VanEck released a new report on Bitcoin’s long-term capital market assumptions today, projecting strong growth over the next several decades and outlining how institutional investors might use the asset in diversified portfolios.

The report, authored by VanEck’s Head of Digital Assets Research Matthew Sigel and Senior Analyst Patrick Bush, models BTC reaching $2.9 million per coin by 2050 under a base-case scenario.

This represents a 15% compound annual growth rate (CAGR) from today’s prices. The model assumes BTC captures 5–10% of global trade and becomes a reserve asset making up 2.5% of central bank balance sheets.

Bitcoin at $53.4 million per coin in 2050

VanEck also provided a range of outcomes. In a conservative “bear” scenario, Bitcoin grows at just 2% per year, reaching around $130,000 per coin.

In a bullish “hyper-bitcoinization” scenario, where BTC captures 20% of global trade and 10% of domestic GDP, the asset could theoretically reach $53.4 million per coin, a 29% CAGR.

The report emphasizes Bitcoin’s potential as a strategic, low-correlation asset for institutional portfolios.

VanEck recommends a 1–3% allocation for most diversified portfolios. For higher risk-tolerant investors, allocations up to 20% historically optimize returns, according to their analysis.

VanEck argues that BTC’s role is becoming more than speculative. It could function as a reserve asset and hedge against monetary debasement, particularly as developed markets face high sovereign debt.

“The risk of zero exposure to the most established non-sovereign reserve asset may now exceed the volatility risk of the position itself,” the report notes.

The firm’s research also addresses volatility and market structure. Annualized BTC volatility is modeled at 40–70%, comparable to frontier equities or early-stage tech, though realized volatility recently hit multi-year lows near 27%.

VanEck attributes much of Bitcoin’s short-term price swings to futures leverage and derivatives, rather than fundamental adoption issues. They also highlight BTC’s historically low correlation to stocks, bonds, and gold, with a long-term negative correlation to the U.S. dollar.

For tactical investors, VanEck tracks blockchain metrics such as the Relative Unrealized Profit (RUP). As of December 31, 2025, Bitcoin’s RUP was 0.43 — mid-cycle — suggesting room for further gains before a market peak.

Futures funding rates remain moderate at 4.9%, below levels that typically signal market tops.

On portfolio impact, VanEck’s simulations show that even small BTC allocations can improve efficiency. In a traditional 60/40 equity-bond portfolio, replacing 1–3% with Bitcoin increased the Sharpe Ratio, capturing the asset’s “convex return” without adding proportional risk.

A 3% allocation historically yielded the highest return per unit of risk in their analysis.

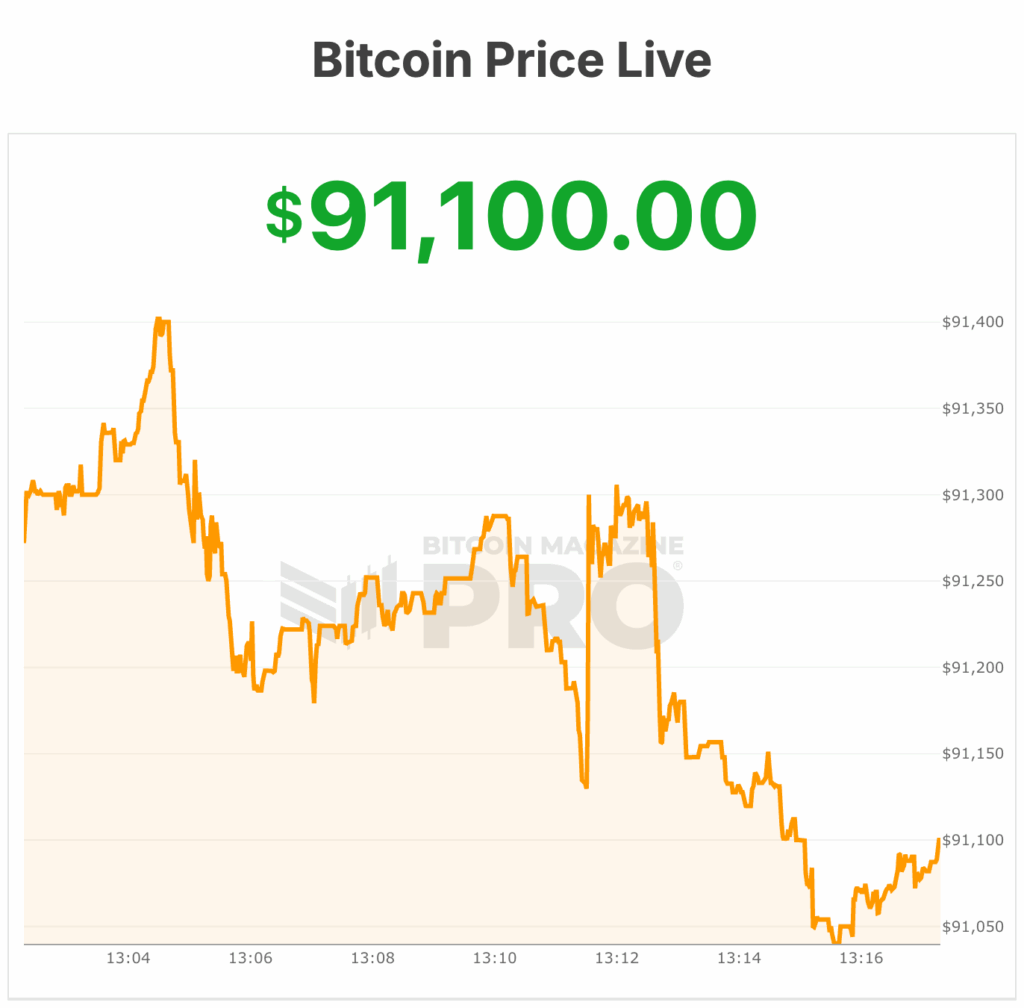

At the time of writing, Bitcoin is near $91,000.