for custom AI chips and application-specific integrated circuits (ASICs).

Competitors such as AMD, Broadcom, Amazon’s Annapurna Labs, and Google’s TPU platforms are already shipping or preparing next-generation chips.

Nvidia Faces Intense Competition from AMD. Source: ARK Invest

Many offer lower operating costs per hour than Nvidia’s highest-end systems, even if performance lags in some cases.

Sponsored

Sponsored

ARK’s data shows Nvidia’s newest GPUs are among the most powerful, but also among the most expensive to run. That pricing pressure could limit Nvidia’s ability to expand margins at the same pace seen in recent years.

What This Means for Nvidia’s Stock

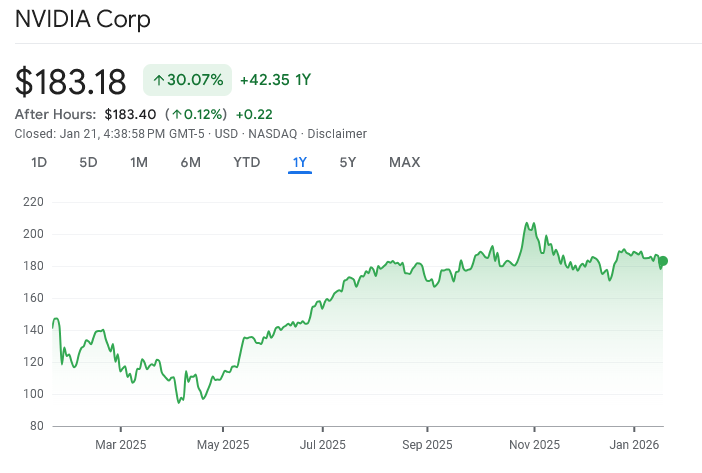

ARK does not predict a collapse in Nvidia’s business. Instead, it signals a shift from explosive dominance to more competitive growth.

For Nvidia’s stock, this implies a different trajectory than Bitcoin’s. Rather than multiple expansion, future gains may depend on earnings growth, software revenue, and ecosystem lock-in.

In practical terms, Nvidia’s share price may still rise over time, but likely with slower growth, higher volatility, and sharper reactions to competition and margin pressure. The easy phase of AI-driven rerating may be over.